Kad Kredit

Kajian Kad Kredit Chase Freedom Flex®: Fokus pada Ganjaran!

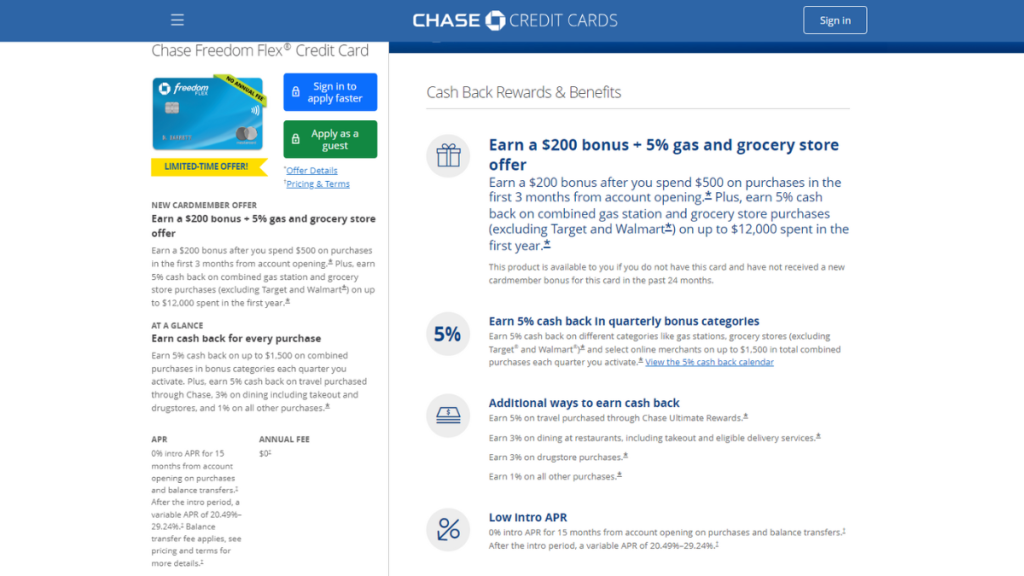

Daripada pulangan tunai untuk barangan runcit dan gas kepada tanpa yuran tahunan, itu hanyalah gambaran tentang perkara yang boleh dibawa oleh Kad Kredit Chase Freedom Flex® ke meja! Dapatkan akses kepada pelbagai faedah dan maksimumkan perbelanjaan harian anda!

IKLAN

Anda akan dialihkan ke laman web lain

Temui kuasa pulangan tunai, bonus pengenalan dan faedah perjalanan semuanya dalam satu kad kredit!

Apabila anda mencari kad kredit yang memfokuskan ganjaran, adalah perkara biasa untuk mengharapkan bayaran yang tinggi dan APR. Dan itulah sebabnya anda perlu menyemak Kad Kredit Chase Freedom Flex® dan ciri-cirinya.

Mohon Kad Kredit Chase Freedom Flex®

Mohon Kad Kredit Chase Freedom Flex® dan nikmati bayaran balik untuk perbelanjaan harian seperti gas dan barangan runcit.

Walaupun program ganjaran mungkin agak rumit, kad ini menawarkan pelbagai manfaat tanpa yuran tahunan! Sebaik sahaja anda memahami cara ia berfungsi, anda perlu memohon segera!

- Skor Kredit: Skor kredit 670 atau lebih tinggi disyorkan.

- Yuran Tahunan: Sifar.

- Beli APR: Jika anda pemegang kad baharu, untuk 15 bulan pertama anda boleh menikmati APR yang diketepikan. Tetapi selepas itu, ia adalah antara 20.49% hingga 29.24%.

- APR Pendahuluan Tunai: 29.99%.

- Ganjaran: Jika anda baru membuka akaun anda, dengan membelanjakan $500 dalam 3 bulan pertama anda mendapat bonus $200. Selain itu, kad ini menawarkan program ganjaran berputar yang memberikan 5% kembali pada pembelian gabungan, tetapi anda perlu mengaktifkannya. Selain itu, anda mendapat jumlah rebat yang sama untuk barangan runcit, gas dan juga perjalanan. Yang terakhir mesti dibeli melalui program ganjaran Chase sendiri. Akhir sekali, anda juga mendapat pulangan tunai 3% dan 1% di kedai ubat dan pembelian lain masing-masing.

Kad Kredit Chase Freedom Flex®: Gambaran Keseluruhan

Sebaik sahaja anda menyemak dan memahami program ganjaran Kad Kredit Chase Freedom Flex®, sukar untuk mengalihkan fikiran anda daripada alat kewangan ini. Lagipun, jumlah pulangan tunai agak menarik!

Dengan kad ini, anda akan mendapat bonus alu-aluan yang besar dengan ambang perbelanjaan minimum dan kadar ganjaran antara 1% hingga 5% pulangan tunai seperti yang dinyatakan sebelum ini.

Selain itu, anda mendapat APR pengenalan sebanyak 0%. Walau bagaimanapun, selepas tempoh pengenalan, APR berubah akan digunakan. Dan bergantung pada kelayakan kredit anda, ia mungkin agak tinggi.

Walaupun tiada yuran tahunan, masih terdapat yuran yang berkaitan seperti yuran pemindahan baki dan yuran transaksi asing, yang boleh memberi kesan kepada kos keseluruhan penggunaan kad.

Ringkasnya, Kad Chase Freedom Flex® menyediakan program ganjaran yang komprehensif. Seperti mana-mana kad kredit, terdapat bayaran yang perlu dipertimbangkan, tetapi faedahnya menjadikan kad ini pilihan yang menarik.

Menganalisis kelebihan dan kelemahan Kad Kredit Chase Freedom Flex®

Walaupun Kad Kredit Chase Freedom Flex® menawarkan faedah yang menarik, ia juga penting untuk menyemak dan menimbang kemungkinan kelemahan untuk mengurus kad secara bertanggungjawab. Semak di bawah!

Kebaikan

- Pemegang kad baharu boleh mendapat bonus yang lumayan

- Tidak perlu risau tentang kos berulang

- Ganjaran pulangan tunai yang berterusan dan bergilir

- Faedah berkaitan perjalanan

- Pelbagai pilihan penebusan

Keburukan

- Terlupa untuk mengaktifkan ganjaran boleh mengakibatkan peluang ganjaran terlepas

- Pulangan tunai untuk kategori berputar adalah terhad

- Mengenakan yuran transaksi luar negara

- Faedah perjalanan terhad

Syarat Kelayakan untuk Kad Kredit Chase Freedom Flex®

Seperti yang anda boleh jangkakan selepas membaca ulasan ini, Kad Kredit Chase Freedom Flex® memerlukan skor kredit yang sangat baik untuk kelulusan. Jadi, jika markah anda lebih rendah daripada 670, anda mungkin tidak layak.

Selain itu, seperti kebanyakan kad kredit lain, pemohon mestilah berumur sekurang-kurangnya 18 tahun dan mempunyai nombor Keselamatan Sosial yang sah. Bank juga mungkin mempertimbangkan faktor lain untuk kelulusan.

Contohnya, pendapatan anda, status pekerjaan dan akaun kredit sedia ada. Memenuhi syarat kelayakan ini meningkatkan kemungkinan kelulusan untuk kad ini.

Memohon Kad Kredit Chase Freedom Flex®: manual

Jadi, adakah anda bersedia untuk menikmati semua faedah tersebut dan mula memaksimumkan perbelanjaan harian anda? Kemudian tiba masanya untuk menyemak panduan lengkap untuk mengetahui cara memohon Kad Kredit Chase Freedom Flex®.

Walaupun permohonan dalam talian lebih mudah dan mudah, pemohon juga boleh pergi ke cawangan Chase untuk memohon secara peribadi. Lihat di bawah dan ketahui cara proses itu berfungsi dalam kedua-dua kes!

Mohon Kad Kredit Chase Freedom Flex®

Mohon Kad Kredit Chase Freedom Flex® dan nikmati bayaran balik untuk perbelanjaan harian seperti gas dan barangan runcit.

TRENDING_TOPICS

American Express Blue Cash Everyday®: Ganjaran tanpa Yuran Tahunan

Temui Kad American Express Blue Cash Everyday®: dapatkan pulangan tunai 3% untuk barang keperluan tanpa yuran tahunan. Sesuai untuk simpanan harian.

Teruskan Membaca

Ulasan Freelancer: Platform untuk Peluang Bebas

Temui Freelancer, platform dinamik yang menghubungkan pekerja bebas dan pelanggan di seluruh dunia. Terokai fungsi, kelebihan dan perbandingan!

Teruskan MembacaANDA_MUNGKIN_JUGA_SUKA

Delta SkyMiles® Gold: Tingkatkan Perjalanan Anda dengan Ganjaran Disesuaikan

Ketahui tentang faedah Delta SkyMiles® Gold Card, seperti beg berdaftar percuma dan ganjaran perjalanan untuk risalah Delta.

Teruskan Membaca