Carta di credito

Scoprilo® Chrome: guadagna Cashback su Benzina e Ristorazione

Ottieni 2% di cashback su benzina e ristoranti con la Discover it® Chrome Card, senza canone annuale e un Cashback Match il primo anno per raddoppiare i tuoi premi!

ANNUNCIO

Verrai reindirizzato a un altro sito web

Una carta di credito pensata per il risparmio quotidiano

La carta di credito Discover it® Chrome Gas & Restaurant è un'opzione di alto livello per chi dà priorità alle spese quotidiane, in particolare per benzina e ristoranti.

Con un rimborso di 2% presso stazioni di servizio e ristoranti e senza canone annuale, questa carta rappresenta un valore eccellente per chi ama la semplicità e i premi che si adattano davvero al proprio stile di vita.

- Punteggio di credito: Buono a Eccellente

- Quota annuale: $0

- APR acquisto: Variabile, da 18,74% a 27,74%, dopo un periodo introduttivo di 0% APR per 15 mesi

- Tasso annuo di anticipo contanti: 29,74%

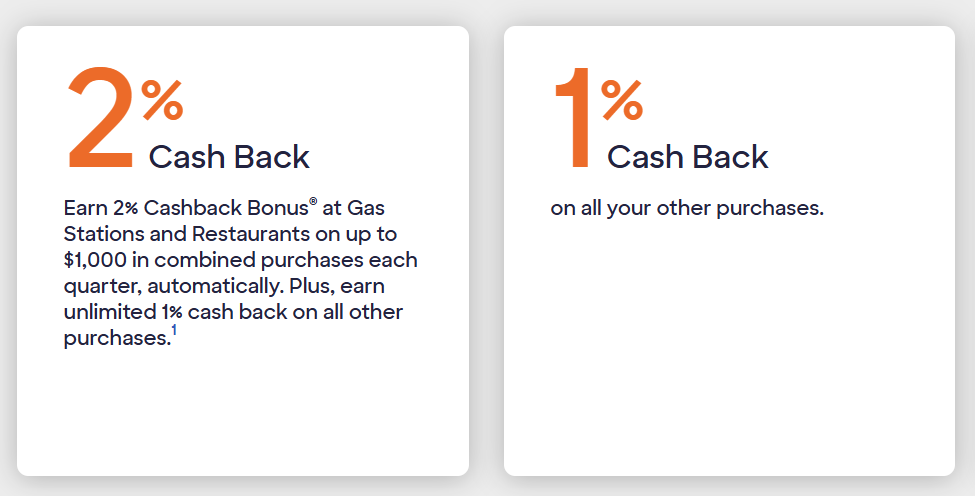

- Premi: Guadagna 2% di rimborso sugli acquisti di ristoranti e carburante, con un rimborso illimitato di 1% su tutto il resto che acquisti

Scoprilo® Chrome: Panoramica

IL Scoprilo® Chrome è progettato per semplificare i premi massimizzando al contempo il valore in due categorie di spesa essenziali: benzina e ristorazione.

Che tu sia un pendolare abituale o una persona a cui piace cenare spesso fuori, questa carta offre vantaggi notevoli senza le complessità spesso associate alle carte di credito premium.

Ecco cosa distingue questa carta:

Struttura dei premi Cashback

- Ottieni 2% di cashback presso stazioni di servizio e ristoranti, il che lo rende ideale per chi viaggia spesso o mangia fuori.

- Il limite trimestrale di $1.000 in acquisti combinati garantisce premi costanti, promuovendo al contempo la disciplina di bilancio.

- Oltre il limite massimo, continuerai a guadagnare 1% di cashback illimitato su tutti gli altri acquisti, mantenendo le cose semplici e trasparenti.

Offerta introduttiva

- Approfitta di un APR pari a 0% per i primi 15 mesi sia sugli acquisti che sui trasferimenti di saldo.

- Dopo il periodo introduttivo, il TAEG passa a un tasso variabile compreso tra 18,74% e 27,74%.

Corrispondenza Cashback

- I nuovi titolari di carta possono usufruire dell'esclusivo Cashback Match di Discover, che raddoppia tutti i premi guadagnati nel primo anno.

- Dopo il primo anno, Discover raddoppierà ogni dollaro di cashback guadagnato, senza limiti o restrizioni.

Nessuna quota annuale

Vantaggi aggiuntivi

- Monitoraggio gratuito del punteggio FICO®: Tieni sotto controllo il tuo credito con aggiornamenti gratuiti tramite l'app Discover o il portale dell'account online.

- Funzione Freeze It®: Blocca immediatamente la tua carta in caso di smarrimento, impedendo transazioni non autorizzate.

- Nessuna commissione sulle transazioni estere: Perfetto per i viaggiatori internazionali che vogliono evitare spese extra sugli acquisti all'estero.

Analisi dei vantaggi e degli svantaggi di Discover it® Chrome

Prima di impegnarsi con una carta di credito, è essenziale soppesare attentamente i pro e i contro.

Pro di Discover it® Chrome

La carta di credito Discover it® Chrome Gas & Restaurant offre diversi vantaggi eccezionali che la rendono interessante per molti consumatori:

- Programma di premi generosi: Il rimborso su benzina e ristorazione si rivolge direttamente alle categorie di spesa più diffuse, offrendo un valore costante.

- Programma Cashback Match:I nuovi utenti possono effettivamente guadagnare premi doppi nel loro primo anno, massimizzando il potenziale di guadagno della carta.

- Nessuna quota annuale: Tieni da parte una quota maggiore dei tuoi premi in cashback senza commissioni ricorrenti per compensare i tuoi guadagni.

- Tasso annuo effettivo introduttivo flessibile: Un APR pari a 0% per 15 mesi offre un margine di manovra per acquisti di grandi dimensioni o trasferimenti di saldo.

- Caratteristiche adatte ai viaggi: Nessuna commissione sulle transazioni estere, rendendo questa carta una compagna intelligente per i viaggi internazionali.

- Funzionalità di sicurezza robuste: Il congelamento immediato della carta e la responsabilità $0 per acquisti non autorizzati aumentano la tranquillità.

Contro di Discover it® Chrome

Nonostante i suoi punti di forza, questa carta potrebbe non essere adatta a tutti:

- Limite trimestrale sui premi 2%:Sebbene il tasso di rimborso di 2% sia generoso, il limite trimestrale di $1.000 sugli acquisti combinati nelle categorie benzina e ristorazione potrebbe risultare restrittivo per chi spende molto.

- Categorie limitate ad alto premio:A differenza di alcuni concorrenti, Discover it® Chrome si concentra solo su due categorie bonus, il che potrebbe non essere adatto a chi ha abitudini di spesa più diversificate.

- Requisito del punteggio di credito:I richiedenti con un merito creditizio non eccellente potrebbero avere difficoltà a qualificarsi per la carta.

Richiedere la carta

Registrarsi a Discover it® Chrome è semplice e senza complicazioni dall'inizio alla fine.

1. Visita il sito web di Discover: Vai al sito ufficiale di Discover e individua la pagina dell'applicazione Discover it® Chrome.

2. Controllare la prequalificazione: Verifica la tua idoneità con lo strumento di prequalificazione, che non avrà alcun impatto sul tuo punteggio di credito.

3. Invia la tua candidatura: Compila il modulo online con i tuoi dati personali, tra cui reddito e numero di previdenza sociale.

4. Attendi l'approvazione:La maggior parte dei richiedenti riceve una decisione di approvazione nel giro di pochi minuti.

Requisiti di ammissibilità

Per qualificarsi per la Discover it® Chrome Gas & Restaurant Credit Card, i richiedenti devono soddisfare i seguenti criteri:

- Punteggio di credito: Per l'approvazione si consiglia di avere una solida storia creditizia, in genere con un punteggio pari o superiore a 670.

- Reddito: Prova di reddito sufficiente a coprire gli obblighi creditizi.

- Residenza negli Stati Uniti: Deve essere un cittadino statunitense o un residente permanente con un numero di previdenza sociale valido.

Scopri altre opzioni: Ecco la carta American Express Blue Cash Everyday®

Per chi cerca categorie di premi più ampie, la carta American Express Blue Cash Everyday® offre un'alternativa interessante alla carta di credito Discover it® Chrome Gas & Restaurant.

La carta Blue Cash Everyday® offre un rimborso di 3% su generi alimentari, benzina e acquisti al dettaglio online, fino a $6.000 all'anno in ciascuna categoria, insieme a un rimborso di 1% su altri acquisti.

Questa carta include un'offerta APR introduttiva di 15 mesi pari a 0% e non prevede alcuna commissione annuale di cui preoccuparsi.

Ciò lo rende particolarmente interessante per le famiglie o per gli acquirenti online abituali che desiderano massimizzare i vantaggi su una gamma più ampia di categorie di spesa.

Tuttavia, vale la pena notare che la carta American Express prevede commissioni per le transazioni estere, il che potrebbe rappresentare uno svantaggio per chi viaggia spesso all'estero, una caratteristica in cui Discover it® Chrome eccelle, non prevedendo commissioni per le transazioni estere.

In definitiva, entrambe le carte offrono premi e vantaggi eccellenti, su misura per diverse abitudini di spesa. Scegli quella che meglio si adatta al tuo stile di vita per massimizzare il tuo potenziale di cashback!

American Express Blue Cash tutti i giorni®

Guadagna 3% di cashback su beni essenziali senza canone annuale. Perfetto per i risparmi quotidiani!

ARGOMENTI DI TENDENZA

Recensione Upwork: il tuo percorso verso il successo freelance

Scopri Upwork, la tua porta d'accesso al successo freelance. Trova progetti, talenti diversi e collaborazione senza soluzione di continuità.

Continua a leggere

Petal 2 Visa: una carta di credito senza commissioni con rimborso in contanti

Scopri come Petal 2 Visa ti aiuta a creare credito senza commissioni e con un rimborso in contanti fino a 1,5%. Un'opzione intelligente e inclusiva per la crescita finanziaria.

Continua a leggere

Come gestire i rimborsi dei prestiti ed evitare i debiti

Scopri come gestire efficacemente i rimborsi dei prestiti con budget, promemoria e strategie per rimanere motivato e raggiungere la stabilità finanziaria.

Continua a leggerePOTREBBE PIACERTI ANCHE

Le migliori app per il budget: scarica e gestisci le tue finanze

Vuoi organizzare in modo efficiente le tue finanze? Leggi l'articolo per scoprire le migliori app di budget per gestire la tua vita finanziaria.

Continua a leggere

Recensione Fiverr: libera il tuo potenziale da freelance

Esplora Fiverr, la tua porta di accesso al successo freelance. Scopri funzionalità e vantaggi unici che rendono Fiverr un'azienda di spicco.

Continua a leggere