Kad Kredit

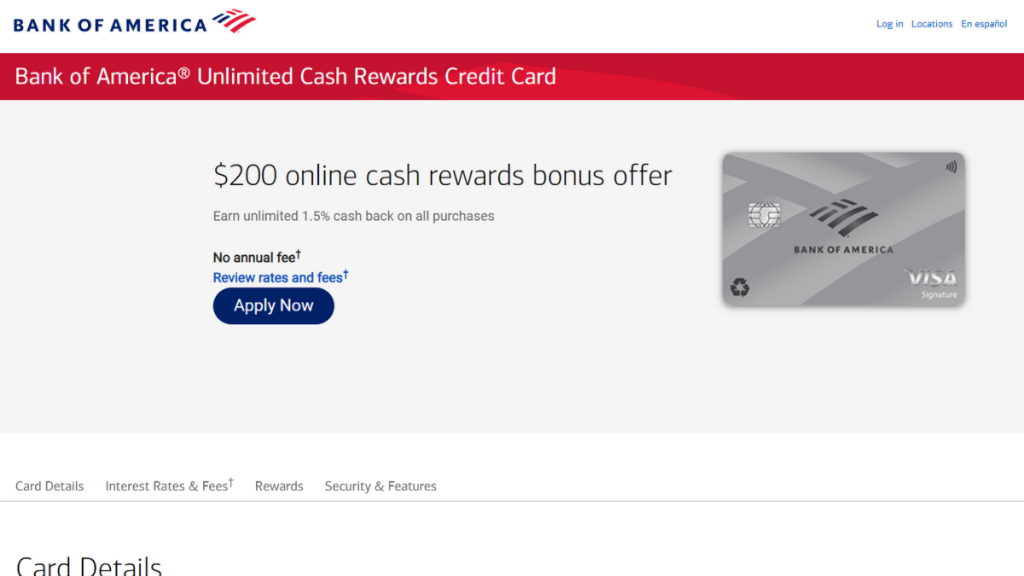

Kad Ganjaran Tunai Tanpa Had Bank of America®: Peroleh Lebih!

Peroleh ganjaran yang tidak berkesudahan dengan Kad Kredit Ganjaran Tunai Tanpa Had Bank of America®. Nikmati pulangan tunai 1.5% tanpa had dan yuran tahunan $0 yang menggembirakan untuk pengembaraan perbelanjaan anda.

IKLAN

Anda akan dialihkan ke laman web lain

Dapatkan ganjaran yang tidak berkesudahan dengan setiap leretan, dan semuanya tanpa yuran tahunan

Jika anda berada di pasaran untuk kad kredit yang tidak ribet dan memberi ganjaran yang tidak mahal untuk disimpan, semakan Kad Ganjaran Tunai Tanpa Had Bank of America® ini pasti dibuat untuk anda.

Mohon untuk Ganjaran Tunai Tanpa Had Bank of America®

Terima potensi pendapatan tanpa had dan tiada yuran tahunan apabila anda memohon Kad Ganjaran Tunai Tanpa Had Bank of America®!

Dengan struktur yang tidak rumit, kad ini menawarkan pelbagai manfaat yang boleh menambah rutin anda dan memberi kelebihan kepada dompet anda. Jadi, teruskan membaca untuk memahami semua tawarannya.

- Skor Kredit: Paling sesuai untuk mereka yang mempunyai skor kredit yang baik hingga cemerlang, memastikan proses kelulusan yang lebih lancar.

- Yuran Tahunan: $0;

- Beli APR: Tempoh permulaan 15 bulan dengan faedah rendah. Kemudian, kadar diselaraskan berdasarkan kepercayaan kredit anda, berbeza antara 18.24% – 28.24%.

- APR Pendahuluan Tunai: Berbeza-beza antara 21.24% dan 29.24%, jadi sebaiknya digunakan dengan berhati-hati.

- Ganjaran: Setiap pembelian menambahkan 1.5% kembali terus ke akaun anda, menjadikan perbelanjaan lebih bermanfaat tanpa sebarang had.

Kad Ganjaran Tunai Tanpa Had Bank of America®: Gambaran Keseluruhan

Temui ganjaran yang tidak berkesudahan dengan Kad Ganjaran Tunai Tanpa Had Bank of America®. Setiap pembelian mengembalikan wang ke dalam poket anda, menyelaraskan simpanan anda dengan mudah.

Selain itu, anda akan dapat menikmati yuran tahunan sifar. Manfaat ini memastikan kewangan anda sentiasa lancar, menawarkan penjimatan yang terkumpul dari semasa ke semasa, meningkatkan daya tarikan kad untuk pengguna yang bijak wang.

Selain itu, tempoh APR pengenalan adalah nafas kewangan. Ia beralih kepada kadar berubah (18.24% – 28.24%), menawarkan gabungan fleksibiliti dan kebolehsuaian selepas tempoh pengenalan.

Tambahan pula, keselamatan dan kemudahan berada di barisan hadapan. Kad ini melindungi perbelanjaan anda sambil menawarkan pilihan penebusan yang mudah dan fleksibel, memastikan ketenangan fikiran.

Akhir sekali, anda boleh membuka kunci kadar pulangan tunai yang unggul dengan menjadi ahli Ganjaran Pilihan, mendorong pengumpulan ganjaran anda ke tahap yang mengagumkan sehingga 75%.

Menganalisis kelebihan dan kelemahan Kad Kredit Ganjaran Tunai Tanpa Had Bank of America®

Mari semak ciri utama Kad Ganjaran Tunai Tanpa Had Bank of America® dan bandingkannya. Lihat mereka di bawah.

Kebaikan

- Peroleh kadar rata 1.5% pada semua perkara, di mana-mana sahaja. Tiada had.

- Ia memastikan dompet anda gembira dengan sifar yuran tahunan.

- Permulaan yang manis dengan APR yang rendah untuk tempoh 15 bulan, memudahkan ke arah kewangan.

- Ganjaran mengalir dengan bebas, dan anda boleh menebus mengikut kehendak anda.

- Langkah keselamatan yang sangat teguh untuk perbelanjaan anda.

- Pulangan tunai yang bertimbun tidak pernah lapuk dan tidak pernah luput.

Keburukan

- Malangnya, APR selepas bulan madu mungkin mematahkan hati anda.

- Pemindahan baki datang dengan pelukan kos sebanyak 3% setiap transaksi.

- Satu kadar tetap tunggal untuk mengawal semua pembelian, tiada kategori istimewa.

- Perjalanan ke luar negara mungkin membawa bayaran tambahan.

Syarat Kelayakan untuk Kad Kredit Ganjaran Tunai Tanpa Had Bank of America®

Seperti yang mungkin anda perhatikan dalam semakan Kad Ganjaran Tunai Tanpa Had Bank of America® ini, kad ini memerlukan skor kredit yang lebih tinggi.

Selain itu, anda perlu memenuhi piawaian kelayakan lain seperti menjadi orang dewasa yang sah, mempunyai kewarganegaraan Amerika dengan alamat surat-menyurat, pendapatan kukuh tanpa kebankrapan dan banyak lagi.

Bank of America boleh menjadi agak ketat dengan tawaran kreditnya. Oleh itu, pastikan anda menyemak status anda sebelum menarik permohonan supaya anda tidak akan memudaratkan skor kredit anda dengan pertanyaan keras.

Memohon Kad Kredit Ganjaran Tunai Tanpa Had Bank of America®: manual

Jadi, sekarang setelah anda melihat perkara yang boleh dibawa oleh Kad Kredit Ganjaran Tunai Tanpa Had Bank of America® kepada kewangan anda, tiba masanya untuk mengambil langkah seterusnya dan menyemak cara proses permohonannya berfungsi.

Walaupun anda boleh meminta kad anda dalam talian tanpa perlu bersusah payah, terdapat cara lain untuk memohon juga. Pelajari semuanya dalam pautan berikut dan bersiap sedia untuk pembelian bermanfaat sepanjang hayat!

Mohon untuk Ganjaran Tunai Tanpa Had Bank of America®

Terima potensi pendapatan tanpa had dan tiada yuran tahunan apabila anda memohon Kad Ganjaran Tunai Tanpa Had Bank of America®!

TRENDING_TOPICS

Apa yang Perlu Dipertimbangkan Sebelum Mengambil Pinjaman Rumah: Langkah dan Peraturan Utama

Pelajari langkah-langkah penting untuk memilih pinjaman rumah yang tepat, daripada membuat bajet hingga membandingkan terma, untuk pengalaman membeli rumah yang lancar.

Teruskan Membaca

Semakan Apl Chime: Perbankan dengan Twist Moden

Temui Chime, apl kewangan yang merevolusikan cara orang ramai membuat bank dengan pelbagai fungsi anda.

Teruskan Membaca

Permohonan untuk Destiny Mastercard®: Bagaimana untuk Memohon?

Membuka Kunci Pintu untuk Kredit yang Lebih Baik! Lihat panduan aplikasi Destiny Mastercard® untuk pembinaan kredit pintar.

Teruskan MembacaANDA_MUNGKIN_JUGA_SUKA

Cara Memaksimumkan Pengalaman Pembelajaran Anda dalam Kursus Profesional

Maksimumkan kursus pembelajaran dengan rangka kerja yang diperibadikan, rutin harian dan penyertaan aktif bagi memastikan pertumbuhan kerjaya yang berkekalan.

Teruskan Membaca

Manfaat Mengambil Kursus Dalam Talian untuk Kemajuan Kerjaya

Majukan kerjaya anda dengan kursus dalam talian dengan memilih program yang berkaitan dan menggunakan kemahiran untuk pertumbuhan dunia sebenar.

Teruskan Membaca

Pembukaan Amazon: Bermula dengan Lebih $18 setiap Jam Manfaat Tambahan

Teroka pekerjaan Amazon bermula pada $18/jam. Peranan peringkat permulaan dengan faedah dan peluang sebenar untuk pertumbuhan kerjaya di AS!

Teruskan Membaca