Tarjeta de crédito

Reseña de la tarjeta Costco Anywhere Visa® de Citi: recompensas en diferentes categorías para miembros de Costco

Descubra las ventajas que ofrece la tarjeta Costco Anywhere Visa® de Citi: una herramienta financiera que ofrece generosas recompensas y no tiene cuotas anuales. ¡Una opción inteligente para los miembros de Costco!

Anuncios

Serás redirigido a otro sitio

Tarifa anual cero y recompensas atractivas: descubre los beneficios de la tarjeta Visa de Costco

¿Es usted socio de Costco o disfruta de comprar en la tienda? La tarjeta Costco Anywhere Visa® de Citi no solo complementa la experiencia de compra en Costco, sino que también puede convertirse en un valioso aliado en sus decisiones financieras.

Imagínese no tener que preocuparse por las tarifas anuales mientras disfruta de generosas recompensas, como un reembolso en efectivo de 4% en compras de gasolina y vehículos eléctricos.

Sin embargo, como ocurre con cualquier decisión financiera, es fundamental examinar detenidamente tanto los beneficios como las consideraciones. ¿Cómo pueden influir en sus decisiones financieras la tasa de interés y la ausencia de un bono de bienvenida?

En este contenido, profundizaremos en los detalles de la Costco Anywhere Visa de Citi, brindando una descripción general completa que lo ayudará a decidir si esta tarjeta es la opción perfecta para sus necesidades financieras.

Tarjeta Costco Anywhere Visa® de Citi: descripción general

La tarjeta Costco Anywhere Visa de Citi presenta una opción atractiva para los miembros de Costco que buscan ventajas sustanciales.

Sin una tarifa anual para los miembros, la tarjeta ofrece generosas recompensas, incluido un reembolso en efectivo de $4% en compras de gasolina y vehículos eléctricos, hasta $$7,000 por año, seguido de $1% a partir de entonces.

Además, garantiza un reembolso de efectivo de 3% en gastos de restaurantes y viajes, incluidos aquellos con Costco Travel, y un reembolso de efectivo de 2% en compras en Costco y Costco.com.

La tarjeta se distingue por sus características como protección de compras, ausencia de comisiones por transacciones en el extranjero y asistencia en viajes.

Además, el proceso de canje es sencillo y convierte el reembolso en efectivo en certificados de recompensa anuales que pueden usarse para canjear efectivo o mercadería en los almacenes de Costco en EE. UU.

Consulta información relevante sobre la tarjeta:

| Puntuación de crédito: | Excelente. |

| Cuota anual: | Sin cuota anual. |

| ABR: | 20.49% para compras y transferencias de saldo; 29.99% para adelantos de efectivo. |

| Bono de bienvenida: | Ninguno. |

| Recompensas: | 4% de reembolso en efectivo en vehículos a gasolina y eléctricos (hasta $7,000/año, 1% después de esa cantidad), 3% en restaurantes y viajes, 2% en compras en Costco y 1% en otras compras. |

¿Cuáles son los pros y contras de la tarjeta Costco Anywhere Visa® de Citi?

Al considerar la tarjeta Costco Anywhere Visa®, es esencial evaluar cuidadosamente las ventajas y desventajas antes de tomar una decisión informada sobre su aplicación.

Al fin y al cabo, esta tarjeta ofrece una serie de ventajas atractivas, pero también tiene sus inconvenientes. Analice en detalle estos aspectos positivos y negativos para obtener una visión integral del producto financiero:

Ventajas

La tarjeta Costco Anywhere Visa de Citi ofrece varias ventajas para los miembros de Costco:

- Sin cuota anual: Sin cuota anual, lo que representa un ahorro directo para los titulares de la tarjeta.

- Generosas recompensas: Un sólido programa de recompensas, que incluye $4% de reembolso en efectivo en vehículos a gasolina y eléctricos (hasta $$7,000/año, $1% después de esa cantidad), $3% en restaurantes y viajes, $2% en compras en Costco y Costco.com, y $1% en otras compras.

- Protección de compra: Beneficios integrales como seguro de viaje y asistencia de emergencia, brindando seguridad adicional en las transacciones.

- Amplia aceptación: Al ser una tarjeta Visa, es ampliamente aceptada en diversos establecimientos a nivel mundial.

Contras

Si bien la tarjeta Costco Anywhere Visa de Citi tiene sus ventajas, es importante tener en cuenta algunas desventajas. Eche un vistazo:

- Tasa de interés alta: Una tasa de interés relativamente alta, con un APR de 20.49% para compras y transferencias de saldo, y 29.99% para adelantos de efectivo, lo que puede representar costos adicionales para quienes mantienen un saldo mensual o realizan adelantos de efectivo frecuentes.

- Falta de bono de bienvenida: La tarjeta no ofrece un bono de bienvenida inicial, lo que puede ser un inconveniente para quienes buscan beneficios inmediatos al adquirir la tarjeta.

En conclusión, a pesar de que la tarjeta Costco Anywhere Visa® de Citi tiene sus desventajas, es esencial equilibrar estos aspectos negativos con los beneficios que ofrece para determinar si la tarjeta satisface las necesidades y preferencias individuales del titular de la tarjeta.

¿Cómo solicitar la tarjeta Costco Anywhere Visa® de Citi?

Solicitar la tarjeta Costco Anywhere Visa® de Citi es un proceso simple que puede abrir puertas a una variedad de beneficios financieros.

Para comenzar, simplemente visita el sitio web oficial de Citi y localiza la sección dedicada a la tarjeta Costco Anywhere Visa. Allí encontrarás información sobre los beneficios, términos y condiciones.

Para una visión más detallada del proceso de solicitud y para que usted esté completamente informado al momento de solicitar este producto financiero, le recomendamos revisar nuestro siguiente contenido, donde detallaremos paso a paso cómo iniciar y completar el proceso de solicitud.

Entonces, ¿vamos a explorar juntos las ventajas de la tarjeta Visa Costco Anywhere y convertir sus compras en Costco en una experiencia aún más gratificante? Acceso:

Tarjeta Costco Anywhere Visa® de Citi: ¿cómo solicitarla?

¿Quieres solicitar la tarjeta Anywhere Visa® de Citi? Te esperan facilidades y recompensas: ¡sigue leyendo y descubre el camino ahora!

Sobre el autor / Pedro Saynovich

Tendencias

Solicite la tarjeta Capital One® Guaranteed Mastercard®: ¡Accesible para todos los puntajes de crédito!

Continúe Leyendo

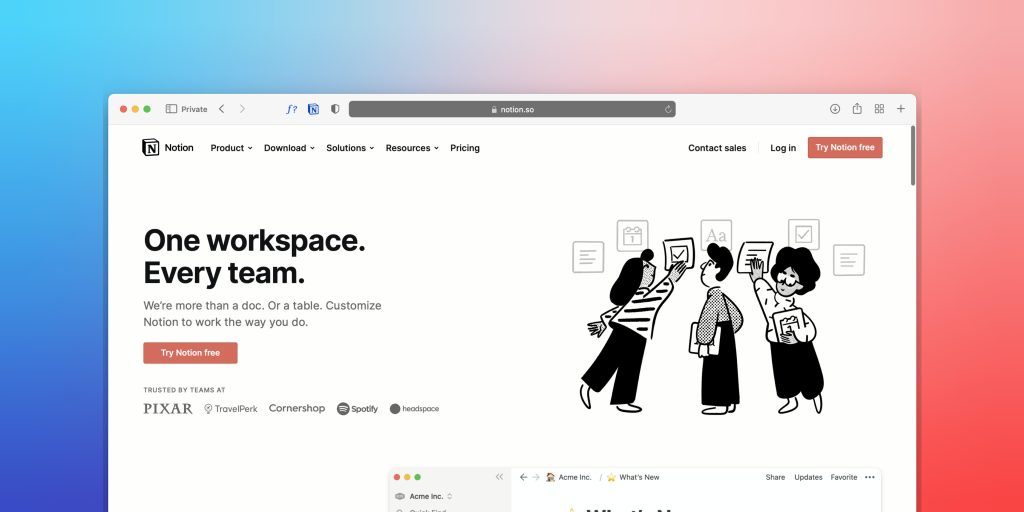

Mejore su productividad con Notion

Notion es una herramienta versátil que fusiona las aplicaciones de trabajo cotidianas en un espacio de trabajo unificado y personalizable. Te permite tomar notas, agregar tareas, administrar proyectos y crear tu base de conocimientos, todo mientras colaboras con tu equipo.

Continúe LeyendoTambién te puede interesar

Cómo elegir un curso que se adapte a tu trayectoria profesional

Elija la trayectoria profesional adecuada con objetivos claros, planes personalizados y tutoría para impulsar el crecimiento y el éxito profesional a largo plazo.

Continúe Leyendo

Empleos en restaurantes y comida rápida: Salarios iniciales desde $28,000/año

¡Descubre trabajos en restaurantes y comida rápida con salarios por hora que comienzan en $10 y mucho espacio para hacer crecer tu carrera!

Continúe Leyendo