Tarjeta de crédito

Solicite la tarjeta US Bank Altitude® Go Visa Signature®: ¡bonificaciones!

Discover the advantages of applying for the US Bank Altitude Go Visa Signature Card. Embrace eco-friendly practices and secure a $15 streaming service credit for endless entertainment options!

Anuncios

Serás redirigido a otro sitio

Anuncio

Start off strong with bonus points that boost your rewards from day one

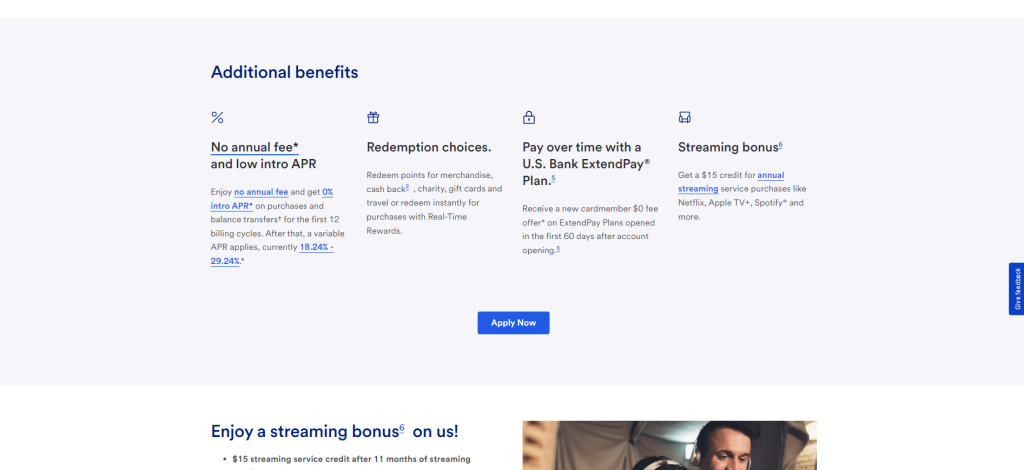

When you apply for the US Bank Altitude® Go Visa Signature® Card, you’re going on a rewarding path that gives back on what you spend the most on, like dining (in and out) and streaming.

The lack of annual and foreign transactions makes this card a cheap option to keep and take with you on your travels. Also, it being made of recycled plastic helps reduce waste, which is another plus.

The alluring welcome bonus is another incredible perk. Spend as usual, reach the minimal threshold, and pocket 20,000 points to redeem whichever way you want – be it money or gifts.

However, there’s a small condition: you need a solid credit rating to qualify. But if that’s your case, then you’re halfway set! Read on to learn how simple and fast it is to apply for this card.

What makes US Bank Altitude® Go Visa Signature® Card stand out

When you apply for the US Bank Altitude® Go Visa Signature® Card, you can enjoy a generous welcome bonus – and the best part is that it is easy to get.

Moreover, rewards flow in quickly with this card, especially on dining, streaming, and your daily spending, turning every transaction you make into an opportunity for points.

The card keeps annual fees away, spotlighting its value. It caters to those who love savings alongside premium benefits. Also, you can take it abroad with 0 foreign fees as well.

Plus, you’ll enjoy 12 months of 0% APR on purchases and balance transfers! It sets a solid foundation for managing your expenses efficiently.

Anuncio

Application Options for the US Bank Altitude® Go Visa Signature® Card

Whether you’re looking for a pocket-friendly credit card or points on daily buys, this card has it all.

Further, check out how to apply for the US Bank Altitude® Go Visa Signature® Card!

Cómo presentar la solicitud en línea

- Verify Your Credit Score: Ensure your credit history aligns with the card’s requirements. A good to excellent score increases your chances of approval, giving a smooth application process.

- Collect Required Documents: Organize necessary personal and financial documents, such as proof of income and employment status. Having these at hand simplifies the application.

- Access the US Bank Application Portal: Visit the US Bank website, navigate to the credit card section, and select the Altitude Go Visa. This directs you to the application form.

- Complete the Application Form: Fill in your details carefully on the application form. Providing accurate and comprehensive information is crucial for a successful application.

- Submit Your Application and Await Decision: After reviewing your application for accuracy, submit it. The approval process may give you an immediate decision based on your provided details.

Anuncio

Cómo presentar la solicitud personalmente en una sucursal bancaria

- Prepare Your Documentation: Before heading to the branch, gather all necessary documents, such as identification, proof of income, and any relevant financial statements.

- Visit Your Nearest US Bank Branch: Locate the nearest US Bank branch. A face-to-face meeting with a bank representative can provide personalized advice and answers about the card.

- Consult with a Bank Representative: Once at the branch, speak about your interest in the Altitude Go Visa Card. They can offer insights and guide you through the application.

- Complete the Application with Assistance: The bank representative will help you fill out the application form. This is an excellent opportunity to ensure all information is accurate with professional guidance.

- Submit Your Application and Discuss Next Steps: After submitting your application at the branch, the representative will inform you about the processing time and how you will be notified about the decision.

Would you like to learn about other options? Here’s the Bank of America® Unlimited Cash Rewards Credit Card

If you’re not sure if you want to apply for the US Bank Altitude® Go Visa Signature® Card, let’s check another option with the Bank of America® Unlimited Cash Rewards Credit Card.

This card dishes out 1.5% back on every purchase, with no exclusions. Also, it has a zero annual fee policy. It’s a wallet-friendly companion that keeps rewarding you for every dollar spent.

What’s more, newcomers are greeted with an enticing introductory APR offer for a 15-month period. It’s a gentle nudge towards managing finances more freely in the initial months.

Are you intrigued by the idea of a simpler reward structure? Then find out if the Bank of America® Unlimited Cash Rewards Credit Card is the best option below!

Apply for Bank of America® Unlimited Cash Rewards

Embrace limitless earning potential and no annual fees when you apply for the Bank of America® Unlimited Cash Rewards Card!

Tendencias

Reseña de Dashlane: proteja sus contraseñas

En este artículo, descubra Dashlane, un administrador de contraseñas robusto con llenado automático y monitoreo de seguridad en tiempo real.

Continúe Leyendo

Reseña de Indeed: consejos, funciones y conocimientos

Explore Indeed, un potente motor de búsqueda de empleo que no solo conecta a quienes buscan trabajo con oportunidades, sino que también proporciona recursos para ambos.

Continúe LeyendoTambién te puede interesar

Reseña de Bitdefender: cómo mejorar su defensa digital

Proteja su mundo digital con Bitdefender. Defensa avanzada, interfaz intuitiva. ¡Elija su protección hoy!

Continúe Leyendo

Las 5 mejores aplicaciones para buscar empleo

Estas plataformas digitales han revolucionado la forma en que exploramos y solicitamos empleo, poniendo un mundo de oportunidades a nuestro alcance.

Continúe Leyendo

Reseña de Freelancer: plataforma para oportunidades de trabajo independiente

Descubre Freelancer, una plataforma dinámica que conecta a freelancers y clientes de todo el mundo. ¡Explora funcionalidades, ventajas y comparaciones!

Continúe Leyendo