Tarjeta de crédito

Solicitar actualización a Triple Cash Rewards Visa®: Pagos fijos

Con la tarjeta Upgrade Triple Cash Rewards Visa®, no solo obtiene una tarjeta, sino un socio de gastos, que ofrece amplia aceptación y pagos predecibles para ayudar a optimizar sus finanzas y presupuesto de manera efectiva.

Anuncios

Serás redirigido a otro sitio

¡Planifique su presupuesto de manera efectiva con pagos mensuales predecibles en compras grandes!

Obtener una tarjeta confiable que combine límites de crédito altos, recompensas y sin cargo anual puede parecer imposible. Pero cuando solicita la Upgrade Triple Cash Rewards Visa®, sabe que es real.

Se trata de una tarjeta que ofrece una flexibilidad y una comodidad inigualables. Podrás realizar compras importantes y devolverlas como si fuera un préstamo, con cuotas mensuales fijas que se adaptan a tu presupuesto.

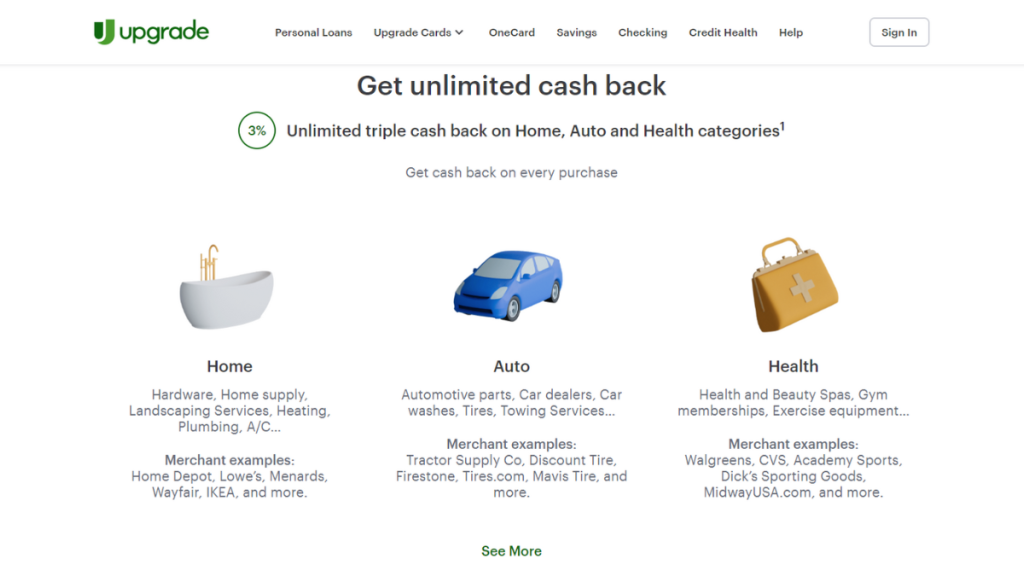

No solo eso, sino que las compras esenciales para tu hogar, auto o salud te recompensan con 3% de reembolso. Cualquier otra compra te brinda un reembolso de 1%, lo que hace que cada vez que pases la tarjeta sea una oportunidad para ganar más.

Descubra cómo la tarjeta Upgrade Triple Cash Rewards Visa® puede cambiar sus finanzas al solicitarla. ¡Siga leyendo para conocer todo el proceso y cómo solicitar la suya fácilmente!

¿Qué hace que Upgrade Triple Cash Rewards Visa® se destaque?

Cuando solicita la Upgrade Triple Cash Rewards Visa®, está entrando a un nuevo nivel de gestión financiera. Sin cargos anuales y con recompensas generosas, es una tarjeta que lo ayuda a evolucionar.

Al igual que un préstamo, la tarjeta Upgrade Triple Cash Rewards Visa® puede brindarle un límite de hasta $25,000 y puede pagar sus compras más importantes en cuotas mensuales fijas e iguales. Es flexibilidad a su alcance.

Además, si compras artículos para tu hogar, salud y vehículo, obtendrás automáticamente 3% de devolución. Todas las demás compras te darán una devolución de 1%. Por lo tanto, no importa lo que compres, siempre habrá una recompensa.

Por último, la sólida seguridad de la tarjeta y su amplia aceptación significan que puedes llevarla a cualquier parte del mundo y tener tranquilidad con cada transacción. No es solo una tarjeta, es un aliado financiero.

Opciones de solicitud para la actualización de la tarjeta Visa® Triple Cash Rewards

Si bien la tarjeta Upgrade Triple Cash Rewards Visa® ofrece una increíble aplicación móvil para la gestión de la cuenta, solo puede solicitarla en línea. ¡Pero el sitio web es compatible con dispositivos móviles para su comodidad!

Cómo presentar la solicitud en línea

- Visita el sitio web oficial: comienza navegando al sitio web de Upgrade. Busca la sección “Tarjetas de crédito” y selecciona Upgrade Triple Cash Rewards Visa®.

- Proceso de precalificación: Participe en el proceso de precalificación, que implica una verificación suave de su crédito para que no se vea afectado. Este paso le dará una idea de su elegibilidad.

- Complete el formulario: complete el formulario de solicitud detallado con su información personal, financiera y laboral. Asegúrese de que la información sea precisa para evitar demoras en el proceso de aprobación.

- Revisar y enviar: antes de enviar, revise toda la información ingresada para comprobar que sea correcta. Una vez que esté satisfecho, envíe su solicitud para continuar con la evaluación crediticia.

- Esperar aprobación: después de enviar el formulario, espera una respuesta de Upgrade. Es posible que te aprueben de inmediato o, en algunos casos, es posible que debas proporcionar información adicional.

- Reciba su tarjeta: Una vez aprobada, le enviaremos por correo su tarjeta Upgrade Triple Cash Rewards Visa®. Siga las instrucciones de activación incluidas para comenzar a usar su tarjeta.

¿Quieres conocer otras opciones? Aquí tienes la Tarjeta de Crédito Avant

Si está indeciso sobre si solicitar o no la tarjeta Upgrade Triple Cash Rewards Visa®, o si todavía necesita mejorar su puntaje para obtenerla, tenemos otra recomendación.

La tarjeta de crédito Avant es conocida por sus requisitos crediticios flexibles y su sencillo proceso de solicitud. Además, ofrece una vía práctica para generar crédito, con revisiones automáticas para los aumentos del límite de crédito.

Además, con su estructura de tarifas transparente y ausencia de cargos ocultos, la tarjeta de crédito Avant se destaca como una herramienta financiera sencilla y fácil de usar para el uso diario.

¿Le intrigan las ofertas de la tarjeta de crédito Avant? Descubra cómo puede ser una alternativa sólida a la tarjeta Upgrade Triple Cash Rewards Visa®. Obtenga más información en el siguiente enlace.

Solicitar tarjeta de crédito Avant

Desde las verificaciones de elegibilidad hasta el envío de la solicitud real, ¡descubra el proceso simple para solicitar la tarjeta de crédito Avant en línea!

Tendencias

Reseña de la tarjeta Citi® Diamond Preferred®: disfrute de la tasa anual introductoria (APR) 0%

Continúe Leyendo

Qué considerar antes de solicitar un préstamo hipotecario: pasos y reglas clave

Aprenda los pasos clave para elegir el préstamo hipotecario adecuado, desde la elaboración del presupuesto hasta la comparación de condiciones, para una experiencia de compra de vivienda sin problemas.

Continúe LeyendoTambién te puede interesar

American Express Blue Cash Everyday®: recompensas sin cargo anual

Descubra la tarjeta American Express Blue Cash Everyday®: obtenga un reembolso de 3% en artículos básicos sin cargo anual. Perfecta para ahorrar todos los días.

Continúe Leyendo

Solicite la tarjeta Bank of America® Unlimited Cash Rewards: devolución de efectivo

Continúe Leyendo

First Progress Prestige Mastercard®: creación de crédito + devolución de efectivo

Con una tasa de interés anual (APR) baja, un reembolso de efectivo del 1% en pagos y sin verificación de puntaje crediticio, ¡la First Progress Prestige Mastercard® es una opción inteligente!

Continúe Leyendo