Tarjeta de crédito

Solicita la tarjeta Mastercard® Platinum de Reflex®: aumenta el límite de crédito

Solicitar la tarjeta Reflex® Platinum Mastercard® le abre las puertas a compras y viajes en todo el mundo, respaldados por características de seguridad que protegen cada transacción para una experiencia de gasto más segura.

Anuncios

Serás redirigido a otro sitio

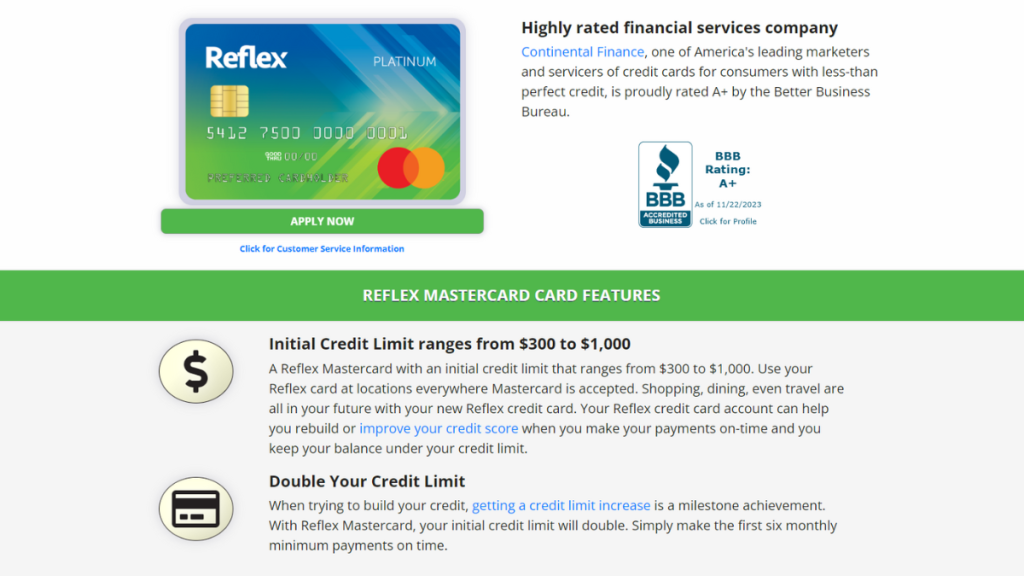

Experimente flexibilidad financiera con límites de crédito duplicados después de solo seis pagos

¿Tiene problemas de crédito y sueña con empezar de nuevo? ¡Solicite la tarjeta Mastercard® Platinum de Reflex® y obtenga su boleto dorado! Esta tarjeta inclusiva está disponible para todos los niveles de crédito.

Con esta tarjeta, podrá recibir informes crediticios mensuales y disfrutar de un límite de crédito respetable. Estas características son perfectas para ayudarlo a mejorar su situación financiera.

Sin embargo, asegúrese de prestar atención a las tarifas, que incluyen un cargo anual y mensual. A pesar de ellas, las ventajas de la tarjeta, como la aceptación global y las características de seguridad, son sólidas.

¿Está ansioso por mejorar su historial crediticio y obtener la libertad financiera que se merece? Descubra lo fácil que es solicitarlo explorando nuestra guía completa a continuación. ¡Comience hoy mismo su camino hacia un mejor historial crediticio!

¿Qué hace que Reflex® Platinum Mastercard® se destaque?

Comenzar su camino hacia la recuperación financiera con la tarjeta Reflex® Platinum Mastercard® hace que todo parezca más alcanzable. Con un enfoque en la creación o reconstrucción de crédito, es una opción sólida para muchos.

Una de las características más atractivas de la tarjeta es la posibilidad de aumentar el límite. Esto significa que si pagas bien, obtendrás una mayor flexibilidad financiera.

Además, la aplicación móvil de la tarjeta de crédito Reflex® simplifica la gestión de la cuenta. Esta herramienta le permite acceder fácilmente a los detalles de su cuenta, todo desde la palma de su mano.

Por último, las medidas de protección y la accesibilidad de la tarjeta la convierten en una opción destacada. Está diseñada para ayudarte a gestionar tus finanzas con confianza, acercándote un paso más a tus objetivos.

Opciones de solicitud para la tarjeta Reflex® Platinum Mastercard®

Ya sea que desee mejorar su salud financiera o simplemente esté buscando un mayor límite de gasto, vea a continuación cómo solicitar la Reflex® Platinum Mastercard® en solo unos pocos y sencillos pasos.

Cómo presentar la solicitud en línea

- Visita el sitio web de Reflex: Visita el sitio web oficial para comenzar tu solicitud. Encontrarás un formulario sencillo listo para que ingreses tus datos, lo que te garantizará un inicio sin problemas.

- Complete el formulario: proporcione información esencial, como su nombre completo, dirección, número de seguro social y datos de ingresos. Este paso es crucial para evaluar su elegibilidad.

- Revise su información: verifique que los datos que ingresó sean correctos. Los errores pueden demorar el procesamiento, así que tómese un momento para asegurarse de que todo esté correcto y actualizado.

- Envíe su solicitud: una vez que esté seguro de su solicitud, envíela. El proceso de aprobación es rápido y, por lo general, le brindamos una respuesta instantánea sobre su estado.

- Espere su tarjeta: si se aprueba, le enviaremos por correo su tarjeta Mastercard® Platinum Reflex®. Se incluirán las instrucciones de activación, lo que lo encaminará a generar un mejor crédito.

Cómo presentar la solicitud por teléfono

- Prepare su información: antes de llamar, reúna los detalles necesarios como su número de seguro social, información de ingresos e identificación personal para un proceso sin problemas.

- Realice la llamada: marque el número de atención al cliente dedicado a solicitudes al 1-888-673-4755. Un agente lo guiará a través del proceso de solicitud.

- Proporcione sus datos: proporcione al agente su información personal y financiera con claridad, tal como se le solicita. Hable despacio y con claridad para evitar malentendidos.

- Confirmar los detalles de la solicitud: el agente puede resumir la información proporcionada para su confirmación. Escuche atentamente y corrija cualquier inexactitud de inmediato.

- Esperar aprobación: una vez que su solicitud esté completa, el agente le informará sobre los próximos pasos, incluido el tiempo que llevará recibir una decisión.

- Seguimiento si es necesario: si no recibe una respuesta dentro del plazo esperado, llame al servicio de atención al cliente nuevamente para obtener una actualización sobre el estado de su solicitud.

¿Quieres conocer otras opciones? Aquí tienes la tarjeta de crédito Visa® de Mission Lane

Si desea solicitar la tarjeta Reflex® Platinum Mastercard®, la tarjeta de crédito Mission Lane Visa® también podría llamar su atención como una alternativa igualmente atractiva.

La tarjeta Visa® de Mission Lane ofrece una manera clara de aumentar su límite de crédito con el tiempo si la utiliza adecuadamente. Además, ¡no es necesario realizar un depósito! Es perfecta para quienes buscan aumentar su puntaje crediticio fácilmente.

Con su aplicación de primera categoría, la tarjeta Visa® de Mission Lane facilita la verificación de saldos y el seguimiento de gastos. Es una herramienta sólida para cualquier persona que se esfuerce por cuidar su salud financiera.

¿Está interesado en una tarjeta de crédito que lo lleve adonde quiere ir? ¡La Visa® de Mission Lane podría ser la indicada! Haga clic en el enlace a continuación para obtener más información y ver si se adapta a sus necesidades.

Solicite la tarjeta de crédito Visa® de Mission Lane

Desde tasas de interés anuales (APR) bajas hasta un proceso de solicitud sin complicaciones, solicite la tarjeta de crédito Mission Lane Visa® y mejore su crédito con confianza.

Tendencias

Cómo equilibrar trabajo y estudio al tomar cursos orientados a la carrera profesional

Aprenda a equilibrar el trabajo y el estudio de manera efectiva con estrategias para establecer rutinas, priorizar tareas y mantener la motivación.

Continúe Leyendo

Las 5 mejores aplicaciones para buscar empleo

Estas plataformas digitales han revolucionado la forma en que exploramos y solicitamos empleo, poniendo un mundo de oportunidades a nuestro alcance.

Continúe LeyendoTambién te puede interesar

Venmo: ¡La forma divertida y conveniente de dividir facturas y compartir gastos!

Embárcate en un viaje hacia una gestión de dinero más inteligente y transacciones sin complicaciones. ¡Prepárate para experimentar la facilidad de Venmo!

Continúe Leyendo

Las mejores aplicaciones de presupuestos: descárgalas y gestiona tus finanzas

¿Quieres organizar tus finanzas de forma eficiente? Lee el artículo para descubrir las mejores aplicaciones de presupuesto para gestionar tu vida financiera.

Continúe Leyendo