クレジットカード

Petal® 1「年会費無料」Visa®クレジットカードに申し込む: 賢く旅行しましょう

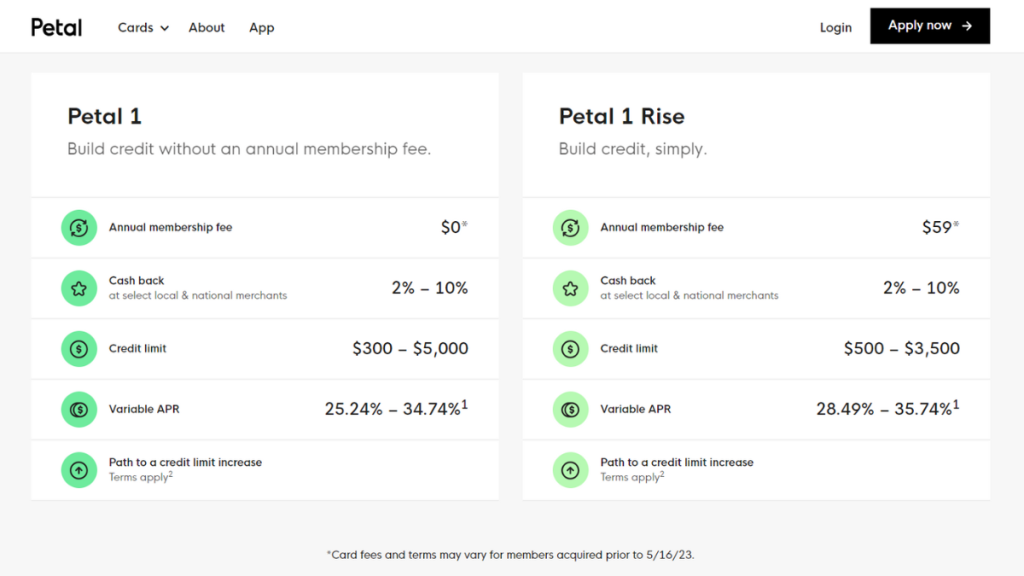

Petal® 1 年会費無料の Visa® クレジットカードに申し込むと、最大 10% のキャッシュバックを獲得し、外国手数料なしで自由に旅行できるようになります。安全で柔軟なクレジット構築がここにあります!

広告

別のウェブサイトにリダイレクトされます

海外手数料なしのジェットセットで、あらゆる旅行をよりお得に、より低コストで

Petal® 1「年会費無料」Visa® クレジットカードに申し込むと、賢い方法で信用を築くことができます。このカードは安価で、さらに特典も得られます。

最初は利用限度額が低くなるかもしれませんが、最初の 6 か月間に責任ある使用を示すことで、限度額を増額できる可能性があります。これは、支出を管理する便利な方法です。

キャッシュバックは参加店舗に紐付けられていますが、アプリを使用してリベートが受けられる場所を見つけることで、キャッシュバックを最大限に活用できます。これにより、さらに稼ぐチャンスが得られます。

これらすべてが夢のように聞こえるなら、読み続けて、当社のガイドを活用して、何の障害もなく、自信を持って Petal® 1「年会費無料」Visa® クレジットカードに申し込んでください。

Petal® 1「年会費無料」Visa®クレジットカードが優れている点

Petal® 1「年会費無料」Visa® クレジットカードに申し込むことは、経済的に賢くなる第一歩です。このカードは年会費が不要で、お金があなたのポケットに戻ります。

また、このカードは毎日の買い物に特典を与え、日常をチャンスに変えます。いずれにせよ購入するものに対してキャッシュバックを獲得することで、すべての取引がよりお得になり、すべての瞬間が重要になります。

さらに、Petal® 1 は単なるクレジットカードではなく、信用を築くパートナーです。主要な信用調査機関に報告することで、責任ある購入を行うたびにスコアが向上します。

最後に、世界中で受け入れられ、外国取引手数料がかからないため、Petal® 1 カードは常に旅行のお供になります。どこにいても経済的にサポートされるので、安心して世界を探索できます。

Petal® 1「年会費無料」Visa®クレジットカードの申し込みオプション

魅力的なクレジット構築、共通手数料なし、購入特典の組み合わせを提供する Petal® 1「年会費無料」Visa® クレジットカードは、カードにもっと期待したい場合に最適です。

オンラインでの申請方法

- 公式サイトにアクセス: まず、Petal® 1 Visa® クレジットカードの公式サイトにアクセスします。手続きを開始するには、トップページの「今すぐ申し込む」ボタンを探します。

- 申請書に記入: 名前、住所、社会保障番号などの個人情報を入力します。遅延を避けるために、すべての詳細が正確であることを確認してください。

- 財務情報の確認: 収入と雇用について質問されます。正直かつ正確に回答してください。この情報は、信用限度額と APR を決定する際に役立ちます。

- 信用調査への同意: 信用スコアに影響を与えないソフト クレジット プルに同意します。この手順は、信用に影響を与えずに適格性を評価するために重要です。

- 申請を送信: 情報を確認し、利用規約に同意した後、申請を送信します。通常はすぐに、多くの場合は即座に応答が届きます。

- 承認を待つ: 承認されると、カードとウェルカム マテリアルが郵送されます。アクティベーション手順も含まれているので、すぐにカードを使い始めることができます。

他のオプションについて知りたいですか?ミッションレーンVisa®クレジットカードはこちら

Petal® 1「年会費無料」Visa® クレジットカードに申し込むべきかどうか迷っていますか? クレジットを簡単に構築でき、隠れた手数料がない、価値のある代替手段として Mission Lane Visa® を検討してください。

さらに、ミッション レーン カードは、透明性の高い料金体系と、顧客のクレジット スコアの向上を支援する取り組みを提供し、財務の進歩を簡単かつストレスフリーにします。

さらに、ユーザーフレンドリーなアプリでは、支出やクレジット利用状況に関するリアルタイムの分析情報が提供され、どこにいても外出先でよりスマートな財務上の決定を下すことができます。

したがって、Petal® 1 オプションよりも Mission Lane の利点に興味がある場合は、以下のリンクを参照して Mission Lane の詳細を確認し、適用プロセスの詳細を確認してください。

ミッションレーンVisa®クレジットカードを申し込む

低い APR から手間のかからない申請手続きまで、Mission Lane Visa® クレジットカードに申し込み、自信を持ってクレジットを向上させましょう。

トレンドトピック

EarnIn: 少額の現金前払いのためのフレンドリーなソリューション

EarnIn は、予期せぬ出費に対処する多くの人々を支援する革新的なソリューションです。アプリの詳細については、こちらをご覧ください。

読み続けるあなたも気に入るかもしれない

Petal 2 Visa: キャッシュバック付きの手数料無料のクレジット構築カード

Petal 2 Visa が手数料無料で最大 1.5% のキャッシュバックを提供し、信用を築く方法を学びましょう。経済的成長のためのスマートで包括的なオプションです。

読み続ける

チェース・サファイア・プリファード・クレジットカード:プレミアム・トラベル・リワード

Chase Sapphire Preferred クレジットカードをお試しください: 旅行特典、ダイニング特典、柔軟なポイント交換。プレミアム特典をご利用ください!

読み続ける