Cartão de crédito

Análise do cartão de crédito Capital One Venture X: viaje com facilidade!

Poucos cartões conseguem compensar os custos de manutenção com um programa de recompensas robusto, mas o Capital One Venture X Credit Card está aqui para provar que é possível! Venha descobrir mais!

Anúncios

Você será redirecionado a outro site

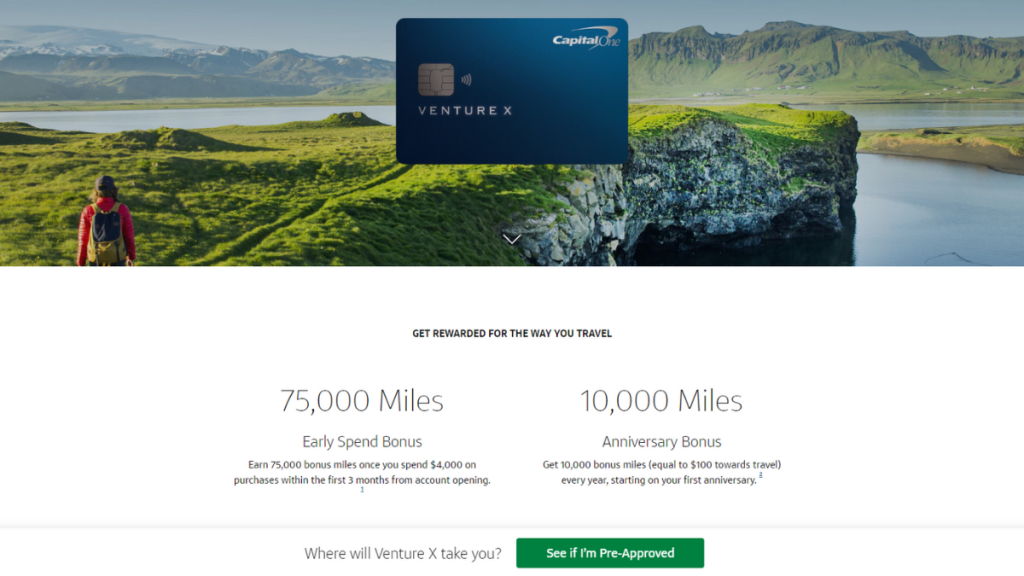

Cartão de crédito Capital One Venture X: 75 mil milhas de bônus!

Na análise do cartão de crédito Capital One Venture X, saiba como este cartão inclui acesso a bônus de boas-vindas, presentes de aniversário e muito mais!

Solicite o cartão de crédito Capital One Venture X

Você pode solicitar o Capital One Venture X Credit Card sem sair de casa! Preencha um formulário virtual rapidamente!

De qualquer forma, este é um cartão para viajantes que buscam alavancar sua excelente pontuação de crédito para explorar o mundo! Confira!

- Pontuação de crédito: Excelente;

- Taxa anual: $395 por ano;

- APR de compra: 19.99% a 29.99%;

- Adiantamento de dinheiro APR: 29.99%;

- Recompensas: 2 a 10 milhas por dólar; Bônus de aniversário; Bônus de boas-vindas.

Cartão de crédito Capital One Venture X: Visão geral

Primeiramente, esta análise do Capital One Venture X Credit Card é crucial para você determinar se o cartão é certo para você! Graças às suas recompensas, este é um cartão perfeito para viajantes frequentes!

É essencial entender como o bônus de recompensas funciona e como ele ajuda a melhorar suas viagens globais. Você ganha 10 milhas para cada dólar gasto em reservas de hotel e carro.

Além disso, você também ganha 5 milhas em reservas de voos e 2 milhas para cada $1 gasto em qualquer compra.

Além disso, você pode resgatar suas milhas de várias maneiras. Primeiro, você pode usar suas milhas para reservar viagens pelo site Capital One. Também é possível transferir milhas para companhias aéreas e hotéis parceiros ou usá-las para vales-presente.

O valor da transferência geralmente é de um centavo por milha, mas é essencial verificar os detalhes no site do Capital One. Além disso, o cartão oferece bônus extras que podem melhorar sua experiência.

Analisando as vantagens e desvantagens do cartão de crédito Capital One Venture X

Para uma análise perfeita do Capital One Venture X Credit Card, precisamos abordar os prós e os contras. Então confira!

Prós:

- Recompensas: Conforme detalhado, você pode ganhar de 2 a 10 milhas em compras!

- Resgate: Várias e vantajosas formas de resgatar suas milhas para viajantes!

- Lounge: Mais de 1.300 lounges de aeroportos no mundo todo para você aproveitar com a exclusividade do cartão de crédito Capital One Venture X.

- Bônus de boas-vindas: você pode ganhar 75.000 milhas se gastar $4.000 nos primeiros três meses, resultando em um bônus de aproximadamente $750!

- Bônus de Aniversário: Você pode ganhar milhas e até dólares para gastar em viagens. Até $300 por ano em reservas e 10.000 milhas após renovar seu cartão!

Contras:

- Alta taxa anual: a taxa anual do cartão de crédito Capital One Venture X pode ser alta, mas compensa facilmente se você usar o cartão ao máximo, aproveitando o bônus de boas-vindas e as recompensas de aniversário!

Requisitos de elegibilidade para o cartão de crédito Capital One Venture X

O principal requisito que podemos destacar é a necessidade de um excelente score de crédito, o que limita a acessibilidade do cartão.

Além disso, você deve ter mais de 18 anos e residência no território dos EUA. Todas as informações precisam ser verificadas por meio de documentação relevante ao preencher o formulário de pré-qualificação.

Solicitando o Cartão de Crédito Capital One Venture X: Um Manual

Solicitar este cartão de crédito é simples e você pode fazê-lo o mais rápido possível. Além disso, este cartão oferece um sistema de pré-qualificação online!

Quer saber mais? Explore o blueprint que preparamos para guiar você pelo processo!

Solicite o cartão de crédito Capital One Venture X

Você pode solicitar o Capital One Venture X Credit Card sem sair de casa! Preencha um formulário virtual rapidamente!

Sobre o autor / Pedro Saynovich

Em Alta

Venmo: a maneira divertida e conveniente de dividir contas e despesas!

Embarque em uma jornada em direção a uma gestão financeira mais inteligente e transações sem complicações. Prepare-se para experimentar a facilidade do Venmo!

Continue lendo

Como aproveitar ao máximo os cursos online gratuitos para o desenvolvimento de habilidades

Aproveite ao máximo os cursos online gratuitos definindo metas claras, criando hábitos de estudo consistentes e aplicando habilidades para o crescimento profissional no mundo real.

Continue lendoVocê também pode gostar

Como obter aprovação para um empréstimo com uma pontuação de crédito baixa

Aprenda como aumentar suas chances de aprovação de empréstimo mesmo com crédito baixo, utilizando estratégias, escolhendo a instituição financeira certa e gerenciando suas finanças.

Continue lendo

Como manter a motivação durante cursos profissionais de longa duração

Mantenha a motivação em alta durante longos cursos profissionais com estratégias como metas, rotinas e apoio da comunidade.

Continue lendo

Truist Enjoy Cash Secured Card: Crie crédito com dinheiro de volta

Construa seu crédito com o Truist Enjoy Cash Secured Card, oferecendo recompensas e limites flexíveis. Um passo inteligente para impulsionar seu futuro financeiro!

Continue lendo