Carte de crédit

Avis sur la carte American Express Platinum® : des avantages de luxe !

Une carte luxueuse avec des avantages exclusifs qui vous offriront les meilleures expériences où que vous soyez. Découvrez plus de 10 options différentes pour utiliser vos crédits avec la carte American Express Platinum® !

Publicité

Vous serez redirigé vers un autre site web

Gagnez des points pour chaque dollar dépensé aux États-Unis et dans le monde avec la carte American Express Platinum® !

Lisez notre évaluation de la carte American Express Platinum Card® et découvrez en quoi consiste cette carte de crédit ! Avec une carte premium conçue pour les personnes ayant un excellent score de crédit, vous pouvez vous offrir divers luxes.

Demandez la carte American Express Platinum®

Il est facile de demander la carte American Express Platinum® et vous pouvez gagner 125 000 points après les six premiers mois !

Chaque achat devient une opportunité de gagner des points, surtout pour ceux qui aiment voyager à travers le monde ! Il est donc temps d'examiner de près les caractéristiques de cette carte et de comprendre pourquoi elle est l'une des plus luxueuses.

- Cote de crédit : Bon – Excellent;

- Cotisation annuelle : $695;

- TAEG d'achat : 21.24% à 29.24%;

- TAEG des avances de fonds : 29.99%

- Récompenses : Gagnez 80 000 points de récompense après avoir dépensé 1 TP4T8 000 $ dans les 6 mois. De plus, gagnez 1 à 5 points par 1 TP4T1 sur chaque achat !

Carte American Express Platinum® : présentation

La carte American Express Platinum® est une option pour ceux qui recherchent des avantages exclusifs et ne se soucient pas des frais annuels !

Non seulement la carte American Express Platinum® ne facture pas de frais à l'étranger, mais elle offre également des crédits automatiques pour divers domaines, notamment les réservations d'hôtel et les frais accessoires des compagnies aériennes.

Le bonus de récompense s'adresse également aux amateurs de voyages, car vous gagnez 5 points par dollar dépensé en billets d'avion ou auprès de la société American Express.

De plus, les réservations d'hôtel via American Express Travel vous rapportent également 5 points par dollar. En d'autres termes, c'est la meilleure façon de réserver votre voyage ! De plus, gagnez 1 point sur d'autres achats !

Analyse des avantages et des inconvénients de la carte American Express Platinum®

Passons maintenant à une évaluation de la carte American Express Platinum® axée sur les avantages et les inconvénients. Cela vous permettra de peser plus facilement tous les points et de décider si cette carte vous convient !

Avantages

- Bonus de bienvenue : L'un des principaux avantages de la carte American Express Platinum® est le bonus de bienvenue disponible. Après avoir dépensé un total de $8,000 au cours des six premiers mois, vous gagnerez 125 000 points !

- Récompenses : Gagnez 5 points pour chaque dollar dépensé pour l'achat de billets et d'hébergements via American Express Travel. De plus, vous pouvez échanger chaque point contre 0,5 ou 2 centimes.

- Crédits automatiques : L'un des principaux avantages de la carte American Express Platinum® est le montant de plus de 1 500 TP4T en crédits. En plus des voyages, vous pouvez obtenir des crédits pour Uber, la salle de sport Equinox, Saks Fifth Avenue, Clear et même des services de streaming.

- Protection du téléphone portable : Cette prestation protège votre téléphone portable et couvre jusqu'à $800 pendant un an, offrant ainsi une sécurité supplémentaire pour l'utilisation de votre smartphone.

- Service de conciergerie : Vous avez également accès à un service d'assistance 24h/24 et 7j/7 !

- Salon des aéroports : De plus, vous avez également accès à différents salons dans les aéroports internationaux pour vous détendre avant vos vols. Il existe plus de 1 300 salons dans le monde !

Inconvénients

- Les frais annuels élevés, atteignant la valeur astronomique de $695, sont l’un de ces inconvénients !

Par conséquent, si vous n'êtes pas prêt à dépenser beaucoup pour profiter de divers avantages liés au voyage, cette carte n'est peut-être pas la meilleure option du marché. Il faut dépenser beaucoup pour que cela en vaille la peine !

Conditions d'éligibilité pour la carte American Express Platinum®

Vous devez avoir au moins 690 pour être considéré comme éligible à la demande de carte.

De plus, il est indispensable d'avoir plus de 18 ans et de fournir une preuve de son âge. Parmi les documents exigés, vous devrez présenter votre numéro de sécurité sociale.

Tous les candidats doivent être des résidents établis aux États-Unis. Vous devez donc fournir votre adresse et une preuve de résidence.

Un autre facteur déterminant est votre revenu mensuel et votre poste actuel. Toutes ces informations doivent être fournies dans la demande.

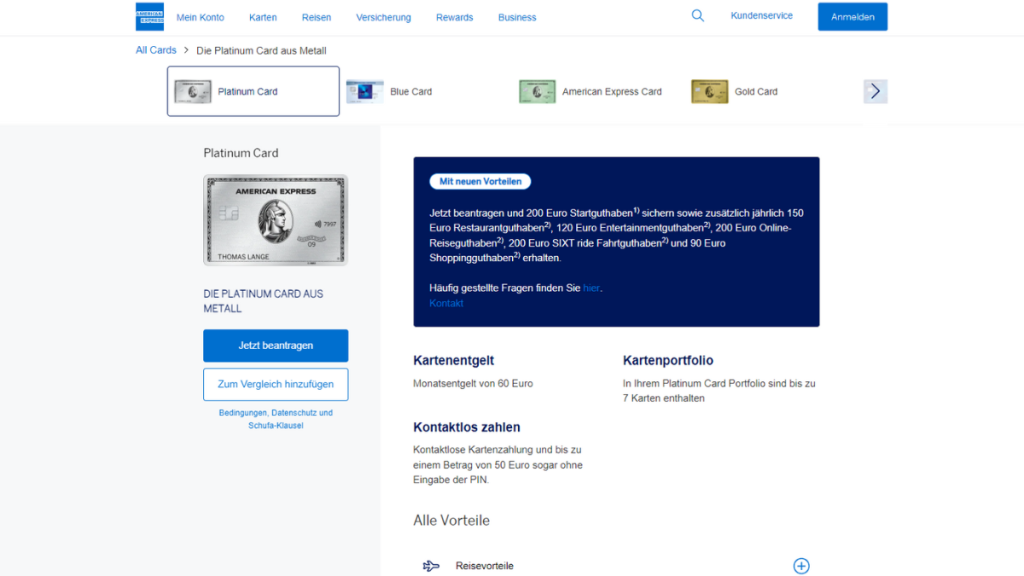

Demande de carte American Express Platinum Card® : un manuel

Si vous souhaitez poursuivre votre candidature, sachez que la démarche est simple et peut être effectuée entièrement en ligne.

Alors, consultez notre article pour savoir comment vous inscrire sans difficulté. Nous vous fournissons un plan contenant toutes les informations nécessaires !

Demandez la carte American Express Platinum®

Il est facile de demander la carte American Express Platinum® et vous pouvez gagner 125 000 points après les six premiers mois !

À propos de l'auteur / Pedro Saynovitch

Sujets Tendance

Application Rakuten : dévoiler le monde des récompenses

Bénéficiez d'économies et de récompenses avec l'application Rakuten ! Profitez de remises en argent, d'offres exclusives et d'une communauté dynamique. Achetez intelligemment dès aujourd'hui !

Continuer la Lecture

Delta SkyMiles® Gold : améliorez votre voyage avec des récompenses sur mesure

Découvrez les avantages de la carte Delta SkyMiles® Gold, comme les bagages enregistrés gratuits et les récompenses de voyage pour les voyageurs Delta.

Continuer la LectureVous aimerez peut-être aussi

Carte Citi Simplicity® : zéro frais et flexibilité ultime

Découvrez la carte de crédit Citi Simplicity® : zéro frais annuels, aucun frais de retard et jusqu'à 21 mois de TAEG 0%. Profitez d'une flexibilité inégalée !

Continuer la Lecture

Offres d'emploi Amazon : salaire horaire de départ : $18, plus avantages

Découvrez les offres d'emploi chez Amazon à partir de $18/heure. Postes d'entrée de gamme avec avantages et réelles perspectives d'évolution professionnelle aux États-Unis !

Continuer la Lecture