クレジットカード

US Bank Altitude® Go Visa: 年会費無料、優れた特典

US Bank Altitude® Go Visa Signature® カードで、特典を最大限に活用し、年会費を節約しましょう。財務を合理化しながら、あらゆる購入をよりお得にする方法を学びましょう。

広告

別のウェブサイトにリダイレクトされます

お食事とストリーミングの特典を最大限に活用しましょう

あらゆる購入で特典が受けられ、年会費が不要になる世界に足を踏み入れましょう。US Bank Altitude® Go Visa Signature® カードをチェックして、さまざまなメリットをご確認ください。

このカードは単なる支払い方法ではありません。あなたの財政を豊かにするためのパートナーです。シームレスな支出から楽な貯蓄まで、このカードを持ち歩くべき理由をご紹介しますので、読み進めてください。

- クレジットスコア: 信用度が良好から優良な人を対象とし、財務状況を向上させます。

- 年会費: 毎年追加料金を心配することなく、財政に余裕を持って支出しましょう。

- 購入 APR: 最初の 12 か月間は購入と残高移行に 0.0% APR、その後は 17.49% ~ 28.49% APR が適用されます。

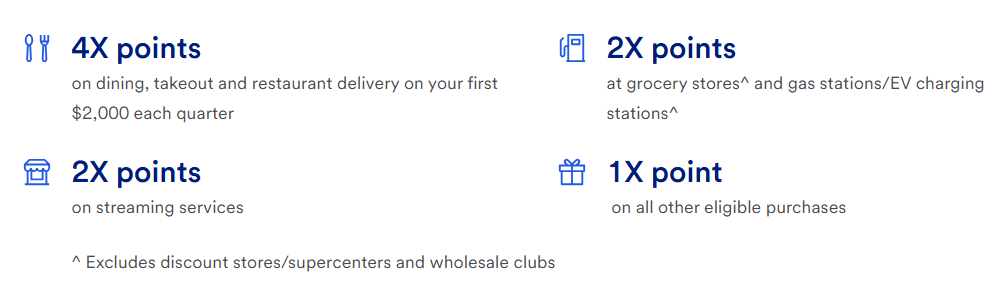

- キャッシュアドバンス APR: 31.49%変数;

- 報酬: 店内飲食、テイクアウト、デリバリーのいずれの場合でも、お食事には高いレート(4 倍のポイント)が適用されます。食料品、燃料、ストリーミング サービスには 2 倍のポイント、その他の対象となるすべての購入には標準レートの 1 倍のポイントが適用されます。

US Bank Altitude® Go Visa Signature® カード: 概要

US Bank Altitude® Go Visa Signature® カードで、魅力的なウェルカム ボーナスから始めて、無限の可能性の世界を広げましょう。このカードは、最初からやりがいのある旅にあなたを誘います。

購入ごとに獲得できる特典をぜひご検討ください。外食でも、お気に入りの番組のストリーミングでも、このカードはこれらの瞬間をポイントに変換し、支出体験を豊かにします。

このカードは年会費が無料なのも魅力で、ポイントや特典をよりお得に利用できます。より多くのお金をポケットに残すことができます。

さらに、残高移行や購入に対して 0% APR オファーをご利用いただけます。この 12 か月間の低金利期間は、競争力のある変動 APR にスムーズに移行します。

最後に、現代の消費者に合わせて、環境に優しい取り組みやストリーミング サービスに対する特典を提供しています。

カードの長所と短所を分析する

ここでは、US Bank Altitude® Go Visa Signature® カードの多くの利点と潜在的な欠点を検討し、このカードが提供するものを総合的にレビューします。

長所

- お食事やストリーミングの購入ですぐにポイントを獲得できます。

- 新規カード所有者向けの特別ボーナスで報酬をキックスタートします。

- 年会費がかからないので、長期的には節約になります。

- 1 年間、低い初回 APR のメリットを享受できます。

- 即時の報酬引き換えにより支出の柔軟性が向上します。

- $15 年間クレジットを取得して、お気に入りのストリーミング サービスのコストを軽減しましょう。

- ポイントの幅広い交換オプションにより、利便性が最大限に高まります。

短所

- 導入期間後はより高い APR が適用されます。

- キャッシングの年利率は著しく高いです。

- 食事やストリーミングにあまりお金をかけない人にとっては魅力が限られます。

- 60 日を過ぎると、残高移行手数料が上昇し始める場合があります。

- 非カテゴリ購入のポイント還元率は競争力が低くなります。

- 特定のクレジットスコア要件により、アクセスが制限されます。

US Bank Altitude® Go Visa Signature® カードの資格要件

US Bank Altitude® Go Visa Signature® カードの資格を得るには、高いクレジット スコアが必要です。

US 銀行は、あなたの収入や負債額などの金銭状況も調べます。これは、あなたが金銭的な問題を抱えることなく新しいカードを扱えるかどうかを確認したいからです。

さらに、18 歳以上の成人であり、米国に居住している必要があります。申請手続きには書類も必要となるため、準備しておいてください。

US Bank Altitude® Go Visa Signature® カードの申し込みオプション

お財布に優しいクレジットカードをお探しでも、日常の買い物でポイントが貯まるカードをお探しでも、このカードならすべて揃っています。

さらに、US Bank Altitude® Go Visa Signature® カードの申し込み方法もご確認ください。

オンラインでの申請方法

- クレジット スコアを確認する: クレジット履歴がカードの要件を満たしていることを確認します。スコアが良好から優秀であれば、承認される可能性が高くなり、申請プロセスがスムーズになります。

- 必要な書類を集める: 収入や雇用状況の証明など、必要な個人および財務書類を整理します。これらを手元に用意しておくと、申請が簡単になります。

- US Bank アプリケーション ポータルにアクセスします。US Bank の Web サイトにアクセスし、クレジットカード セクションに移動して、Altitude Go Visa を選択します。これで、申請フォームが表示されます。

- 申請書を記入してください: 申請書に詳細を慎重に記入してください。申請を成功させるには、正確で包括的な情報を提供することが重要です。

- 申請書を提出し、決定を待ちます: 申請書の正確性を確認した後、提出してください。承認プロセスでは、提供された詳細に基づいて即時に決定が下される場合があります。

銀行支店で直接申し込む方法

- 書類を準備する: 支店に向かう前に、身分証明書、収入証明、関連する財務諸表など、必要な書類をすべて集めてください。

- 最寄りの US Bank 支店にお越しください: 最寄りの US Bank 支店を探します。銀行の担当者と直接面談することで、カードに関する個別のアドバイスや回答を得ることができます。

- 銀行の担当者に相談する: 支店に到着したら、Altitude Go Visa カードに関心があることを伝えてください。担当者がアドバイスを提供し、申請手続きを案内します。

- サポートを受けて申請書を完成させる: 銀行の担当者が申請書の記入をお手伝いします。専門家の指導を受けながら、すべての情報が正確であることを確認する絶好の機会です。

- 申請書を提出し、次のステップについて話し合う: 支店で申請書を提出すると、担当者が処理時間と決定の通知方法についてお知らせします。

他のオプションについて知りたいですか?Bank of America® Unlimited Cash Rewardsクレジットカードはこちら

US Bank Altitude® Go Visa Signature® カードを申し込むかどうかわからない場合は、別の選択肢である Bank of America® Unlimited Cash Rewards クレジットカードを検討してみましょう。

このカードは、例外なく、すべての購入に対して 1.5% の還元率を提供します。また、年会費は無料です。お財布に優しく、支出するたびに報酬がもらえます。

さらに、新規加入者には、15 か月間の魅力的な初回 APR オファーが提供されます。これは、最初の数か月でより自由に資金を管理できるようにするための優しい後押しとなります。

よりシンプルな報酬構造に興味がありますか? それなら、Bank of America® Unlimited Cash Rewards クレジットカードが最適な選択肢であるかどうかを以下でご確認ください。

トレンドトピック

Upwork レビュー: フリーランスとして成功するための道

フリーランスとして成功するための入り口、Upwork を見つけましょう。プロジェクト、多様な才能、シームレスなコラボレーションを見つけましょう。

読み続けるあなたも気に入るかもしれない

Destiny Mastercard® の申し込み: 申し込み方法は?

より良い信用への扉を開きます! スマートな信用構築については、Destiny Mastercard® アプリケーション ガイドをご覧ください。

読み続ける