Credit Card

Ink Business Cash®: Earn High Cash Back with Essential Business Perks

The Ink Business Cash® offers 5% cash back, welcome bonus, and no annual fee—ideal for maximizing business spending.

Advertisement

Save big on business expenses!

Created with small businesses in mind, the Ink Business Cash® offers substantial rewards on routine expenses.

This no-annual-fee card gives you the chance to pocket up to $750 in bonus cash back.

- Credit Score: Good to Excellent (typically 670 or higher)

- Annual Fee: $0

- Purchase APR: 0% intro APR for the first 12 months. Then, variable rate between 17.74% and 25.74%

- Cash Advance APR: 29.49% variable

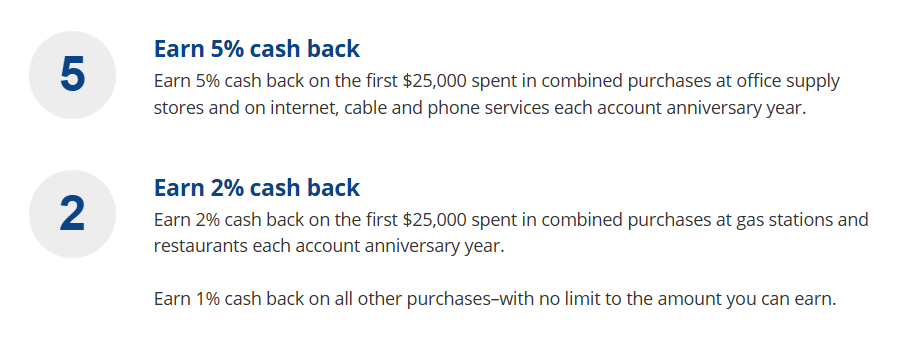

- Rewards: Up to 5% cash back on select categories and 1% unlimited cash back on all other purchases

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Ink Business Cash®: What you need to know

The Ink Business Cash® Credit Card is tailored to meet the needs of small business owners, providing a robust cash back program to help save on essential expenditures.

With a tiered rewards system, the card offers elevated cash back rates for select business expenses and a standard rate for all other purchases.

This structure aligns with typical business spending, making it a cost-effective choice for managing operational expenses while earning meaningful rewards.

Additionally, its lack of an annual fee and introductory 0% APR on purchases for 12 months further enhance its value, allowing businesses to manage cash flow more effectively.

Who Is It For?

This card is ideal for small business owners who frequently spend on office supplies, internet, cable, phone services, gas, and dining.

It’s particularly beneficial for those seeking a no-annual-fee card with substantial cash back opportunities.

Why Is It Special?

The card stands out due to its high cash back rates in specific categories and a generous sign-up bonus.

Additionally, it offers a 0% introductory APR on purchases for the first 12 months, aiding in managing cash flow.

Analyzing the advantages and drawbacks

While the Ink Business Cash® Credit Card offers numerous benefits, it’s essential to consider both its strengths and limitations.

Pros

- Generous Cash Back Rates: Earn 5% and 2% cash back in categories that align with typical business expenses.

- No Annual Fee: No annual fee means every dollar saved stays in your business’s pocket.

- Significant Sign-Up Bonus: Potential to earn up to $750 in bonus cash back by meeting spending thresholds.

- Introductory Interest-Free Period: Enjoy 0% APR for one year, ideal for financing major purchases or consolidating existing balances.

- Employee Cards at No Additional Cost: Issue additional cards to employees without extra fees, with the ability to set individual spending limits.

Tips for earning maximum rewards

To unlock its full potential, focus spending on categories with higher cashback rates. Here are some valuable tips:

- Prioritize Bonus Categories: Use the card for office supplies, internet, and dining expenses to earn 5% and 2% cash back.

- Track Spending Caps: Monitor the $25,000 annual limit for elevated cashback categories and adjust spending to maximize rewards without exceeding the threshold.

- Combine Rewards: Link the card to Chase Ultimate Rewards® to pool cashback earnings and enhance value, such as transferring points for travel.

- Use Employee Cards: Centralize spending through employee cards to consolidate rewards more effectively while simplifying budget tracking.

Cons

- Spending Caps on Bonus Categories: The elevated cash back rates apply only to the first $25,000 spent annually in each bonus category; subsequent spending earns 1% cash back.

- International Transaction Charge: A fee of 3% is applied to any purchases made outside the United States.

- Minimal Perks on Travel: Lacks premium travel benefits found in other business credit cards.

How this card powers small business expansion

The Ink Business Cash® Credit Card provides key features that enable businesses to manage expenses efficiently while reinvesting savings into growth. Here’s how:

- Cashback Savings: Earn up to 5% cash back on office supplies, internet, cable, and phone services—expenses every business needs. These savings can be reinvested into expanding operations or purchasing equipment.

- 0% Introductory APR: For the first 12 months, enjoy 0% APR on purchases, making it easier to finance big-ticket items without immediate interest costs.

- No Annual Fee: Businesses can save money yearly, keeping costs low while maximizing benefits.

- Employee Cards: Provide team members with cards at no additional cost, making it easier to track spending and allocate budgets for growth-focused initiatives.

Simplifying employee spending

Employee spending can be managed efficiently with the Ink Business Cash® Credit Card’s features. These tools ensure control while enabling team productivity:

- Individual Limits: Assign custom spending limits to each employee card to prevent overspending and maintain budgets.

- Centralized Reporting: Track all employee transactions in one place, simplifying expense reports and identifying spending trends.

- No Additional Fees: Provide employee cards without extra charges, ensuring cost-effective management of business expenditures.

- Detailed Statements: Gain insights into specific purchases, helping businesses ensure that spending aligns with company goals.

How to apply for the card

Applying for the Ink Business Cash® is a straightforward process that can be completed online in just a few minutes.

To ensure a smooth experience, gather your business and personal information beforehand.

- Visit the Official Website: Head to Chase’s website and find the Ink Business Cash® application page.

- Initiate the Application: Click on the “Apply Now” button to begin the process.

- Provide Business Information: Enter details such as your business name, address, type, and annual revenue.

- Supply Personal Information: Include your name, address, Social Security number, and total annual income.

- Review and Submit: Double-check your details before finalizing the application submission.

Upon submission, Chase will review your application and notify you of the decision, typically within a few business days.

Learn about other options

While the Ink Business Cash® Credit Card offers valuable cash back opportunities for business expenses, those seeking travel rewards might consider the Chase Sapphire Preferred.

This card provides flexible point redemption options, including transfers to various travel partners.

In conclusion, the Ink Business Cash® is a valuable choice for entrepreneurs looking to optimize their everyday spending.

However, if you focus on travel rewards, the Chase Sapphire Preferred may better align with your goals. Learn more at the link below, and explore the card’s features and benefits!

Chase Sapphire Preferred

Explore the Chase Sapphire Preferred Credit Card: travel rewards, dining perks, and flexible point redemption.

Trending Topics

Top Courses to Help You Develop Key Skills for Career Growth

Discover the best courses for career growth, with strategies to develop skills that will set you apart in the industry.

Keep Reading