Krediitkaart

Avasta see® Chrome: teeni raha tagasi bensiini ja toitlustuse pealt

Saa Discover it® Chrome kaardiga 2% bensiini ja einestamise pealt raha tagasi, ilma aastamaksuta ja esimesel aastal raha tagasi matši, et oma preemiaid kahekordistada!

REKLAAM

Teid suunatakse teisele veebisaidile

Igapäevaseks säästmiseks kohandatud krediitkaart

Discover it® Chrome'i gaasi- ja restoranikrediitkaart on tipptasemel valik neile, kes seavad esikohale igapäevased kulutused, eriti bensiini ja toitlustuse pealt.

See kaart pakub 2% raha tagasi bensiinijaamades ja restoranides ning ilma aastamaksuta suurepärast väärtust inimestele, kes armastavad lihtsust ja preemiaid, mis sobivad tõeliselt nende elustiiliga.

- KrediidiskoorHea kuni suurepärane

- Aastamaks: $0

- Ostu krediidi kulukuse määr: Muutuv intressimäär vahemikus 18,74% kuni 27,74% pärast sissejuhatavat 0% krediidi kulukuse määra 15-kuulist perioodi

- Sularaha ettemaksu krediidi kulukuse määr: 29,74%

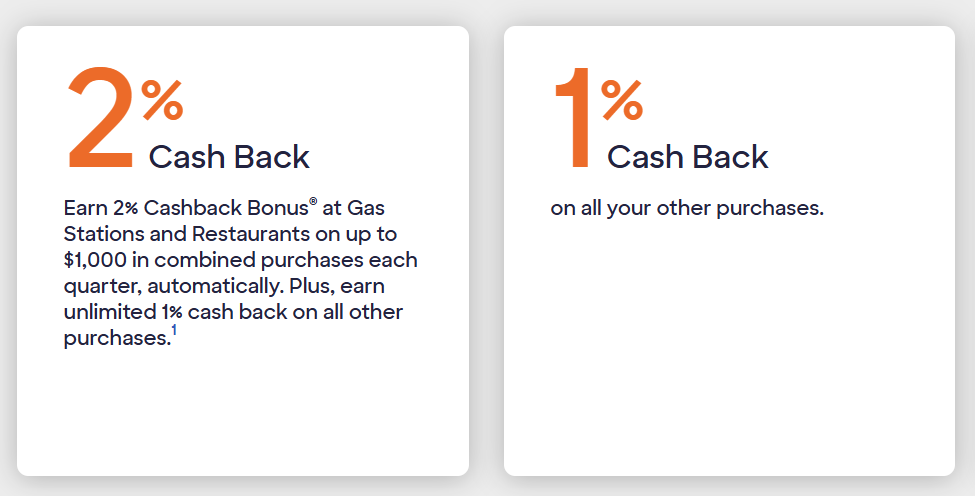

- AuhinnadTeeni 2% raha tagasi söögi- ja kütuseostudelt ning piiramatu 1% raha tagasi kõikidelt muudelt ostudelt

Avasta see® Chrome: ülevaade

See Avasta see® Chrome on loodud selleks, et lihtsustada preemiate saamist, maksimeerides samal ajal väärtust kahes olulises kulukategoorias: bensiin ja toitlustus.

Olenemata sellest, kas oled sage pendeldaja või sulle meeldib tihti väljas einestada, pakub see kaart muljetavaldavaid eeliseid ilma premium-krediitkaartidega sageli kaasnevate keerukusteta.

Mis eristab seda kaarti teistest:

Cashback-preemiate struktuur

- Teeni bensiinijaamades ja restoranides 2% cashbacki, mis sobib ideaalselt neile, kellel on sageli reisimise või väljas söömise harjumus.

- Kvartaalne ostulimiit $1000 koondostude puhul tagab järjepideva preemia ja edendab eelarvedistsipliini.

- Lisaks ülempiirile teenid kõigi teiste ostude pealt ikkagi 1% piiramatut raha tagasi, hoides asjad lihtsana ja läbipaistvana.

Sissejuhatav pakkumine

- Kasutage esimese 15 kuu jooksul nii ostude kui ka saldoülekannete puhul ära 0% krediidi kulukuse määra.

- Pärast sissejuhatavat perioodi läheb krediidi kulukuse määr üle muutuvale määrale vahemikus 18,741 TP3T kuni 27,741 TP3T.

Raha tagasi matš

- Uued kaardiomanikud saavad nautida Discoveri ainulaadset raha tagasi pakkumist, mis kahekordistab esimesel aastal teenitud preemiad.

- Pärast esimest aastat kahekordistab Discover iga teenitud raha tagasi dollari, ilma piirangute või piiranguteta.

Aastamaksu ei ole

Lisahüved

- Tasuta FICO® skoori jälgiminePüsige oma krediidiskoori kursis tasuta värskendustega Discoveri rakenduse või veebipõhise kontoportaali kaudu.

- Freeze It® funktsioonLukustage kaart koheselt, kui see kaotsi läheb, hoides ära volitamata tehingud.

- Välismaiste tehingute tasusid ei oleIdeaalne rahvusvahelistele reisijatele, kes soovivad vältida lisatasusid välismaal tehtud ostude eest.

Discover it® Chrome'i eeliste ja puuduste analüüs

Enne mis tahes krediitkaardiga liitumist on oluline hoolikalt kaaluda plusse ja miinuseid.

Discover it® Chrome'i plussid

Discover it® Chrome'i gaasi- ja restoranikrediitkaart pakub mitmeid silmapaistvaid eeliseid, mis muudavad selle paljude tarbijate jaoks atraktiivseks:

- Helde preemiaprogrammBensiini ja toitlustuse pealt saadav raha tagasi teenib otse populaarseid kulukategooriaid, pakkudes järjepidevat väärtust.

- Raha tagasi maksmise programmUued kasutajad saavad esimesel aastal teenida sisuliselt kahekordseid preemiaid, maksimeerides kaardi teenimispotentsiaali.

- Aastamaksu ei ole: Hoidke oma raha tagasi preemiaid ilma korduvate tasudeta, et oma tulu kompenseerida.

- Paindlik sissejuhatav krediidi kulukuse määr0% krediidi kulukuse intressimäär 15 kuuks annab hingamisruumi suurte ostude või saldoülekannete tegemiseks.

- Reisisõbralikud omadusedVälismaiste tehingutasude puudumine teeb sellest kaardist nutika kaaslase rahvusvahelistel reisidel.

- Tugevad turvafunktsioonidKaardi kohene külmutamine ja $0 vastutus volitamata ostude eest suurendavad meelerahu.

Discover it® Chrome'i miinused

Vaatamata oma tugevustele ei pruugi see kaart kõigile sobida:

- 2% preemiate kvartali ülempiirKuigi 2% raha tagasi määr on helde, võib $ 1000 kvartalilimiit bensiini- ja toitlustuskategooriate ostude kombineeritud osas tunduda suurte kulutajate jaoks piirav.

- Piiratud kõrge tasuga kategooriadErinevalt mõnest konkurendist keskendub Discover it® Chrome vaid kahele boonuskategooriale, mis ei pruugi sobida mitmekesisemate kulutusharjumustega inimestele.

- Krediidiskoori nõueTaotlejatel, kelle krediidiskoor ei ole suurepärane, võib kaardi saamise raskustega silmitsi seista.

Kaardi taotlemine

Discover it® Chrome'i registreerumine on algusest lõpuni lihtne ja probleemivaba.

1. Külasta Discoveri veebisaitiMinge Discoveri ametlikule veebisaidile ja leidke Discover it® Chrome'i rakenduse leht.

2. Kontrollige eelkvalifitseerimistKontrollige oma abikõlblikkust eelkvalifitseerimise tööriista abil, mis ei mõjuta teie krediidiskoori.

3. Esitage oma avaldusTäitke veebivorm oma isikuandmetega, sh sissetuleku ja sotsiaalkindlustusnumbriga.

4. Oodake kinnitustEnamik taotlejaid saab heakskiitva otsuse vaid mõne minutiga.

Abikõlblikkuse nõuded

Discover it® Chrome'i gaasi- ja restoranikrediitkaardi saamiseks peavad taotlejad vastama järgmistele kriteeriumidele:

- KrediidiskoorHeakskiitmiseks on soovitatav kindel krediidiajalugu, tavaliselt skooriga 670 või kõrgem.

- SissetulekTõend krediidikohustuste katteks piisava sissetuleku kohta.

- USA residentsusPeab olema USA kodanik või alaline elanik kehtiva sotsiaalkindlustusnumbriga.

Lisateavet teiste valikute kohta leiate siit: American Express Blue Cash Everyday® kaart

Neile, kes otsivad laiemat valikut preemiaid, pakub American Express Blue Cash Everyday® kaart veenvat alternatiivi Discover it® Chrome Gas & Restaurant krediitkaardile.

Blue Cash Everyday® kaart pakub 3% raha tagasi toidukaupade, bensiini ja veebiostude pealt kuni $6000 aastas igas kategoorias, lisaks 1% raha tagasi muude ostude pealt.

See kaart sisaldab 15-kuulist 0% sissejuhatavat krediidi kulukuse määra ja sellel pole aastamaksu, mille pärast muretseda.

See muudab selle eriti atraktiivseks peredele või sagedastele veebiostlejatele, kes soovivad maksimeerida hüvesid laiemas kulukategooriate valikus.

Siiski väärib märkimist, et American Expressi kaart sisaldab välismaksete tasusid, mis võib olla ebasoodne neile, kes reisivad sageli rahvusvaheliselt – see on funktsioon, mille poolest Discover it® Chrome särab ilma välismaksete tasudeta.

Lõppkokkuvõttes pakuvad mõlemad kaardid suurepäraseid preemiaid ja hüvesid, mis on kohandatud erinevatele kulutamisharjumustele. Valige see, mis sobib kõige paremini teie elustiiliga, et maksimeerida oma raha tagasi potentsiaali!

American Express Blue Cash Everyday®

Teeni 3% raha tagasi oluliste kaupade pealt ilma aastamaksuta. Ideaalne igapäevaseks säästmiseks!

TRENDING_TOPICS

Citi® Diamond Preferred® kaardi ülevaade: nautige 0% sissejuhatavat krediidikulukuse määra

Jätka lugemist

Kuidas valida kursus, mis sobib teie karjääriteega

Vali õige karjääritee selgete eesmärkide, personaalsete plaanide ja mentorlusega, et edendada pikaajalist karjäärikasvu ja edu.

Jätka lugemist

PayPali uurimine: veebimaksete revolutsioon

Avastage, kuidas PayPal muudab raha saatmise ja vastuvõtmise viisi revolutsiooniliselt. Kogege turvalisemat ja kiiremat viisi oma rahaasjade haldamiseks.

Jätka lugemistVÕIB SULLE KA MEELDIDA

Ink Business Cash®: teenige palju raha tagasi oluliste ärihüvedega

Avage nutikamad kulutusstrateegiad Ink Business Cash®-iga. Teenige valitud ostude pealt kuni 5% raha tagasi – kõik see ilma aastamaksuta!

Jätka lugemist

EarnIn: Sõbralik lahendus väikeste sularaha ettemaksete jaoks

EarnIn on uuenduslik lahendus, mis aitab paljudel inimestel ettenägematute kuludega toime tulla. Lisateavet rakenduse kohta leiate siit!

Jätka lugemist