ローン

FinChoice 個人ローン: 迅速な支払いで最大 R25,000 を取得

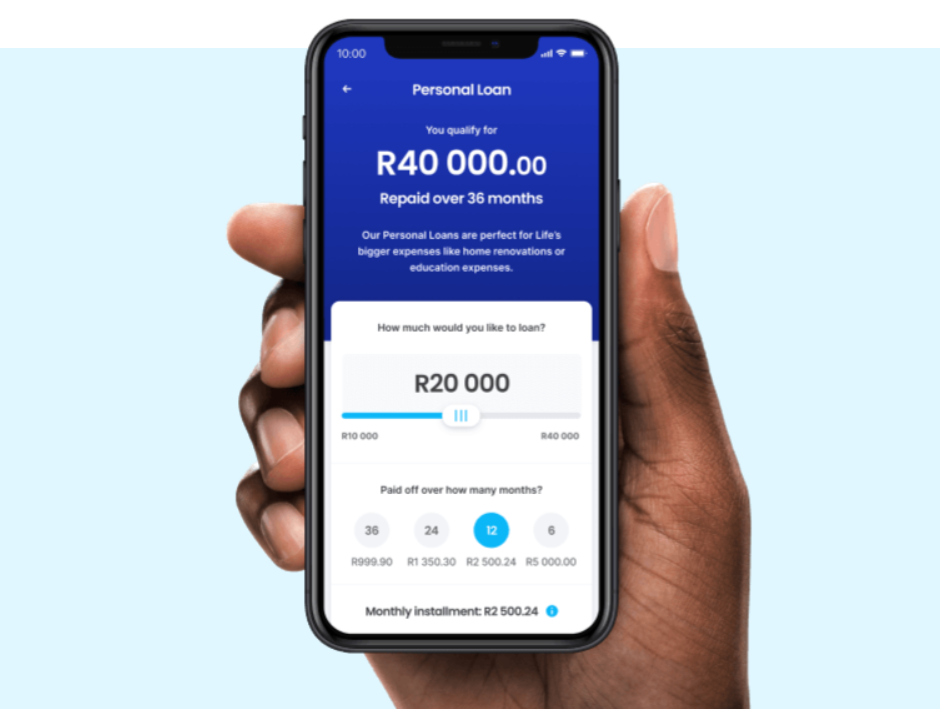

FinChoice 個人ローンをご覧ください。オンラインで最大 R25,000 を借り入れ、最長 24 か月で返済し、わずか 1 日で資金を受け取ることができます。

広告

別のウェブサイトにリダイレクトされます

簡単な申請と柔軟な支払い

FinChoice パーソナルローンは、南アフリカの人々が生活上の大きな出費を簡単に処理できるように設計されています。

柔軟な返済オプションと迅速な承認により、最も必要なときに実用的なサポートを提供します。

- クレジットスコア: 普通から良い

- 融資額: R500からR25 000

- ローン期間: 6ヶ月、12ヶ月、または24ヶ月

FinChoice 個人ローン:概要

FinChoice パーソナルローンは、迅速かつ柔軟な資金アクセスを必要とする個人を対象とした金融商品です。

借り手は完全にオンラインで申請し、最大 25,000 ランドまで融資を受けることができ、返済期間は最大 24 か月です。

承認されると、融資額は通常 1 日以内に振り込まれるため、時間的に厳しい財務ニーズに迅速なソリューションを提供します。

このプラットフォームは、書類手続きや長い待ち行列がなく、すべてが携帯電話またはコンピューターから行われるため、手間がかからない体験を提供します。

申請者は、「支払いスキップ」機能と 14 日間の満足保証の恩恵も受け、より高度な制御と柔軟性が得られます。

誰のためのものですか?

このローンは、大きな出費をシンプルかつ安全、かつ迅速に管理する方法を探している個人に適しています。

以下の方に最適です:

- 緊急資金にすぐにアクセスする必要がある

医療費、車両のメンテナンス、直前の旅行などの予期せぬ出費に対処している人。 - オンラインソリューションを好む

店舗に来店せずに、携帯電話やパソコンのみで申し込みたい方。 - 返済の柔軟性を重視

厳しい月の間に支払いをスキップするなど、調整可能な条件と機能を求める借り手。 - 安定した収入がある

定期的な雇用収入があり、収入証明を提供できる方に最適です。

何が特別なのでしょうか?

FinChoice パーソナルローンは、顧客に優しい機能により、南アフリカの他のパーソナルローンよりも際立っています。

- 最短1日で資金が利用可能

承認され、すべての書類が提出されると、翌日までに借り手の銀行口座にお金が反映されます。 - 予算に合わせて返済期間をカスタマイズ可能

顧客は予算に応じて 6 か月、12 か月、または 24 か月の返済期間を選択できます。 - 支払いスキップ機能

経済的に困難な月には支払いを延期するオプションを提供し、顧客に余裕を与えます。 - 100%デジタルプロセス

ローンの申請は書類のアップロードを含めすべてオンラインで行えるため、時間と労力を節約できます。 - 2週間の満足保証

顧客が気が変わった場合は、14 日以内にローンを返却できます。罰金や手数料はかかりません。

この個人ローンは安全で信頼できるものでしょうか?

FinChoice は国家信用法 (NCA) に基づいて運営されており、すべてのローンが規制金利と公正な融資慣行に準拠していることを保証します。

借り手は、ローンの条件の完全な透明性と、手数料の明確な内訳を通じて保護されます。

DebiCheck を使用すると、借り手にデビット注文の指示を確認するよう要求し、同意を確実にして詐欺のリスクを軽減することで、セキュリティが強化されます。

すべての個人情報および提出された書類は暗号化され、機密に扱われます。

FinChoice では、電子メール、WhatsApp、安全なアップロードなど、プライバシー保護のために監視された複数の方法で書類を送信できます。

FinChoice は、規制された運営と強力なデジタル インフラストラクチャを備え、南アフリカの消費者に信頼できる融資体験を提供します。

FinChoiceパーソナルローンの実践的な活用方法

このローンは「人生における大きな出費」のために設計されており、さまざまな個人的ニーズや経済的ニーズに利用できます。

突然の財政上の緊急事態に対処する場合でも、重要な計画を立てる場合でも、このローンは状況に合わせて適応します。

一般的な用途は次のとおりです:

- 医療費 – 医療援助で完全にカバーされない処置や健康関連の費用をカバーします。

- 住宅修理 – 貯金に手を付けることなく、配管、屋根、電気系統の問題を解決します。

- 債務整理 – さまざまな小額の借金を 1 つの整理された月々の分割払いにまとめることで、財務を簡素化します。

- 学費 – 経済的な負担によって子供たちの教育が中断されないようにします。

- 特別な機会 – 長期的な経済的ストレスなしに、結婚式、誕生日、旅行の資金を調達できます。

どのようなニーズでも、FinChoice は自信を持って対応できるスピードと柔軟性を提供します。

ローンの簡単な申請手続き

FinChoice 個人ローンの申請は迅速かつデジタル化されており、わずか数ステップで完了します。

- 1. 希望するローン金額を選択し、見積もりを受け取ります。

オンライン スライダー ツールを使用して必要な金額を選択し、月々の分割払いの見積額を即座に表示します。 - 2. オンラインで申請書を提出します。

FinChoiceのウェブサイトまたはモバイルプラットフォームにアクセスし、申込書にご記入ください。24時間365日、安全にご利用いただけます。 - 3. DebiCheck の義務化を承認します。

DebiCheck を使用して返済契約を確認してください。DebiCheck は、銀行口座の詳細を安全に確認し、将来の引き落とし注文を承認します。 - 4. 収入証明書類と書類を提出してください。

給与明細書とID番号が記載された収入証明書をお送りください。メール、FAX、WhatsApp、またはウェブサイトからご提出いただけます。 - 5. 承認を受けてお金を受け取る:

すべての書類が提出され、確認されると、通常24時間以内に融資が行われます。融資が利用可能になると、SMSで通知されます。

要件

FinChoice 個人ローンの資格を得るには、申請者はいくつかの基本的な基準を満たす必要があります。

定期的かつ検証可能な収入源が必要であり、通常は最近の給与明細書で証明されます。

また、応募資格としては、南アフリカの永住者または国民であり、南アフリカの公式身分証明書を所持していることも必要です。

これはオンラインでのローン手続きであるため、インターネットに接続できる携帯電話またはコンピューターへのアクセスが必須です。

申請者は、資金を受け取ったり、DebiCheck の引き落とし注文を設定したりするために、自分名義の個人銀行口座も持っている必要があります。

完璧なクレジットスコアは必須ではありませんが、まずまずから良いスコアであれば、承認される可能性とローン条件が向上します。

別の選択肢を検討してください:ネッドバンク個人ローン

FinChoice は迅速で柔軟な個人ローンに最適な選択肢ですが、借り手の中にはより伝統的な選択肢を好む人もいるかもしれません。

Nedbank 個人ローンでは、より高い借入限度額とより長い返済期間が提供されており、より実質的な財務目標を持つ人々に最適です。

最高金額は R400 000、期間は最長 72 か月で、住宅改修、自動車ローン、多額の負債の統合などに最適です。

Nedbank は固定金利も提供しており、特に長期契約の場合、月々の予算を立てやすくなります。

より強力な借入オプションをお探しの場合、または南アフリカの大手銀行との取引を希望する場合は、Nedbank 個人ローンを検討する価値があります。

Nedbank 個人ローンに関する記事全文を読んで詳細を確認し、どの商品があなたの財務目標に最も適しているかを確認してください。

トレンドトピック

Upwork レビュー: フリーランスとして成功するための道

フリーランスとして成功するための入り口、Upwork を見つけましょう。プロジェクト、多様な才能、シームレスなコラボレーションを見つけましょう。

読み続けるあなたも気に入るかもしれない

アメリカン・エキスプレス・ブルー・キャッシュ・エブリデイ®:年会費無料の特典

American Express Blue Cash Everyday® カードをご覧ください。年会費無料で必需品の購入で 3% のキャッシュバックを獲得できます。毎日の節約に最適です。

読み続ける

ウォルマートの求人: 時給 $14 から採用されます

Walmart でエントリーレベルから成長レベルのキャリア チャンスを見つけましょう。競争力のある給与と充実した福利厚生で、今すぐキャリアをスタートしましょう。

読み続ける