Tarjeta de crédito

Revisión de la tarjeta de crédito Capital One Venture X: ¡Viaje con facilidad!

Pocas tarjetas logran compensar los costos de mantenimiento con un sólido programa de recompensas, pero la tarjeta de crédito Capital One Venture X está aquí para demostrar que es posible. ¡Ven a descubrir más!

Anuncios

Serás redirigido a otro sitio

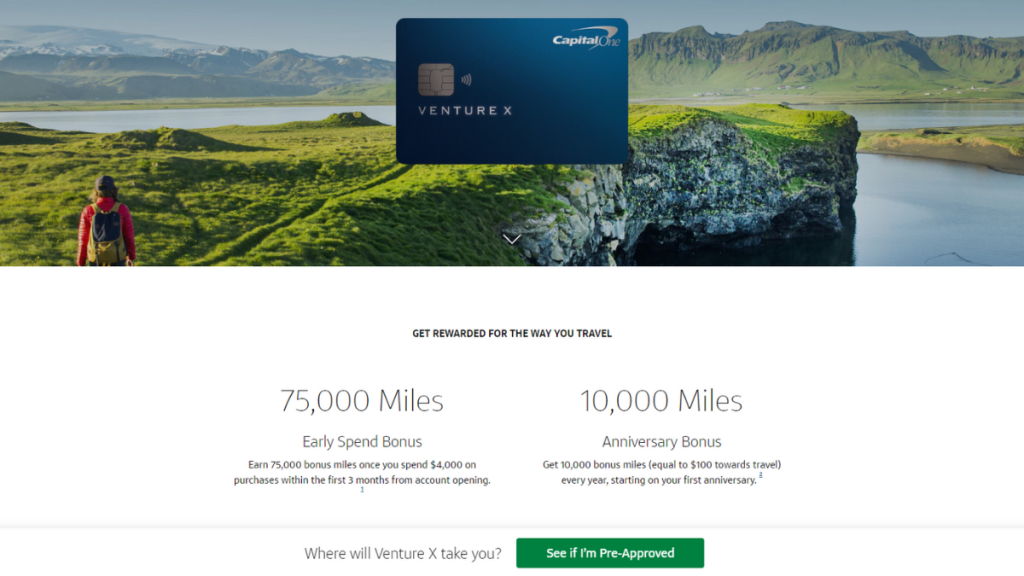

Tarjeta de crédito Capital One Venture X: ¡75.000 millas de bonificación!

En la revisión de la tarjeta de crédito Capital One Venture X, descubra cómo esta tarjeta incluye acceso a bonos de bienvenida, regalos de cumpleaños y más.

Solicite la tarjeta de crédito Capital One Venture X

¡Puedes solicitar la tarjeta de crédito Capital One Venture X sin salir de casa! ¡Completa un formulario virtual rápidamente!

En cualquier caso, ¡esta es una tarjeta para viajeros que buscan aprovechar su excelente calificación crediticia para explorar el mundo! ¡Échale un vistazo!

- Puntuación de crédito: Excelente;

- Cuota anual: $395 por año;

- Tasa de interés anual (APR) de compra: 19.99% a 29.99%;

- APR de anticipo de efectivo: 29.99%;

- Recompensas: 2 a 10 millas por dólar; Bono de aniversario; Bono de bienvenida.

Tarjeta de crédito Capital One Venture X: descripción general

En primer lugar, esta reseña de la tarjeta de crédito Capital One Venture X es fundamental para que usted determine si la tarjeta es adecuada para usted. Gracias a sus recompensas, ¡es una tarjeta perfecta para viajeros frecuentes!

Es fundamental comprender cómo funcionan las bonificaciones de recompensas y cómo ayudan a mejorar sus viajes por el mundo. Obtendrá 10 millas por cada dólar gastado en reservas de hotel y de automóvil.

Además, también ganarás 5 millas en reservas de vuelos y 2 millas por cada $1 gastado en cualquier compra.

Además, puedes canjear tus millas de varias maneras. En primer lugar, puedes utilizarlas para reservar viajes a través del sitio web de Capital One. También es posible transferir millas a aerolíneas y hoteles asociados o utilizarlas para obtener tarjetas de regalo.

El valor de la transferencia suele ser de un centavo por milla, pero es fundamental consultar los detalles en el sitio web de Capital One. Además, la tarjeta ofrece bonificaciones adicionales que pueden mejorar tu experiencia.

Análisis de las ventajas y desventajas de la tarjeta de crédito Capital One Venture X

Para realizar una reseña perfecta de la tarjeta de crédito Capital One Venture X, debemos analizar los pros y los contras. ¡Échale un vistazo!

Ventajas:

- Recompensas: Como se detalla, ¡podrás ganar de 2 a 10 millas por compras!

- Canje: ¡Múltiples y ventajosas formas de canjear tus millas para viajeros!

- Sala VIP: Más de 1.300 salas VIP en aeropuertos de todo el mundo para que disfrutes con la exclusividad de la tarjeta de crédito Capital One Venture X.

- Bono de bienvenida: ¡Puedes ganar 75,000 millas si gastas $4,000 en los primeros tres meses, lo que resulta en un bono de aproximadamente $750!

- Bono de Aniversario: Podrás sumar millas e incluso dólares para gastar en viajes. ¡Hasta $300 al año en reservas y 10.000 millas al renovar tu tarjeta!

Contras:

- Tarifa anual alta: La tarifa anual de la tarjeta de crédito Capital One Venture X puede ser alta, pero se compensa fácilmente si usas la tarjeta al máximo, aprovechando el bono de bienvenida y las recompensas de aniversario.

Requisitos de elegibilidad para la tarjeta de crédito Capital One Venture X

El principal requisito que podemos destacar es la necesidad de tener un excelente puntaje crediticio, limitando la accesibilidad de la tarjeta.

Además, debe ser mayor de 18 años y residir en territorio estadounidense. Toda la información debe verificarse mediante la documentación pertinente al completar el formulario de precalificación.

Cómo solicitar la tarjeta de crédito Capital One Venture X: manual

Solicitar esta tarjeta de crédito es sencillo y puedes hacerlo lo antes posible. Además, ¡esta tarjeta ofrece un sistema de precalificación en línea!

¿Quieres saber más? ¡Explora el plan que hemos preparado para guiarte a través del proceso!

Solicite la tarjeta de crédito Capital One Venture X

¡Puedes solicitar la tarjeta de crédito Capital One Venture X sin salir de casa! ¡Completa un formulario virtual rápidamente!

Sobre el autor / Pedro Saynovich

Tendencias

Cómo usar los cursos para obtener una ventaja competitiva en su carrera

Impulse su carrera con cursos competitivos que llenan las brechas de habilidades y brindan un impacto inmediato para el crecimiento a largo plazo.

Continúe Leyendo

Cómo generar crédito mediante un préstamo y fortalecer su salud financiera

Aprenda cómo un préstamo para crear crédito puede ayudarle a establecer hábitos financieros sólidos y mejorar su puntaje crediticio con pasos prácticos y opciones de préstamos inteligentes.

Continúe LeyendoTambién te puede interesar

Cómo elegir un curso que se adapte a tu trayectoria profesional

Elija la trayectoria profesional adecuada con objetivos claros, planes personalizados y tutoría para impulsar el crecimiento y el éxito profesional a largo plazo.

Continúe Leyendo

OpenSky Plus Secured: su puerta de entrada a un mejor crédito, sin comisiones

Fortalezca su historial crediticio con la tarjeta OpenSky Plus Secured Visa®, que no tiene verificación de crédito y no tiene tarifas anuales.

Continúe Leyendo