Carta di credito

Carta Citi Simplicity®: zero commissioni e massima flessibilità

La carta di credito Citi Simplicity® non prevede commissioni annuali, né penali per ritardo e fino a 21 mesi di APR introduttivo 0%.

ANNUNCIO

Verrai reindirizzato a un altro sito web

Una scelta intelligente per risparmiare denaro

La carta di credito Citi Simplicity® offre un'esperienza senza canone annuale, con particolare attenzione alla trasparenza.

Con un lungo TAEG introduttivo per trasferimenti di saldo e acquisti, è progettato per offrire agli utenti una pausa dagli elevati interessi passivi.

La carta elimina i comuni punti dolenti eliminando commissioni di mora, TAN di penale e commissioni annuali, rendendola una scelta eccezionale per chi cerca flessibilità finanziaria e tranquillità.

- Punteggio di credito: Buono o meglio

- Quota annuale: $0

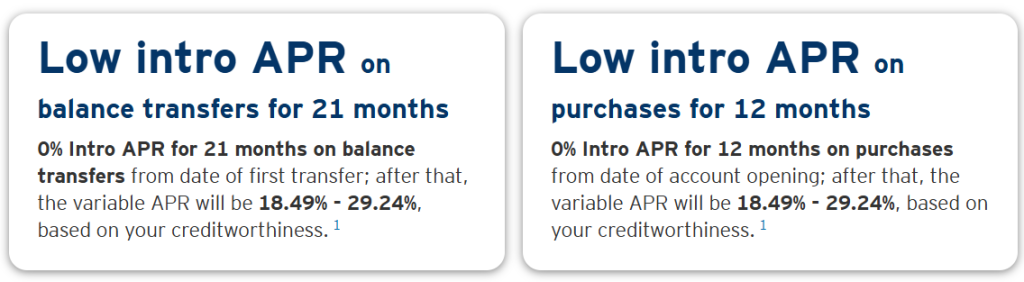

- 0% Tasso annuo percentuale introduttivo: 21 mesi per i trasferimenti di saldo e 12 mesi per gli acquisti

- Acquista APR: Variabile, da 18,49% a 29,24% dopo il periodo introduttivo

- Tasso annuo di anticipo contanti: 29.74%

Citi Simplicity®: Panoramica

La carta di credito Citi Simplicity® mantiene la promessa di vantaggi diretti e facilità d'uso. Ecco in cosa si distingue:

- Politiche di facile utilizzo: Progettata per ridurre lo stress, questa carta semplifica la gestione delle carte di credito con condizioni trasparenti e senza sorprese nascoste.

- Lunghi periodi APR 0%: Offre uno dei periodi senza interessi più estesi del mercato: 21 mesi sui trasferimenti di saldo e 12 mesi sugli acquisti, ideale per il consolidamento dei debiti o per spese ingenti.

- Nessuna penale per ritardo nel pagamento: Dimenticare una data di pagamento non comporta penali per il ritardo o tassi di interesse più elevati, il che lo rende una delle opzioni più tolleranti disponibili.

- Vantaggi del trasferimento del saldo: Nonostante una commissione di trasferimento pari a 5% o $5, il periodo prolungato senza interessi può comportare risparmi significativi per coloro che trasferiscono saldi con interessi elevati.

- Nessuna quota annuale: La carta richiede poca manutenzione ed è conveniente, poiché non prevede alcuna commissione annuale di cui preoccuparsi, consentendoti di concentrarti sui tuoi obiettivi finanziari.

Queste caratteristiche rendono la carta di credito Citi Simplicity® una scelta eccellente per chi cerca sollievo dai debiti ad alto tasso di interesse, maggiore flessibilità nei pagamenti e uno strumento finanziario conveniente.

Analisi dei vantaggi e degli svantaggi della carta di credito Citi Simplicity®

La carta di credito Citi Simplicity® offre numerosi vantaggi che soddisfano specifiche esigenze finanziarie, ma è fondamentale soppesare questi vantaggi alla luce dei suoi limiti.

Professionisti

La carta di credito Citi Simplicity® offre notevoli vantaggi, soprattutto per chi è interessato a risparmiare denaro ed evitare commissioni inutili.

- Nessuna quota annuale: Una commissione annuale di $0 ti garantisce di non dover sostenere costi aggiuntivi solo per il possesso della carta.

- Periodi APR introduttivi estesi: Con 21 mesi di APR 0% sui trasferimenti di saldo e 12 mesi sugli acquisti, la carta offre uno dei periodi di APR introduttivi più lunghi del settore.

- Nessuna commissione di mora o penale APR: La flessibilità nella gestione dei pagamenti è una caratteristica distintiva. Dimenticare un pagamento non comporta penali, il che è raro nel mondo delle carte di credito.

- Termini semplici: Senza programmi di premi o strutture complicate, questa carta è facile da capire e da usare.

- Vantaggi del consolidamento del debito: Ideale per saldare i saldi delle carte con interessi più elevati senza dover sostenere interessi aggiuntivi per quasi due anni.

Contro

Sebbene la carta di credito Citi Simplicity® eccella in molti ambiti, potrebbe non essere adatta a tutti.

- Commissione di trasferimento del saldo: La commissione di $5 o 5% per ogni trasferimento potrebbe superare il risparmio per saldi più piccoli.

- Mancanza di programma di premi: Questa carta non include cashback, punti o premi di viaggio, ma si concentra invece sul risparmio sulle commissioni e sui periodi senza interessi.

- Tasso APR post-introduzione elevato:Una volta terminato il periodo introduttivo, il TAEG variabile può salire fino a 29,24% per gli acquisti, cifra elevata per alcuni utenti.

- Valore limitato a lungo termine:Il principale vantaggio della carta risiede nelle sue offerte introduttive, quindi potrebbe non offrire vantaggi a coloro che non necessitano di trasferimenti di saldo o finanziamenti senza interessi.

- Non ideale per chi spende tutti i giorni: Senza premi, gli utenti abituali potrebbero trovare più valore nel cashback o nelle carte dedicate ai viaggi.

Richiesta della carta di credito

La procedura di richiesta per la carta di credito Citi Simplicity® è rapida e semplice. Citi consente ai potenziali titolari di carta di fare richiesta online con il minimo sforzo.

Per candidarsi, seguire i passaggi successivi:

- Visita la pagina ufficiale della carta di credito: Vai al sito ufficiale di Citi per accedere alla pagina di richiesta della carta.

- Controlla la prequalificazione: Citi offre uno strumento di prequalificazione che ti consente di verificare le tue possibilità di approvazione senza influire sul tuo punteggio di credito.

- Compila il modulo di domanda: Fornisci dati personali accurati, tra cui reddito, stato occupazionale e indirizzo. Queste informazioni aiutano Citi a valutare la tua idoneità.

- Invia la tua candidatura: Dopo aver compilato il modulo, invia la tua richiesta. Citi solitamente risponde con una decisione di approvazione entro pochi minuti, anche se in alcuni casi potrebbe volerci più tempo.

- Attiva la tua carta dopo l'approvazione: Una volta approvata, attiva la tua carta di credito Citi Simplicity® tramite il sito web o l'app mobile di Citi e inizia a usarla immediatamente.

Requisiti di ammissibilità

Prima di inviare la domanda, assicurati di soddisfare i requisiti di idoneità necessari.

- Punteggio di credito: In genere, l'approvazione è più probabile con un punteggio di credito pari o superiore a 670.

- Requisito di età: Per presentare domanda è necessario avere almeno 18 anni.

- Reddito: È richiesta la prova di un reddito stabile sufficiente per gestire i pagamenti con carta di credito.

- Residenza: I richiedenti devono risiedere negli Stati Uniti e possedere un numero di previdenza sociale valido.

Scopri altre opzioni: Carta di credito Petal® 1

La carta di credito Citi Simplicity® è la scelta ideale per chiunque cerchi un sollievo finanziario attraverso lunghi periodi senza interessi e politiche di cancellazione delle commissioni.

L'attenzione alla trasparenza lo rende particolarmente interessante per gli utenti che vogliono consolidare i debiti o che necessitano di flessibilità nei pagamenti.

Tuttavia, sebbene la carta di credito Citi Simplicity® sia un'ottima soluzione per ridurre al minimo le commissioni e gestire i debiti, potrebbe non soddisfare le esigenze di tutti.

Per chi ha una storia creditizia limitata o è alla ricerca di un programma fedeltà, la carta di credito Petal® 1 è una valida alternativa.

La carta di credito Petal® 1 è nota per il suo approccio inclusivo e di facile utilizzo.

È pensato per le persone con una storia creditizia discreta o inesistente, e offre un'opportunità unica per costruire il proprio credito in modo responsabile.

Senza canoni annuali e con la possibilità di guadagnare cashback sugli acquisti, si rivolge a un pubblico diverso.

Per gli utenti interessati a premi o a creare un credito partendo da zero, la carta di credito Petal® 1 rappresenta un'opzione competitiva.

Dai un'occhiata al prossimo articolo per saperne di più sulla Petal® 1 Card prima di prendere una decisione!

Petal® 1: Credito affidabile

Scopri come puoi costruire una solida base creditizia, guadagnando denaro e sfruttando l'assenza di commissioni annuali.

ARGOMENTI DI TENDENZA

Lavori in ristoranti e fast food: stipendi iniziali da $28.000/anno

Scopri i lavori nel settore della ristorazione e del fast food con retribuzioni orarie a partire da $10 e tante possibilità di crescita professionale!

Continua a leggerePOTREBBE PIACERTI ANCHE

Perché le certificazioni sono importanti e come sceglierne una per la tua carriera

Scopri come scegliere la certificazione professionale giusta con passaggi pratici, domanda di mercato e strategie per un successo professionale a lungo termine.

Continua a leggere

Alla scoperta di PayPal: la rivoluzione dei pagamenti online

Scopri come PayPal rivoluziona il modo in cui inviamo e riceviamo denaro. Prova un modo più sicuro e veloce per gestire le tue finanze.

Continua a leggere