クレジットカード

Chase Freedom Flex® クレジットカードのレビュー: 特典に注目!

食料品やガソリンのキャッシュバックから年会費無料まで、これらは Chase Freedom Flex® クレジットカードがもたらすメリットのほんの一部です。さまざまな特典を利用して、日々の支出を最大限に活用しましょう。

広告

別のウェブサイトにリダイレクトされます

キャッシュバック、入会ボーナス、旅行特典がすべて 1 枚のクレジットカードに詰まったパワーを体験してください。

特典重視のクレジットカードを探す場合、一般的には手数料と APR が高くなることを予想します。だからこそ、Chase Freedom Flex® クレジットカードとその機能を検討する必要があります。

Chase Freedom Flex® クレジットカードに申し込む

Chase Freedom Flex® クレジットカードに申し込むと、ガソリン代や食料品などの日常的な支出に対する払い戻しを受けることができます。

ポイントプログラムは少々複雑かもしれませんが、年会費無料で幅広い特典が受けられるカードです!仕組みがわかったら、すぐに申し込みたくなるはずです!

- クレジットスコア: クレジットスコア670以上が推奨されます。

- 年会費: ゼロ。

- 購入 APR: 新規カード所有者の場合、最初の 15 か月間は APR が免除されます。ただし、それ以降は 20.49% から 29.24% の範囲となります。

- キャッシュアドバンス APR: 29.99%.

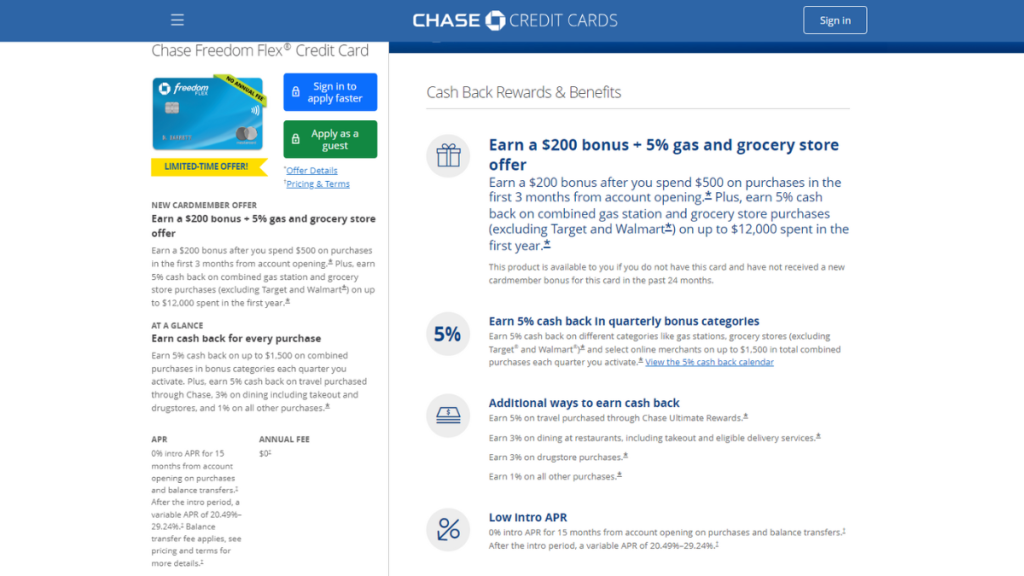

- 報酬: 口座を開設したばかりの場合、最初の 3 か月で $500 を使うと、$200 のボーナスがもらえます。さらに、このカードには、合計購入額に対して 5% が戻ってくるローテーション リワード プログラムがありますが、有効化する必要があります。さらに、食料品、ガソリン、旅行でも同額のリベートがもらえます。旅行は、Chase 独自のリワード プログラムを通じて購入する必要があります。最後に、ドラッグストアやその他の購入に対してそれぞれ 3% と 1% のキャッシュバックも得られます。

Chase Freedom Flex® クレジットカード: 概要

Chase Freedom Flex® クレジットカードの特典プログラムを確認して理解すると、この金融ツールから心を離すことは難しくなります。結局のところ、キャッシュバックの額は非常に魅力的です。

このカードを使用すると、最低限の支出額でかなりのウェルカムボーナスが得られ、前述のように 1% から 5% のキャッシュバックの報酬率が得られます。

さらに、0% の導入 APR が適用されます。ただし、導入期間後は変動 APR が適用されます。また、信用度によってはかなり高くなる可能性があります。

年会費は無料ですが、残高振替手数料や海外取引手数料などの関連手数料がかかり、カードの使用にかかる総コストに影響を与える可能性があります。

要約すると、Chase Freedom Flex® カードは包括的な特典プログラムを提供します。他のクレジットカードと同様に、手数料を考慮する必要がありますが、その特典により、このカードは魅力的な選択肢となります。

Chase Freedom Flex® クレジットカードのメリットとデメリットを分析する

Chase Freedom Flex® クレジットカードは魅力的な特典を提供していますが、責任を持ってカードを管理するためには、考えられるデメリットも確認して検討することも重要です。以下をご確認ください。

長所

- 新規カード会員はお得なボーナスを獲得できます

- 定期的なコストを心配する必要はありません

- 継続的かつローテーション的なキャッシュバック報酬

- 旅行関連の特典

- さまざまな交換オプション

短所

- 報酬の有効化を忘れると、報酬獲得の機会を逃す可能性があります

- ローテーションカテゴリーのキャッシュバックは制限されています

- 海外取引手数料がかかる

- 旅行特典が限定的

Chase Freedom Flex® クレジットカードの資格要件

このレビューを読めばおわかりのように、Chase Freedom Flex® クレジットカードの承認には優れたクレジット スコアが必要です。したがって、スコアが 670 未満の場合は、資格がない可能性があります。

さらに、他の多くのクレジットカードと同様に、申請者は 18 歳以上で、有効な社会保障番号を持っている必要があります。銀行は承認のために他の要素も考慮する場合があります。

たとえば、収入、雇用状況、既存のクレジット アカウントなどです。これらの資格要件を満たすと、このカードが承認される可能性が高まります。

Chase Freedom Flex® クレジットカードの申し込み: マニュアル

では、これらのメリットをすべて享受し、日々の支出を最大限に活用する準備はできていますか? それでは、Chase Freedom Flex® クレジットカードの申し込み方法を学ぶための完全なガイドをご覧ください。

オンラインでの申し込みは簡単でわかりやすいですが、申請者は Chase 支店に直接行って申し込むこともできます。以下をチェックして、両方の場合の手続きの流れを確認してください。

Chase Freedom Flex® クレジットカードに申し込む

Chase Freedom Flex® クレジットカードに申し込むと、ガソリン代や食料品などの日常的な支出に対する払い戻しを受けることができます。

トレンドトピック

Grow Debit Mastercard: 手数料なしで信用を築く

Grow Debit Mastercard で簡単にクレジットを構築できます。クレジット履歴が限られている方に最適な、手数料無料、借金なしのソリューションです。

読み続ける