Credit Card

Revvi Card Review: A Visa® Card to Build Credit!

The Revvi Card is a Visa® option for building credit your way. Tailored for individuals with varying credit histories, this card offers access to a user-friendly mobile app and convenient features.

Advertisement

Enjoy monthly credit bureau reporting, cash back rewards and easy redemption options!

Want to build credit and improve your score without compromising on rewards? Then, review the Revvi Card features and learn how this credit card can help redefine credit accessibility.

Apply for Revvi Card: Accessible Credit!

Take control of your finances and access valuable credit resources with the Revvi Card. Enjoy a Visa® credit card option, regardless of your credit history

Although this card is focused on people with less-than-perfect credit, it doesn’t require a security deposit. Plus, you get to use a Visa® card and enjoy accessibility and convenience in one card!

- Credit Score: This doesn’t require a perfect credit history for approval.

- Annual Fee: You’ll be required to pay a $75 fee during the first year of usage. But after that, the amount is down to $48 annually.

- Purchase APR: It stands at 35.99%.

- Cash Advance APR: Also 35.99%.

- Rewards: The Revvi Card presents a rewards initiative, granting users a 1% cash back on their payments. Besides, you can easily track and redeem your rewards through the user-friendly Revvi mobile app.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Revvi Card: Overview

While the Revvi Card can be a valuable asset in your financial toolkit, you should review and understand its features in order to make the right choice for your profile.

When considering the Revvi Card, you can expect a credit solution for people with varying credit backgrounds. Besides, the application process is quick, and you can receive a response in seconds.

But upon approval, anticipate a single Program Fee of $95. Plus, there’s an Annual Fee amounting to $75 for the initial year. Subsequently, it decreased to $48 on an annual basis thereafter.

Additionally, there’s $8.25 every month. This Monthly Servicing Fee is initially waived for the first year. Although this is a good option to build credit, there are other cards out there with lower fees.

If you’re looking for rewards while building credit, the Revvi Card gives you 1% cash back on payments. By providing regular reports to credit bureaus facilitates the improvement of your credit standing.

Analyzing the advantages and drawbacks of the Revvi Card

As with any other credit card, you should review the pros and cons to be sure the Revvi Visa® Card is the right option for your financial profile. So, keep reading and find out more!

Pros

- Visa® credit card solution tailored to individuals with diverse credit histories;

- Cash back rewards;

- Assists users in establishing or improving their credit profiles;

- Mobile app offers a seamless and intuitive experience;

- Responsive and helpful customer support.

Cons

- The card comes with significant fees;

- Has an elevated Annual Percentage Rate;

- The redemption process for rewards is restrictive.

Eligibility Requirements for the Revvi Card

While the Revvi Card accepts users with less-than-perfect credit scores, there are certain eligibility criteria you should review before applying. First, you must be at least 18 years of age.

Moreover, you must have a valid Social Security number and a checking account in your name, as the Revvi Card requires an account to be linked for payments and transactions.

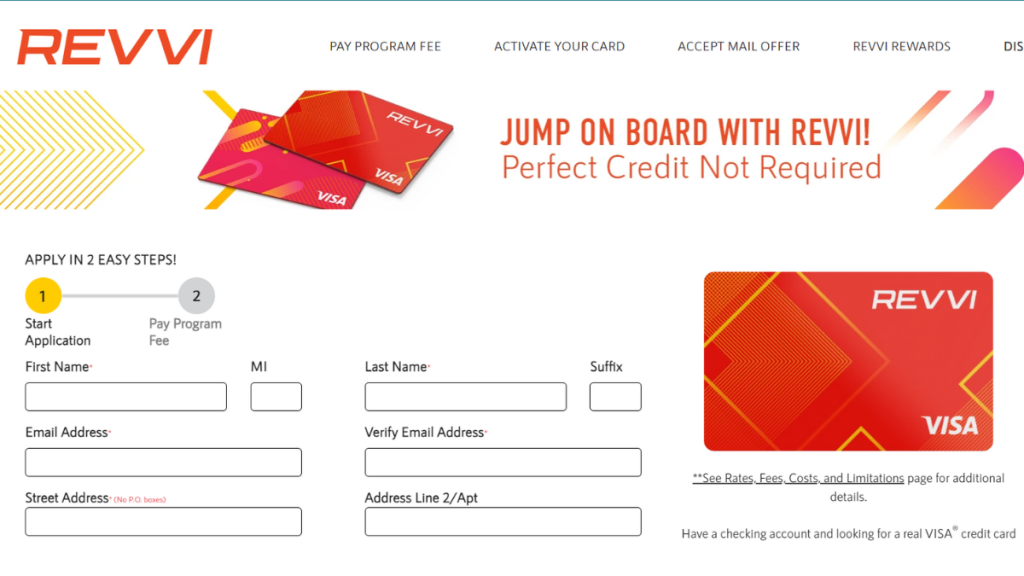

Applying for the Revvi Card: a manual

So, want to get your very own Visa® credit card? Then just review an easy step-by-step to learn how to apply for the Revvi Card. As mentioned before, the process is quick and online!

This means in just a few minutes you can be approved for your new credit card! From visiting the official website to filling out your form, below you can check out a simple guide to apply!

Apply for Revvi Card: Accessible Credit!

Take control of your finances and access valuable credit resources with the Revvi Card. Enjoy a Visa® credit card option, regardless of your credit history

Trending Topics

Improve your Productivity with Notion

Notion is a versatile tool that merges everyday work apps into a unified, customizable workspace. It allows you to take notes, add tasks, manage projects, and create your knowledge base, all while collaborating with your team.

Keep Reading

Destiny Mastercard® Review: Build Your Credit Effectively

Is Destiny Mastercard® Card the right choice for you? Dive into its advantages and disadvantages to make an informed decision.

Keep ReadingYou may also like

How to Maximize Your Learning Experience in Professional Courses

Maximize learning courses with personalized frameworks, daily routines, and active participation to ensure lasting career growth.

Keep Reading