Credit Card

Upgrade Triple Cash Rewards Visa® Review: Rewarding Flexibility

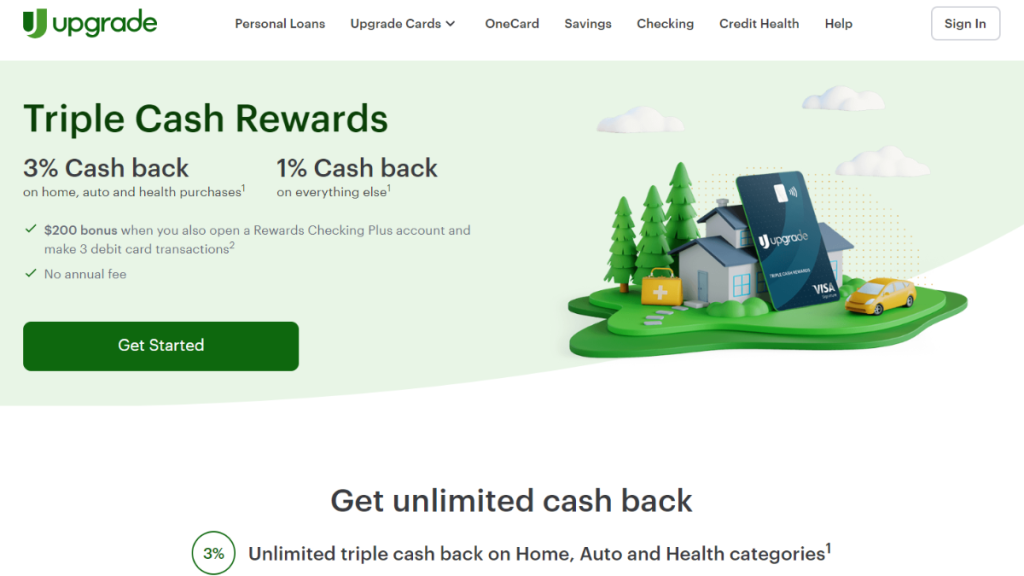

The Upgrade Triple Cash Rewards Visa® offers a higher purchasing power than average, with cash back benefits and without the burden of annual charges. See why it could be the ideal card for you.

Advertisement

Enjoy the versatility of high credit limits and fixed monthly payments on your buys

If you’re looking for a card that doubles as a loan, with a high credit limit, and unmatched rewards on daily expenses, you won’t want to miss this Upgrade Triple Cash Rewards Visa® review.

Apply for Upgrade Triple Cash Rewards Visa®

Looking for more than a payment method? Apply for Upgrade Triple Cash Rewards Visa® for rewards on essentials and no annual fee.

With no annual charges and broad acceptance, this credit card lets you repay your purchases in fixed installments, and you can manage it all online via a mobile app. Discover more below!

- Credit Score: You can apply even with a fair score, but the better your rating, the more favorable your Upgrade Triple Cash offer will be.

- Annual Fee: Absolutely zero, so you can earn and save at the same time.

- Purchase APR: Between 14.99% and all the way up to 29.99% variable, according to your financial standing.

- Cash Advance APR: This card does not favor cash withdrawals from ATMs, so, none.

- Rewards: You can earn 1% back on everything you buy and 3% back on essentials such as health purchases, along with auto and home buys.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Upgrade Triple Cash Rewards Visa®: Overview

When you review the Upgrade Triple Cash Rewards Visa®, it’s impossible to overlook its generous spending limit. By fitting the right profile, you can get up to $25,000 in this powerful card.

And whether you’re remodeling your home, repairing your car, or purchasing a coffee, every purchase fuels your savings, turning routine into money back in your pocket with a 1% to 3% return rate.

Moreover, the absence of an annual fee makes it all more appealing. This card respects your budget, allowing you to invest more in what truly matters to you, free from unnecessary charges.

When it comes to APRs, the card offers a competitive range from 14.99% to 29.99%. This flexibility ensures that the financial benefits extend across different credit profiles, making it accessible.

Lastly, the global acceptance and security features of the Upgrade Triple Cash cannot be understated. The card is a passport to peace of mind, making every transaction safe and simple.

Analyzing the advantages and drawbacks of the Upgrade Triple Cash Rewards Visa®

If you’re looking for the simplicity of no annual fees or the gratification of rewards, it’s important to review all that the Upgrade Triple Cash Rewards Visa® has in store, including the cons.

Pros

- Zero annual fees enrich your financial well-being.

- Generous rewards on select purchases enhance savings.

- Adaptable credit limits suit diverse financial landscapes.

- Worldwide acceptance broadens spending horizons.

- Effortless account management via a sleek app.

- Advanced security fortifies your financial frontier.

- Fixed purchase APR fosters predictable budgeting.

Cons

- Elevated APR demands vigilant balance management.

- No option for cash advances reduces flexibility.

- Rewards concentrated in specific categories limit scope.

- Geographic restrictions narrow eligibility.

- Foreign transactions incur additional costs.

- Balance transfer fees could offset benefits.

- Credit score requirements may exclude some applicants.

Eligibility Requirements for the Upgrade Triple Cash Rewards Visa®

Even though the Upgrade Triple Cash Rewards Visa® has a broader acceptance range, it’s important to review whether or not you qualify before applying. Firstly, you must be of legal age.

To apply with confidence, make sure your finances are in order, and your identifying documentation is within reach. You’ll need to verify income and employment as well as your address.

In order to speed things along, Upgrade helps you pre-qualify for their Upgrade Triple Cash Rewards card with a soft pull before performing a hard inquiry, so make use of it to see where you stand.

Applying for the Upgrade Triple Cash Rewards Visa®: a manual

Our Upgrade Triple Cash Rewards Visa® review made you equipped to get your card online with no fuss. So why not go a little further and check how to apply with our step-by-step guide?

Even though the application process is simple, we can help you prepare, so it goes even smoother. Follow the link below for a comprehensive breakdown, and get ready for a rewarding experience.

Apply for Upgrade Triple Cash Rewards Visa®

Looking for more than a payment method? Apply for Upgrade Triple Cash Rewards Visa® for rewards on essentials and no annual fee.

Trending Topics

How to Find Affordable and Quality Courses for Professional Development

Find affordable professional courses that offer practical skills and real-world application to boost your career without overspending.

Keep ReadingYou may also like

How to Refinance Your Loan for Better Terms and Rates: Refinance Loan Tips for Every Step

Explore smart refinance loan tips to save money, improve terms, and achieve long-term financial success with clear, actionable steps.

Keep Reading

How to Balance Work and Study When Taking Career Focused Courses

Learn to balance work and study effectively with strategies for setting routines, prioritizing tasks, and maintaining motivation.

Keep Reading