Carte de crédit

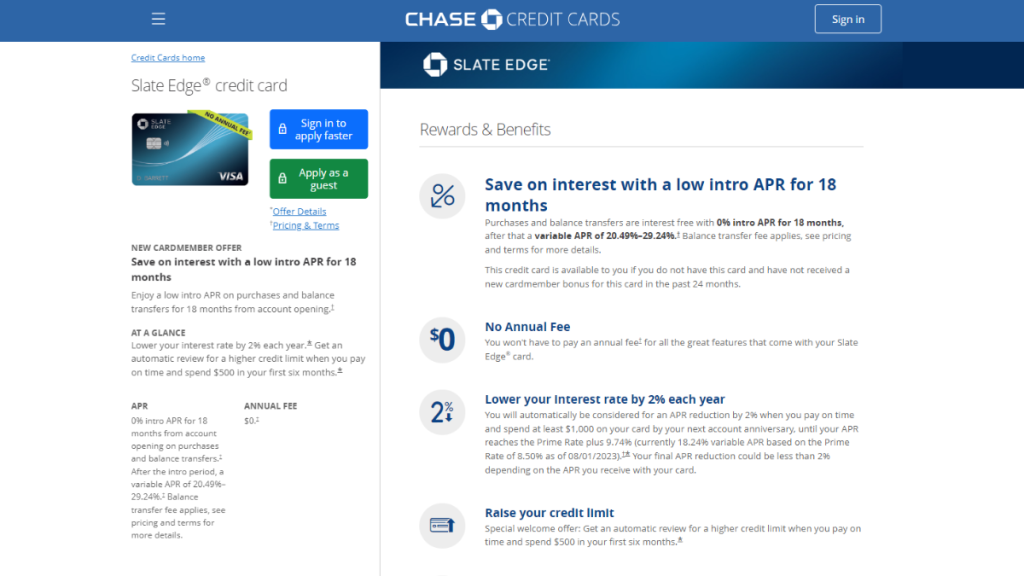

Examen de la carte de crédit Chase Slate Edge® : simplifiez vos finances !

La carte de crédit Chase Slate Edge® offre des augmentations automatiques de la limite de crédit et des réductions potentielles du TAEG pour une utilisation responsable. Préparez-vous à maximiser votre potentiel financier et à profiter d'une longue période de TAEG 0%.

Publicité

Vous serez redirigé vers un autre site web

Prenez de l'avance financièrement et bénéficiez d'une réduction potentielle du TAEG pour une utilisation responsable de votre carte !

Bien que les récompenses puissent ajouter de la valeur à une carte de crédit, le fait d'avoir un TAEG de 0% permet aux gens d'économiser beaucoup en transférant leurs dettes. Cette évaluation de la carte de crédit Chase Slate Edge® est donc pour vous.

Demander une carte de crédit Chase Slate Edge®

Montrez que vous êtes un titulaire de carte responsable et obtenez des lignes de crédit plus élevées et un TAEG plus bas lorsque vous demandez la carte de crédit Chase Slate Edge® !

Avec une longue période de taux d'intérêt nul, cette carte de crédit est idéale si vous devez effectuer des transferts de solde ou même si vous souhaitez effectuer un achat important. Découvrez les spécificités de la carte et apprenez-en plus !

- Cote de crédit : Bien que les critères d’approbation individuels puissent varier, un crédit bon à excellent est généralement requis.

- Cotisation annuelle : Zéro.

- TAEG d'achat : Au cours des 18 premiers mois, vous pouvez profiter d'un taux d'intérêt de lancement de 0%. Mais ensuite, il varie de 20,49% à 29,24%.

- TAEG des avances de fonds : Un taux d'intérêt moyen de 29,99% est applicable pour tout besoin de trésorerie inattendu que vous pourriez rencontrer.

- Récompenses : Puisqu’elle se concentre sur la gestion financière, cette carte n’offre aucune récompense traditionnelle.

Carte de crédit Chase Slate Edge® : aperçu

Avec la carte de crédit Chase Slate Edge®, vous découvrirez un instrument financier conçu pour faciliter une gestion efficace du crédit. Vous avez une dette erronée qui fait grimper les taux d'intérêt ?

Cette carte offre une période prolongée de taux d'intérêt nul sur les achats et les transferts de solde. Cela signifie que vous disposez d'une période généreuse pour consolider vos soldes existants ou effectuer de nouveaux achats.

De plus, vous bénéficiez d'augmentations automatiques de votre ligne de crédit. Mais seulement après avoir dépensé $500. De plus, vous devez le faire dans les six premiers mois et effectuer tous les paiements à temps, démontrant ainsi votre fiabilité.

De plus, en effectuant régulièrement vos paiements à temps et en dépensant au moins $1 000 sur votre carte, vous avez la possibilité de réduire votre taux d'intérêt au fil du temps. Cela récompense un comportement responsable !

Enfin, au-delà de ces fonctionnalités, la carte de crédit Chase Slate Edge® met l’accent sur la simplicité en facturant zéro frais annuel. Dans l’ensemble, il s’agit d’un outil précieux pour gérer judicieusement le crédit.

Analyse des avantages et des inconvénients de la carte de crédit Chase Slate Edge®

Bien que la carte de crédit Chase Slate Edge® n'offre pas de récompenses courantes, il existe d'autres avantages à examiner si vous souhaitez en faire la demande. Vous pouvez alors être sûr que c'est la bonne carte pour vous.

Avantages

- 0% sur les taux d’intérêt pendant une période donnée ;

- Pas de frais annuels ;

- Augmentez automatiquement votre ligne de crédit;

- Réduisez vos frais d’intérêt au fil du temps ;

- Commodité et sécurité du paiement sans contact.

Inconvénients

- Aucune récompense traditionnelle ni incitation en cashback ;

- Les transferts de solde deviennent variables après la période initiale ;

- Des frais sont facturés pour l’utilisation de la carte à l’étranger ;

- Il manque certains des avantages premium.

Conditions d'éligibilité pour la carte de crédit Chase Slate Edge®

Vous envisagez de faire une demande de carte de crédit Chase Slate Edge® après avoir lu cet avis ? Il est alors important de suivre ses critères d'éligibilité pour vous assurer que vous correspondez au profil.

Tout d’abord, un historique de crédit solide et une expérience avérée en matière de gestion responsable du crédit sont généralement nécessaires pour obtenir l’approbation. De plus, les candidats doivent répondre à d’autres critères.

Par exemple, vous devez être citoyen ou résident des États-Unis et avoir au moins 18 ans. De plus, il est obligatoire de posséder un numéro de sécurité sociale valide. Cependant, le fait de répondre aux exigences ne garantit pas l'approbation.

Demande de carte de crédit Chase Slate Edge® : un manuel

Si vous vous sentez prêt à obtenir la Chase Slate Edge®, vous devez d'abord consulter le site Web officiel. Ensuite, accédez au formulaire en ligne. Mais si vous préférez faire votre demande en personne, vous pouvez vous rendre dans une agence bancaire.

Vous avez des questions sur le processus de demande ? Ne vous inquiétez pas ! Découvrez un guide complet et comprenez rapidement le processus de demande de carte de crédit Chase Slate Edge® !

Demander une carte de crédit Chase Slate Edge®

Montrez que vous êtes un titulaire de carte responsable et obtenez des lignes de crédit plus élevées et un TAEG plus bas lorsque vous demandez la carte de crédit Chase Slate Edge® !

Sujets Tendance

Comment choisir une formation adaptée à votre parcours professionnel

Choisissez le bon parcours professionnel avec des objectifs clairs, des plans personnalisés et un mentorat pour favoriser votre croissance et votre réussite professionnelles à long terme.

Continuer la LectureVous aimerez peut-être aussi

US Bank Altitude® Go Visa : pas de frais annuels et d'excellentes récompenses

Gagnez des récompenses sur les repas, le streaming, l'épicerie et plus encore avec la carte Visa Signature® US Bank Altitude® Go : pas de frais annuels, des avantages infinis !

Continuer la Lecture

Comment obtenir un prêt malgré un faible score de crédit

Découvrez comment augmenter vos chances d'obtenir un prêt malgré un faible historique de crédit en utilisant des stratégies efficaces, en choisissant le bon prêteur et en gérant vos finances.

Continuer la Lecture

Carte Truist Enjoy Cash Secured : développez votre crédit avec Cash Back

Développez votre crédit avec la carte Truist Enjoy Cash Secured Card, qui offre des récompenses et des limites flexibles. Une étape intelligente pour booster votre avenir financier !

Continuer la Lecture