Credit Card

First Digital Mastercard® Review: Power Up Your Credit!

You can transform your credit story with the First Digital Mastercard®. Accepted nationwide, this genuine Mastercard® offers cash back on all payments. Begin your path to credit empowerment!

Advertisement

Get 1% cash back, manageable monthly payments, and build credit with every purchase you make!

When it comes to building or rebuilding your credit, the First Digital Mastercard® might be a good credit card option to review. With some compelling features, it can help you while offering rewards.

Apply for First Digital Mastercard®

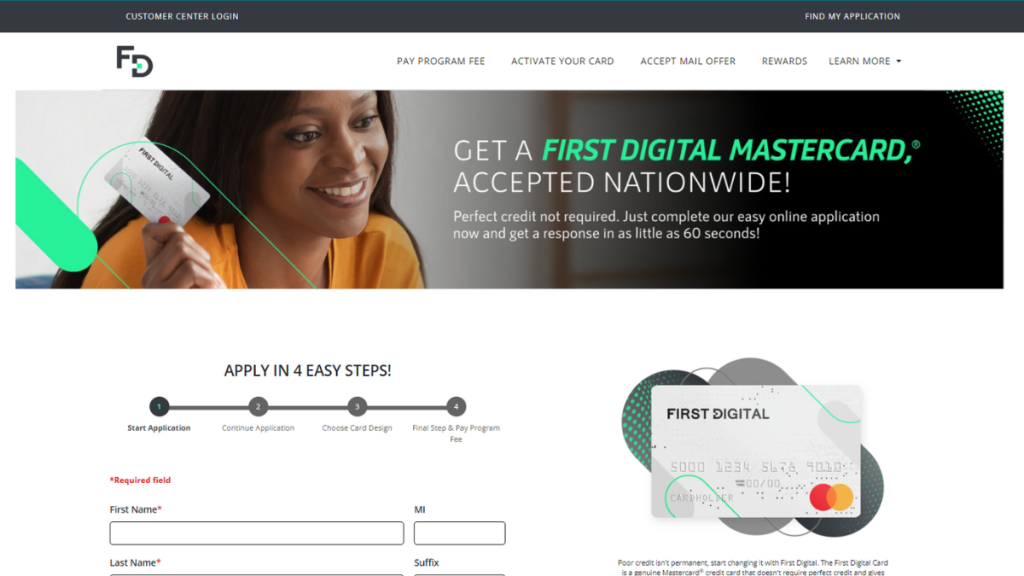

With the First Digital Mastercard® you can apply online in minutes! Discover a credit solution that embraces all credit histories!

Although cardholders can get cash back on purchases, the First Digital Mastercard® charges some fees along the way. So, it’s a good idea to understand the features before you decide to apply.

- Credit Score: Designed to accommodate individuals with less-than-perfect credit, offering an opportunity to build or rebuild their credit history.

- Annual Fee: Besides a program fee of $95, this card charges an annual fee of $75 for the first year. After that period, the annual fee is $48.

- Purchase APR: 35.99%.

- Cash Advance APR: Similar to the Purchase APR, the Cash Advance APR is 35.99%.

- Rewards: Cardholders earn 1% cash back on all payments made towards the balance on their account. You earn rewards points at the end of each billing cycle.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

First Digital Mastercard®: Overview

Unlike most credit-building cards, the First Digital Mastercard® doesn’t require a security deposit, but it’s essential to review its features to make sure it’s the right option for you.

Firstly, one of its standout features is the accessibility it offers, as it doesn’t require a perfect credit score for approval.

Besides, it offers an interesting rewards program of 1% cash back on all payments made towards the balance on your account. However, the points can only be redeemed once you reach 500 points.

Additionally, the card reports to credit bureaus on a monthly basis. This reporting can have a positive impact on a user’s credit history, provided they make timely payments.

Issued by Synovus Bank, a reputable financial institution based in Columbus, GA, the First Digital Mastercard® provides users with confidence in their financial transactions!

Analyzing the advantages and drawbacks of the First Digital Mastercard®

As you’ll find in this review, the First Digital Mastercard® presents an opportunity for accessible credit building. But it’s important to weigh the pros and drawbacks to make an informed decision.

Pros

- Doesn’t demand a perfect credit score for approval;

- Cash back on all payments made towards account balance;

- Convenient application process;

- The card contributes positively to users’ credit histories;

- Cardholders can make manageable monthly payments;

- Mobile app for easy account management.

Cons

- $95.00 program fee that you need to pay upon approval;

- This card charges annual fee;

- Redemption of rewards points is subject to a 500-point minimum;

- or security reasons, you can’t use the card at automated fuel pumps.

Eligibility Requirements for the First Digital Mastercard®

So, are you interested in applying for this card? Then, review some of the eligibility criteria for the First Digital Mastercard®, set by the issuer, Synovus Bank.

While the card is designed to accommodate a range of credit profiles, individuals must comply with certain legal requirements, including providing necessary identification information.

This may include details such as name, address, date of birth, and other information to allow the bank to identify the applicant reasonably.

Applying for the First Digital Mastercard®: a manual

If after this review you are ready to apply for the First Digital Mastercard®, be prepared for a straightforward and convenient application process! This means you can get your answer today.

After all, with four easy steps and a 60 seconds response, you can get your very own First Digital Mastercard® and start positively impacting your credit standing. Discover the step-by-step below!

Apply for First Digital Mastercard®

With the First Digital Mastercard® you can apply online in minutes! Discover a credit solution that embraces all credit histories!

Trending Topics

How to Choose a Course That Fits Your Career Path

Choose the right course career path with clear goals, personalized plans, and mentorship to drive long-term career growth and success.

Keep Reading

Best Budgeting Apps: Download and Manage Your Finances

Do you want to efficiently organize your finances? Read the article to discover the best budget apps to manage your financial life.

Keep ReadingYou may also like

Destiny Mastercard® Review: Build Your Credit Effectively

Is Destiny Mastercard® Card the right choice for you? Dive into its advantages and disadvantages to make an informed decision.

Keep Reading

Ink Business Cash®: Earn High Cash Back with Essential Business Perks

Unlock smarter spending strategies with the Ink Business Cash®. Earn up to 5% cash back on select purchases—all with no annual fee!

Keep Reading