Tarjeta de crédito

Revisión de la tarjeta de crédito Chase Slate Edge®: ¡Simplifique sus finanzas!

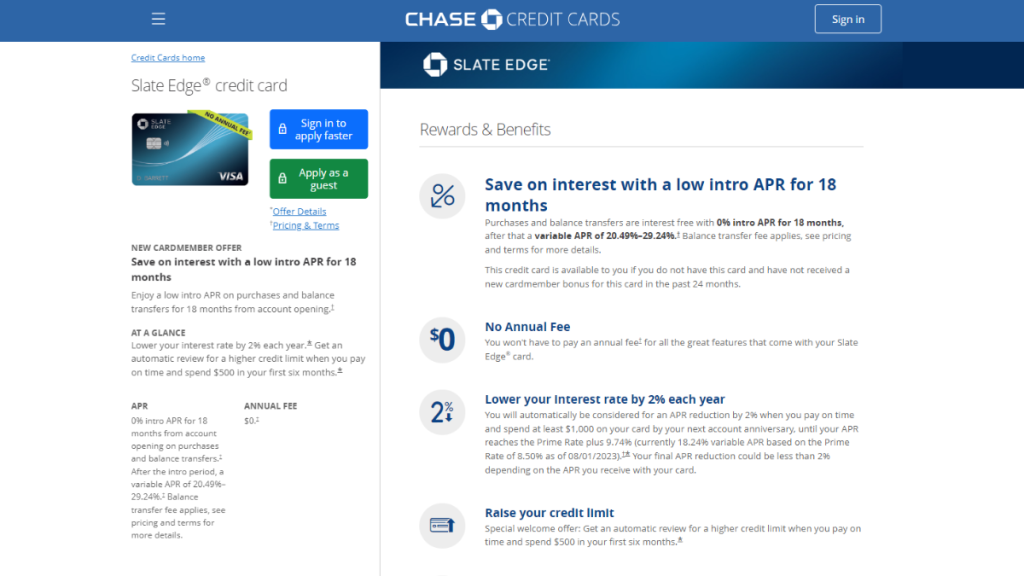

La tarjeta de crédito Chase Slate Edge® ofrece aumentos automáticos del límite de crédito y posibles reducciones de la tasa anual (APR) por uso responsable. Prepárese para maximizar su potencial financiero y disfrutar de un largo período de APR de 0%.

Anuncios

Serás redirigido a otro sitio

¡Avance financieramente y benefíciese de una posible reducción de TAE por un uso responsable de la tarjeta!

Si bien las recompensas pueden agregar valor a una tarjeta de crédito, tener una tasa de interés anual (APR) de 0% ayuda a las personas a ahorrar mucho al transferir su deuda. Por eso, esta reseña de la tarjeta de crédito Chase Slate Edge® es para usted.

Solicite la tarjeta de crédito Chase Slate Edge®

¡Demuestre que es un titular de tarjeta responsable y obtenga mayores líneas de crédito y una tasa de porcentaje anual (APR) más baja cuando solicite la tarjeta de crédito Chase Slate Edge®!

Con un largo período de tasas de interés cero, esta tarjeta de crédito es ideal si necesita realizar transferencias de saldo o incluso si desea realizar una compra importante. ¡Explore las características de la tarjeta y obtenga más información!

- Puntuación de crédito: Aunque los criterios de aprobación individuales pueden variar, generalmente se requiere un crédito bueno o excelente.

- Cuota anual: Cero.

- Tasa de interés anual (APR) de compra: Durante los primeros 18 meses, podrá disfrutar de una tasa de interés introductoria de 0%. Pero después, oscila entre 20,49% y 29,24%.

- APR de anticipo de efectivo: Se aplica una tasa de interés promedio de 29.99% para cualquier necesidad de efectivo inesperada que pueda surgir.

- Recompensas: Dado que se centra en la gestión financiera, esta tarjeta no tiene ninguna recompensa tradicional.

Tarjeta de crédito Chase Slate Edge®: descripción general

Con la tarjeta de crédito Chase Slate Edge®, descubrirá un instrumento financiero diseñado para facilitar la gestión eficiente del crédito. ¿Tiene un error de deuda que acumula tasas de interés?

Esta tarjeta ofrece un período extendido sin intereses tanto en compras como en transferencias de saldos. Esto significa que tienes un amplio margen para consolidar saldos existentes o hacer nuevas compras.

Además, obtienes aumentos automáticos en la línea de crédito, pero solo después de gastar entre 1TP y 500 T. Además, debes hacerlo en los primeros seis meses y realizar todos los pagos a tiempo, demostrando así tu confiabilidad.

Además, si realiza pagos puntuales de manera constante y gasta al menos $1,000 en su tarjeta, tendrá la oportunidad de reducir su tasa de interés con el tiempo. ¡Esto recompensa el comportamiento responsable!

Por último, más allá de estas características, la tarjeta de crédito Chase Slate Edge® enfatiza la simplicidad al no cobrar comisiones anuales. En general, se trata de una herramienta valiosa para administrar el crédito de manera inteligente.

Analizando las ventajas y desventajas de la tarjeta de crédito Chase Slate Edge®

Si bien la tarjeta de crédito Chase Slate Edge® no ofrece recompensas comunes, existen otros beneficios que puede consultar si desea solicitarla. De esa manera, podrá estar seguro de que esta es la tarjeta adecuada para usted.

Ventajas

- 0% sobre las tasas de interés por un período de tiempo;

- Sin cargos anuales;

- Mejora tu línea de crédito automáticamente;

- Reducir sus cargos por intereses a lo largo del tiempo;

- Comodidad y seguridad del pago sin contacto.

Contras

- Sin recompensas tradicionales ni incentivos de devolución de dinero;

- Las transferencias de saldo se vuelven variables después del período inicial;

- Cobra una tarifa por utilizar la tarjeta en el extranjero;

- Carece de algunas de las ventajas premium.

Requisitos de elegibilidad para la tarjeta de crédito Chase Slate Edge®

¿Está pensando en solicitar la tarjeta de crédito Chase Slate Edge® después de leer esta reseña? Entonces es importante que controle sus criterios de elegibilidad para asegurarse de que cumple con el perfil.

En primer lugar, para la aprobación, generalmente se requiere un sólido historial crediticio con un historial demostrado de gestión responsable del crédito. Además, los solicitantes deben cumplir con otros criterios.

Por ejemplo, debe ser ciudadano o residente de los EE. UU. y tener al menos 18 años. Además, es necesario tener un número de Seguro Social válido. Sin embargo, cumplir con los requisitos no garantiza la aprobación.

Cómo solicitar la tarjeta de crédito Chase Slate Edge®: manual

Si te sientes preparado para obtener la tarjeta Chase Slate Edge®, primero debes consultar el sitio web oficial. Luego, accede al formulario en línea. Pero, si prefieres solicitarla en persona, puedes acudir a una sucursal bancaria.

¿Tienes alguna pregunta sobre el proceso de solicitud? ¡No te preocupes! ¡Explora una guía completa y comprende rápidamente el proceso para solicitar la tarjeta de crédito Chase Slate Edge®!

Solicite la tarjeta de crédito Chase Slate Edge®

¡Demuestre que es un titular de tarjeta responsable y obtenga mayores líneas de crédito y una tasa de porcentaje anual (APR) más baja cuando solicite la tarjeta de crédito Chase Slate Edge®!

Tendencias

Cash App: tu aliado financiero ideal para la gestión del dinero y la elaboración de presupuestos

Cash App es un servicio de pagos móviles que simplifica al máximo tus transacciones financieras. Desarrollado por Square Inc.

Continúe Leyendo

Empleos en construcción: Comienza tu carrera con salarios desde $17/hora

Explore trabajos de construcción en EE. UU.: Carreras estables desde $17/hora y oportunidades de crecimiento en una industria en auge.

Continúe LeyendoTambién te puede interesar

Reseña de Indeed: consejos, funciones y conocimientos

Explore Indeed, un potente motor de búsqueda de empleo que no solo conecta a quienes buscan trabajo con oportunidades, sino que también proporciona recursos para ambos.

Continúe Leyendo