Credit Card

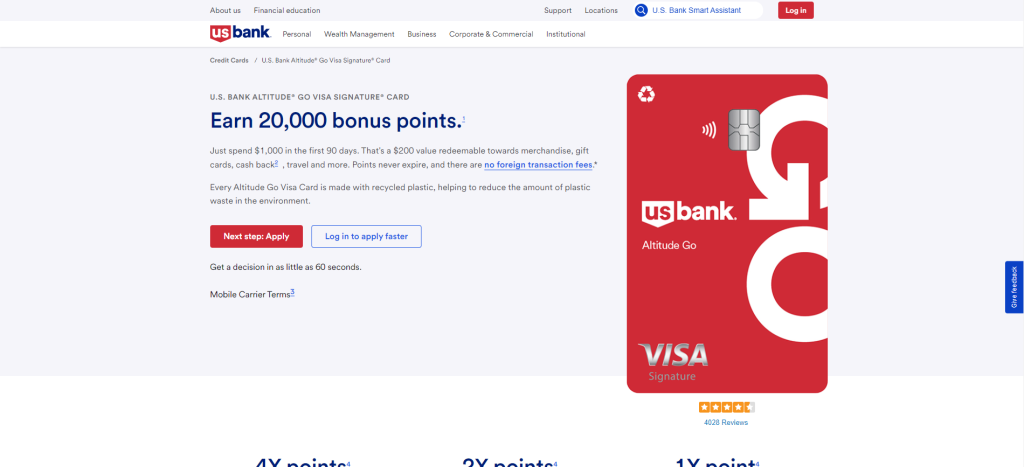

US Bank Altitude® Go Visa Signature® Card Review: Go Green!

Enjoy the full potential of rewards and say goodbye to annual fees with the US Bank Altitude® Go Visa Signature® Card. Learn how to make every buy more rewarding while keeping your finances streamlined!

Advertisement

Turn payments into green actions and swipe towards a more sustainable future

Step into a world where every purchase rewards you and annual fees are a thing of the past! Review the US Bank Altitude® Go Visa Signature® Card and uncover its layers of benefits.

Apply for US Bank Altitude® Go Visa Signature®

Apply for the US Bank Altitude Go Visa Signature Card for a $0 ExtendPay® fee offer and a $15 streaming credit. Start saving smartly!

This card is more than a payment method; it’s a partner to keep your finances thriving. From seamless spending to effortless saving, we’ll show you why it’s the card to carry, so keep reading!

- Credit Score: Aimed at those with good to excellent credit, elevating their financial status.

- Annual Fee: Let your finances breathe and spend without the worry of an extra charge each year.

- Purchase APR: 0% APR on purchases and balance transfers for the first 12 months, 18.24% to 29.24% after.

- Cash Advance APR: 29.99% variable;

- Rewards: Higher rates (4X points) on dining, whether you’re eating in, taking out, or getting delivery. 2X points on groceries, fuel, and streaming services, and a standard rate of 1X points on all other qualifying purchases.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

US Bank Altitude® Go Visa Signature® Card: a deep dive

Unlock a world of possibilities with the US Bank Altitude® Go Visa Signature® Card, starting with its enticing welcome bonus. This card invites you on a rewarding journey right from the start.

Dive into the rewards that await with every purchase. Whether dining out or streaming your favorite shows, the card turns these moments into points, enriching your spending experience.

The card also shines with no annual or foreign conversion fees, ensuring your points and perks feel more rewarding even while traveling. It’s about keeping more money in your pocket.

Furthermore, you can enjoy the 0% APR offers on balance transfers and purchases. This 12-month period of low rates smoothly transitions into competitive variable APRs.

Lastly, it offers eco-friendly initiatives and rewards for streaming services, aligning with modern consumers.

Analyzing the advantages and drawbacks of the US Bank Altitude® Go Visa Signature® Card

Now, we’ll explore the many advantages and potential lows of the US Bank Altitude® Go Visa Signature® Card to give you a well-rounded review of what it has to offer.

Advertisement

Pros

- Earn points quickly with dining and streaming purchases.

- Kickstart rewards with a special bonus for new cardholders.

- No annual fee adds to long-term savings.

- Benefit from a low introductory APR for one year.

- Instant rewards redemption enhances spending flexibility.

- Eco-friendly card design supports sustainable practices.

- Get a $15 annual credit to ease the cost of your favorite streaming services.

- A wide range of redemption options for points maximizes utility.

Cons

- A higher APR applies after the introductory period.

- Cash advance APR is notably high.

- Limited appeal for those who spend little on dining/streaming.

- After 60 days, balance transfer fees can start to increase.

- The reward rate on non-category purchases is less competitive.

- Specific credit score requirements limit accessibility.

Advertisement

Eligibility Requirements for the US Bank Altitude® Go Visa Signature® Card

Qualifying for the US Bank Altitude® Go Visa Signature® Card requires a solid credit score.

US Bank also looks at your money situation, like how much you earn and what you owe. This happens because they want to make sure you can handle a new card without any financial trouble.

Additionally, you have to be a legal adult over the age of 18 and have residence in the United States. Your documentation will be part of the application process, so get those ready.

Applying for the US Bank Altitude® Go Visa Signature® Card: a manual

Are you looking forward to a life fee of pesky fees and enhanced rewards? Then take some time to review our easy guide on how you can apply for the US Bank Altitude® Go Visa Signature® Card.

Below, we’ll outline specific details so you’ll know what to expect. The process is very simple, and you’ll get a response in under 60 seconds! Follow the link to learn more about it.

Apply for US Bank Altitude® Go Visa Signature®

Apply for the US Bank Altitude Go Visa Signature Card for a $0 ExtendPay® fee offer and a $15 streaming credit. Start saving smartly!

Trending Topics

How to Download Photo Editing Apps?

Turn your photos into works of art! Learn how to download photo editing apps here and have fun while improving your photographs.

Keep ReadingYou may also like

BLK – Dating for Black Singles: Finding Love in Unity

Discover BLK, the exclusive dating app created for Black singles seeking meaningful connections and genuine relationships.

Keep Reading

Tor Browser Review: Navigating the Web in Stealth Mode

Stay private online with Tor Browser. Discover its advantages and why it's the go-to choice for safeguarding your digital identity.

Keep Reading