Cartão de crédito

Solicite o cartão de crédito Chase Freedom Flex®: comece a economizar!

Interessado em maximizar suas recompensas de cartão de crédito? Descubra instruções passo a passo sobre como solicitar on-line e em uma agência o Chase Freedom Flex® Credit Card e aproveite bônus de introdução, cashback e muito mais!

Anúncios

Você será redirecionado a outro site

Aproveite ao máximo suas compras diárias e economize muito com recompensas de cashback!

Se você é o tipo de gastador inteligente que não se importa com recompensas complexas que lhe trazem bônus generosos em dinheiro de volta, então você deve solicitar o cartão de crédito Chase Freedom Flex®!

Não é muito fã de aplicações online? Não se preocupe! Já que você pode ir até uma agência do Chase mais próxima de sua localização e falar com um representante. Então, você pode se candidatar pessoalmente com confiança!

Embora este cartão exija que você acompanhe seus gastos para ativar categorias, ele oferece uma chance de maximizar suas finanças. Isso significa que você será recompensado toda vez que usar seu cartão!

E se você for um novo membro do cartão, você também pode ganhar um generoso bônus introdutório. Então, continue lendo e descubra como funciona o processo de inscrição, e comece a aproveitar os benefícios hoje mesmo!

O que faz o cartão de crédito Chase Freedom Flex® se destacar

O Chase Freedom Flex® Credit Card oferece um programa de recompensas versátil com cashback variando de 1% a 5%. Isso significa que você pode receber dinheiro de volta em uma variedade de categorias.

De compras de supermercado a gasolina e compras de farmácia, ele foi projetado para atender a uma ampla gama de hábitos e preferências de gastos. Além disso, você pode aproveitar um generoso bônus de inscrição.

Além do programa de recompensas, este cartão oferece benefícios adicionais para melhorar sua experiência. Tenha acesso a vantagens relacionadas a viagens, como seguro de cancelamento e interrupção de viagem.

Isso proporciona tranquilidade para interrupções inesperadas de viagem. E sem anuidade, você pode aproveitar esses benefícios sem se preocupar com custos recorrentes!

Opções de aplicação para o cartão de crédito Chase Freedom Flex®

Com uma combinação de recompensas, bônus iniciais e benefícios, o cartão de crédito Chase Freedom Flex® é a escolha perfeita para você aproveitar ao máximo seus gastos diários!

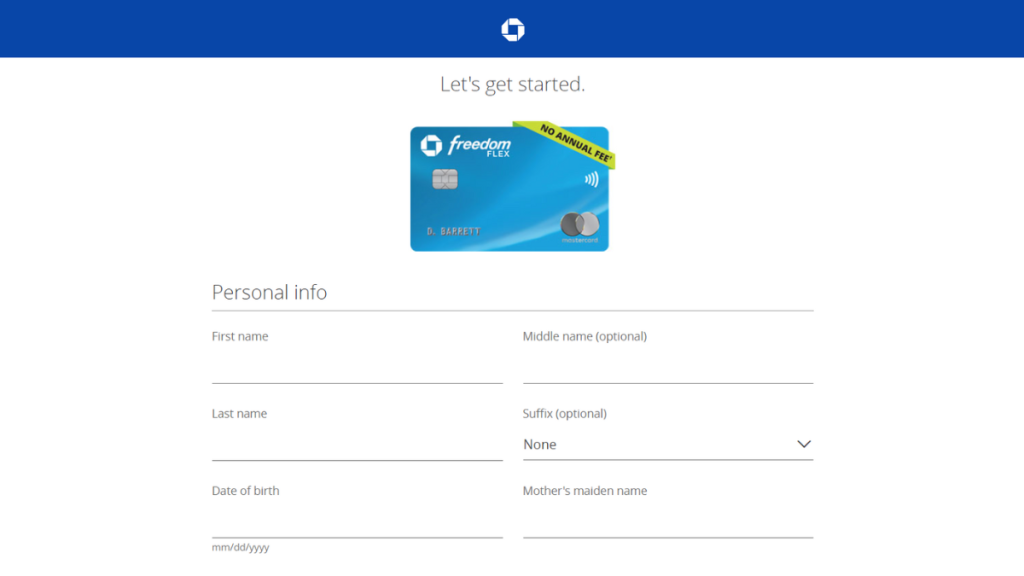

Como se candidatar online

- Visite o site do banco: Primeiro, vá ao site do Chase Bank e clique em “Credit Cards” no menu principal. Depois, selecione a opção para ver cartões de crédito pessoais.

- Revise as informações: Quando você encontrar o Chase Freedom Flex® Credit Card, clique para revisar suas informações antes de solicitar. Certifique-se de que este é o cartão certo para seu estilo de vida.

- Iniciar inscrição: Em seguida, clique no botão “Apply Now” e preencha o formulário de inscrição com as informações necessárias. Quando terminar, envie o formulário online.

- Aprovação: Você pode receber uma decisão instantânea sobre sua inscrição, ou o Chase pode precisar de mais tempo para revisar suas informações. Após a aprovação, você receberá seu Chase Freedom Flex® Credit Card pelo correio.

Como se candidatar pessoalmente numa agência bancária

- Localize uma agência: O primeiro passo é acessar o site do Chase Bank e localizar uma agência mais próxima de você. Então, certifique-se de que a agência oferece serviços de solicitação de cartão de crédito.

- Reúna os documentos: Em seguida, reúna os documentos necessários para a solicitação do cartão de crédito, como identificação, recibos de pagamento ou extratos bancários recentes e o que o Chase exige para uma solicitação de cartão de crédito.

- Visite a agência: Ao chegar, dirija-se a um representante de atendimento ao cliente ou ao gerente do banco e expresse seu interesse em solicitar o cartão de crédito Chase Freedom Flex®.

- Preencha o formulário: Preencha o formulário de inscrição com informações pessoais precisas, incluindo seu nome completo, endereço, data de nascimento, número do Seguro Social e informações de contato.

- Envie o formulário e aguarde a aprovação: Quando terminar, envie o formulário. Depois que sua inscrição for enviada, aguarde até que o Chase analise suas informações e forneça uma decisão. Se for aprovado, você também receberá seu Chase Freedom Flex® Credit Card pelo correio.

Gostaria de saber sobre outras opções? Aqui está o US Bank Altitude® Go Visa Signature® Card!

Achar que as complexas recompensas rotativas não são para você? Então solicite o US Bank Altitude® Go Visa Signature® Card em vez do Chase Freedom Flex® Credit Card.

Se você está procurando recompensas com uma abordagem mais fácil, esta pode ser a melhor opção para seu estilo de vida. Com pontos em restaurantes, compras de supermercado e até serviços de streaming, este cartão é uma opção atraente!

Além disso, o US Bank Altitude® Go Visa Signature® Card também oferece um generoso bônus introdutório sem nenhuma taxa anual para se preocupar. Então, você está interessado em saber mais?

Então, confira uma análise aprofundada e obtenha insights sobre o programa de recompensas, benefícios, taxas e requisitos de elegibilidade do cartão. Isso ajudará você a tomar uma decisão informada!

Banco dos EUA Altitude® Go Visa Signature®

Solicite o US Bank Altitude Go Visa Signature Card para uma oferta de taxa $0 ExtendPay® e um crédito de streaming $15. Comece a economizar de forma inteligente!

Em Alta

Como usar um empréstimo para investir no seu desenvolvimento de carreira

Saiba como um empréstimo para desenvolvimento de carreira pode financiar seu crescimento, com estratégias para pagar de forma eficiente e impulsionar suas perspectivas de carreira.

Continue lendo

McDonald's está contratando: posições de nível básico a partir de $10/hora

Comece sua carreira no McDonald's! Horários flexíveis, pagamento fixo e oportunidades de crescimento fazem dele um ótimo lugar para trabalhar. Veja como se candidatar hoje!

Continue lendo