Tarjeta de crédito

Tarjeta Truist Enjoy Cash Secured: genere crédito con devolución de efectivo

Con la tarjeta Truist Enjoy Cash Secured, puede mejorar su perfil crediticio y recuperar hasta un 3% en sus gastos.

Anuncios

Serás redirigido a otro sitio

Una tarjeta segura que ofrece generosas recompensas en efectivo

La tarjeta Truist Enjoy Cash Secured se destaca en el mercado de tarjetas de crédito garantizadas al combinar la facilidad de acceso con atractivas recompensas en efectivo.

Para las personas que trabajan para establecer o reconstruir su crédito, esta tarjeta ofrece una solución práctica pero gratificante, ofreciendo características normalmente reservadas para tarjetas no garantizadas.

- Puntaje crediticio:No se requiere puntuación específica; ideal para aquellos con historial crediticio limitado o dañado

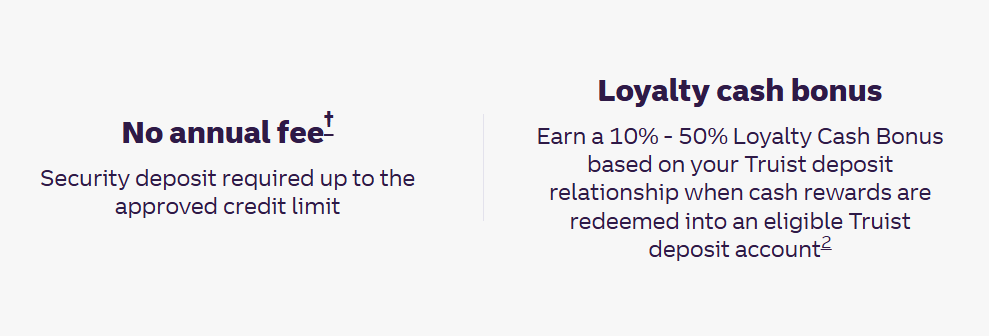

- Cuota anual: Cero

- Tasa de interés anual (APR) de compra:Tasa variable competitiva a 27,99%

- Tasa de porcentaje anual (APR) de anticipo de efectivo:Ligeramente más alto a 28.99%; se recomienda usarlo con precaución

- Recompensas:Disfrute de un reembolso de efectivo de 3% en combustible, 2% en compras de comestibles y 1% en todas las demás compras que califiquen.

Tarjeta Truist Enjoy Cash Secured: descripción general

Las tarjetas de crédito garantizadas sirven como un trampolín para que los usuarios construyan o reconstruyan su credibilidad financiera.

Lo que distingue a la tarjeta Truist Enjoy Cash Secured es su atractivo programa de recompensas, lo que la convierte en una herramienta de doble propósito para mejorar el crédito y obtener beneficios financieros.

Dirigida a aquellos que desean mejorar o establecer su crédito, esta tarjeta vincula su límite de crédito a un depósito reembolsable, ofreciendo estructura y oportunidad.

El depósito mínimo comienza en $300, lo que lo hace flexible para varios presupuestos.

Características que brillan

- Recompensas en devolución de efectivo:

Con 3% de reembolso en efectivo en gasolina y 2% en comestibles, esta tarjeta convierte los gastos de rutina en valiosos ahorros. Además, los titulares de la tarjeta reciben 1% de reembolso en todas las demás compras que califiquen. - Límite de crédito personalizable:

El límite de crédito del titular de la tarjeta se corresponde directamente con su depósito de seguridad, lo que permite controlar el gasto y, al mismo tiempo, generar un historial crediticio positivo. - Informes a las principales agencias de crédito:

Las actualizaciones mensuales sobre la actividad de su cuenta se comparten con Experian, TransUnion y Equifax, lo que garantiza que las principales agencias de crédito realicen un seguimiento de su crecimiento crediticio. Estos informes constantes ayudan a los usuarios responsables a mejorar sus puntajes crediticios con el tiempo. - Acceso a herramientas en línea:

Los titulares de tarjetas pueden administrar sus cuentas a través de un portal en línea fácil de usar o una aplicación móvil, lo que simplifica el seguimiento del saldo y la programación de pagos. - Camino a la actualización:

Después de un uso responsable constante, Truist puede ofrecer oportunidades de transición a una tarjeta no garantizada, reembolsando el depósito y conservando el historial crediticio.

¿Quién se beneficia más de esta tarjeta?

Esta tarjeta es la más adecuada para personas que:

- ¿Está comenzando con el crédito o tiene un historial crediticio corto?

- ¿Necesita una herramienta confiable para reconstruir sus puntajes de crédito?

- Prefiera ganar recompensas en compras esenciales.

- Busque una opción de depósito personalizable que establezca directamente su límite de gasto.

Analizando las ventajas y desventajas de la tarjeta

Es fundamental comprender las ventajas y desventajas de la tarjeta Truist Enjoy Cash Secured antes de tomar una decisión. A continuación, se detallan sus ventajas y posibles limitaciones.

Ventajas

La tarjeta Truist Enjoy Cash Secured ofrece varias ventajas distintivas que la hacen atractiva:

- Programa de recompensas generosas:

Las tarjetas aseguradas rara vez ofrecen recompensas en efectivo, lo que hace que la tarjeta Truist sea una opción destacada. - Opciones flexibles de depósito y límite:

Los usuarios pueden establecer su límite de crédito en función de su capacidad financiera, proporcionando control y tranquilidad. - Sin cuota anual:

La tarjeta no tiene tarifa anual, lo que la convierte en una opción aún más atractiva para quienes buscan generar crédito sin costos adicionales. - Potencial de creación de crédito:

Informar a las tres principales agencias de crédito garantiza que el uso responsable tendrá un impacto positivo en las puntuaciones crediticias. - Oportunidades de actualización:

Con el tiempo, los usuarios pueden calificar para una tarjeta de crédito Truist sin garantía, recibir su depósito de vuelta y mejorar aún más su perfil crediticio.

Contras

A pesar de sus numerosos beneficios, la tarjeta tiene algunas limitaciones:

- Tasas de interés anuales (APR) altas:

Las tasas de porcentaje anual (APR) variables para compras y adelantos de efectivo son relativamente altas, por lo que es esencial evitar mantener saldos. - Requisito de depósito de seguridad:

Si bien es reembolsable, el depósito inicial puede ser un obstáculo para aquellos con presupuestos ajustados. - Categorías de recompensas limitadas:

El reembolso en efectivo de 3% se aplica a compras de gasolina y 2% a compras de comestibles, lo que puede no coincidir con los hábitos de gasto de cada titular de tarjeta.

Cómo solicitar la tarjeta Truist Enjoy Cash Secured

El proceso de solicitud para la tarjeta Truist Enjoy Cash Secured es sencillo y se puede completar en línea. A continuación, se incluye una guía paso a paso para comenzar:

- Paso 1: Visite el portal oficial en línea de Truist.

- Vaya al sitio web oficial de Truist Bank y localice la sección de tarjetas seguras.

- Paso 2: Complete la solicitud

- Ingrese sus datos básicos, como su nombre, número de Seguro Social y comprobante de ingresos.

- Paso 3: Establezca el monto de su depósito

- Seleccione un depósito, a partir de $300, que servirá como límite de gasto de su tarjeta.

- Paso 4: Presentar la solicitud

- Revise sus datos para comprobar que sean correctos y envíe la solicitud. Es posible que Truist le pida documentación adicional para verificar su identidad.

- Paso 5: Esperar la aprobación

- Las decisiones suelen tomarse en unos pocos días hábiles. Una vez aprobada, deposite fondos en su depósito de seguridad para activar su cuenta.

Requisitos de elegibilidad

Para calificar para la tarjeta Truist Enjoy Cash Secured, los solicitantes deben cumplir con los siguientes criterios:

- Debe haber cumplido 18 años o más.

- Se requiere un número de Seguro Social o de identificación del contribuyente legítimo.

- Poseer una dirección postal válida en EE.UU.

- Debe demostrar la capacidad para cubrir el depósito de seguridad reembolsable.

Conozca otras opciones: Aquí está la tarjeta de crédito asegurada PREMIER Bankcard®

Si bien la tarjeta Truist Enjoy Cash Secured Card se destaca por sus recompensas y flexibilidad, puede que no sea adecuada para todos. La tarjeta de crédito PREMIER Bankcard® Secured Credit Card se destaca como una opción viable para explorar.

Esta tarjeta está dirigida específicamente a personas que no tienen crédito o que lo tienen deteriorado. Su principal ventaja radica en la accesibilidad, ya que no requiere una puntuación crediticia alta ni un depósito sustancial.

¿Qué hace que la tarjeta de crédito asegurada PREMIER Bankcard® sea una opción atractiva?

- Sin recompensas pero con menores barreras de entrada:

Si bien carece de beneficios de devolución de efectivo, la tarjeta PREMIER Bankcard ofrece criterios de aprobación accesibles, lo que la hace ideal para quienes necesitan opciones de creación de crédito inmediata. - Límites de crédito personalizables:

Al igual que la tarjeta Truist, permite flexibilidad para establecer límites de crédito en función del depósito.

Reflexiones finales

La tarjeta Truist Enjoy Cash Secured es una excelente opción para las personas que desean reconstruir su crédito mientras disfrutan de valiosas recompensas en efectivo.

Su combinación de asequibilidad, flexibilidad y potencial de creación de crédito la convierte en una opción destacada en el mercado de tarjetas aseguradas.

Sin embargo, para aquellos que consideran que los criterios de elegibilidad de Truist o la disponibilidad regional son limitantes, la tarjeta de crédito asegurada PREMIER Bankcard® ofrece una alternativa viable.

Explore sus opciones y dé el siguiente paso para mejorar su futuro financiero.

Tarjeta de crédito asegurada PREMIER Bankcard®

¡Prepárese para tomar el control de su crédito y solicite la tarjeta de crédito asegurada PREMIER Bankcard®! ¡Construya un futuro financiero más sólido!

Tendencias

Ink Business Cash®: obtenga grandes reembolsos en efectivo con beneficios comerciales esenciales

Descubra estrategias de gasto más inteligentes con Ink Business Cash®. ¡Obtenga hasta $5% de reembolso en compras seleccionadas, todo sin cargo anual!

Continúe Leyendo

Los pros y contras de los préstamos personales que debes comprender

Explore los pros y contras de los préstamos personales para tomar decisiones informadas, evitar cargos ocultos y alinear los préstamos con sus objetivos financieros.

Continúe LeyendoTambién te puede interesar

McDonald's está contratando: puestos de nivel inicial a partir de $10/hora

¡Comienza tu carrera en McDonald's! Horarios flexibles, salario estable y oportunidades de crecimiento lo convierten en un excelente lugar para trabajar. ¡Descubre cómo postularte hoy mismo!

Continúe Leyendo

Los diferentes tipos de préstamos y cómo funcionan

Explore una guía completa de tipos de préstamos con consejos para comparar opciones, comprender los términos y tomar decisiones crediticias más inteligentes.

Continúe Leyendo