Kad Kredit

Permohonan untuk Destiny Mastercard®: Bagaimana untuk Memohon?

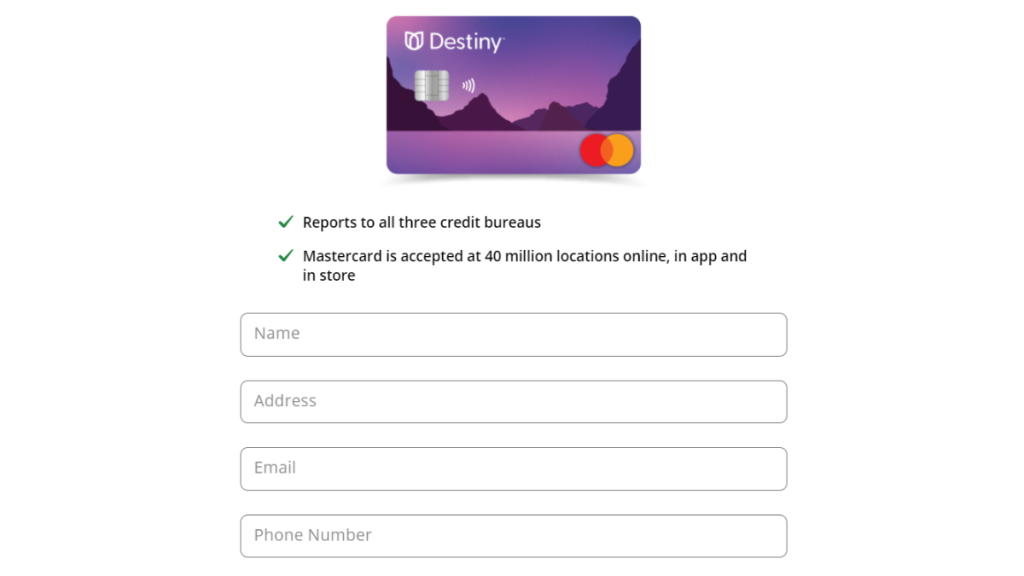

Mulakan perjalanan membina semula kredit anda dengan Destiny Mastercard®! Lihat panduan permohonan mudah di bawah!

IKLAN

Anda akan dialihkan ke laman web lain

Destiny Mastercard®: Peluang kedua anda sudah tiba

Adakah anda ingin membina semula kredit anda, tetapi sedang bergelut untuk mencari kad kredit yang akan menerima skor anda yang kurang sempurna? Kad Destiny Mastercard® mungkin penyelesaian untuk anda!

Kad kredit ini menawarkan bantuan yang hebat untuk individu yang mempunyai kredit buruk. Jadi, permohonan anda agak mudah: jika anda diluluskan selepas mengisi permohonan, anda akan diberi had kredit!

Destiny Mastercard® direka untuk membantu dengan pembinaan semula kredit, jadi ia melaporkan kepada ketiga-tiga biro kredit utama! Selain itu, apabila anda menggunakannya dan membuat pembayaran tepat pada masanya, skor kredit anda akan bertambah baik.

Jadi, jika anda ingin membaiki sejarah kredit anda, kad ini boleh menjadi peluang kedua anda. Baca terus untuk memahami cara proses permohonan berfungsi.

Destiny Mastercard®: Gambaran keseluruhan pantas

Kad Destiny Mastercard® dikeluarkan oleh First Electronic Bank, dan apabila anda memohon kad dalam talian, anda berpeluang untuk melayakkan diri untuk dua daripadanya: 201 dan 209.

Secara umum, dua kad yang tersedia untuk aplikasi dalam talian mempunyai ciri yang serupa, tetapi berbeza dari segi kos:

- Skor kredit: Semua sejarah kredit dipertimbangkan, yang bermaksud bahawa walaupun mereka yang mempunyai sejarah kredit yang mencabar mempunyai peluang untuk diluluskan.

- Yuran tahunan: Yuran tahunan adalah antara $59 hingga $99, bergantung pada versi yang dipilih.

- Kadar faedah: APR untuk pembelian ialah 24.9%, manakala APR untuk pendahuluan tunai ialah 29.9%.

Kerana ia direka terutamanya untuk membantu pemegang kad membina semula atau mewujudkan skor kredit mereka secara bertanggungjawab, Kad Destiny Mastercard® tidak menawarkan program ganjaran atau bonus alu-aluan yang menarik.

Walau bagaimanapun, ia adalah pilihan yang kukuh bagi mereka yang ingin meningkatkan profil kredit mereka.

Permohonan Destiny Mastercard®: Dalam Talian

Memohon Destiny Mastercard® dalam talian adalah sangat mudah dan boleh dilakukan dalam beberapa minit sahaja. Selain itu, syarat kelayakan adalah sangat mudah.

Untuk bermula, lawati tapak web rasmi Destiny, di mana anda akan menemui butang “Mohon Hari Ini” yang menonjol.

Klik pada butang di bawah untuk dibawa ke borang permohonan Destiny Mastercard®.

Borang permohonan Destiny Mastercard® akan meminta maklumat peribadi anda, termasuk nombor Keselamatan Sosial anda.

Sebaik sahaja anda telah mengisi borang, anda akan menerima balasan segera melalui e-mel, termasuk tawaran.

Jika tawaran itu memenuhi jangkaan anda, hanya kembali ke tapak web Destiny dengan kod aplikasi yang disediakan dan ikut arahan yang diberikan untuk melengkapkan permohonan anda.

Itu sahaja! Destiny Mastercard® menawarkan laluan mudah untuk membina atau membina semula kredit anda tanpa kerumitan yang tidak perlu.

Aplikasi Destiny Mastercard®: mudah alih

Walaupun aplikasi mudah alih tidak tersedia, tapak web mesra pengguna Destiny memastikan anda boleh mengurus akaun anda dengan mudah di mana-mana dan melalui telefon bimbit anda, menjadikannya pilihan yang mudah untuk mereka yang mempunyai gaya hidup yang sibuk.

Oleh itu, untuk mengurus akaun anda, anda boleh mengakses laman web rasmi Destiny Mastercard®, menggunakan log masuk dan kata laluan.

Kesimpulan

Membina semula kredit boleh mencabar, tetapi Destiny Mastercard® menjadikannya lebih mudah diakses berbanding sebelum ini dengan kelayakan dan proses permohonan yang mudah.

Produk kewangan menawarkan peluang berharga untuk individu yang ingin meningkatkan kepercayaan kredit mereka.

Jadi, mulakan perjalanan anda ke skor kredit yang lebih sihat hari ini, mengambil kesempatan daripada proses permohonan Destiny Mastercard® yang mudah dan tanpa kerumitan.

ABOUT_THE_AUTHOR / Pedro Saynovich

ANDA_MUNGKIN_JUGA_SUKA

Kursus Terbaik untuk Membantu Anda Membangunkan Kemahiran Utama untuk Pertumbuhan Kerjaya

Temui kursus terbaik untuk pertumbuhan kerjaya, dengan strategi untuk membangunkan kemahiran yang akan membezakan anda dalam industri.

Teruskan Membaca