Tarjeta de crédito

Solicite la tarjeta de crédito Chase Freedom Unlimited®: acceso instantáneo

Deja que cada compra te resulte más productiva. Solicita la tarjeta de crédito Chase Freedom Unlimited® y comienza a disfrutar de los beneficios de no tener cuota anual y de una protección integral contra fraudes para gastar sin preocupaciones.

Anuncios

Serás redirigido a otro sitio

Obtenga poder adquisitivo inmediato con acceso rápido a la tarjeta digital después de la aprobación

Mantener su puntaje de crédito en buen estado vale la pena, y eso queda muy claro cuando solicita la tarjeta de crédito Chase Freedom Unlimited®, una candidata digna para ser una de las mejores tarjetas con devolución de efectivo.

La lista de ventajas de la tarjeta es bastante impresionante y es aún mejor por la falta de cargos anuales. Además, los recién llegados reciben una bonificación de $200 más reembolsos aumentados y una TAE introductoria baja.

Además, la estructura de recompensas de Freedom Unlimited® no requiere ningún tipo de seguimiento. Deslizas la tarjeta y ganas, y eso puede significar 1,5%, 3% o 5% de vuelta, según lo que hayas comprado y dónde.

¿Suena demasiado bueno para ser verdad? Descubre cómo todo esto podría convertirse en realidad cuando solicites la tarjeta de crédito Chase Freedom Unlimited® y sigue leyendo para saber exactamente cómo hacerlo.

¿Qué hace que la tarjeta de crédito Chase Freedom Unlimited® se destaque?

En primer lugar, la tarjeta de crédito Freedom Unlimited® se destaca de muchas maneras diferentes. Por ejemplo, con esta tarjeta, tienes la posibilidad de ganar dinero con cada uso, ya sea por un café o por un televisor nuevo.

Una vez que solicite y obtenga la tarjeta de crédito Chase Freedom Unlimited®, podrá dejar de pensar en las tasas de interés durante 15 meses en nuevas compras y transferencias de saldos.

Además, los recién llegados obtienen incentivos adicionales como un bono de $200 y más descuentos en gasolina y comestibles, lo que hace que el paquete de introducción sea difícil de resistir, y todo esto con cero cargos anuales.

Además de las recompensas, los miembros cuentan con protección y seguro integral, canje de recompensas flexibles e incluso programas de recomendación que suman hasta $$500 en reembolsos en efectivo al año.

Opciones de solicitud para la tarjeta de crédito Chase Freedom Unlimited®

Si bien la tarjeta de crédito Chase Freedom Unlimited® se puede gestionar a través de la aplicación móvil, solo se puede solicitar en línea o visitando una sucursal. Analicemos ambos procesos para que pueda obtener su tarjeta.

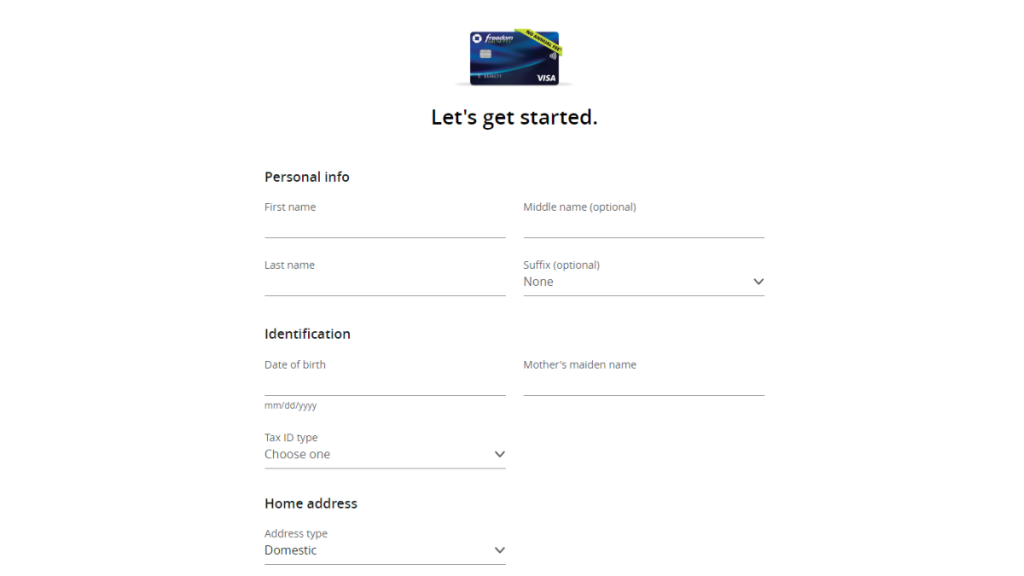

Cómo presentar la solicitud en línea

- Comience el proceso: visite el sitio web de Chase. Busque la tarjeta de crédito Freedom Unlimited® en la sección “Tarjetas de crédito” para comenzar su aventura de solicitud.

- Conozca más sobre usted: Complete el formulario de solicitud. Proporcione datos personales como su nombre, dirección, ingresos y número de seguro social para ayudar a Chase a conocerlo.

- Historias financieras: comparta su situación laboral y sus ingresos anuales. Esta información ofrece una visión de su salud financiera y garantiza que Chase comprenda su historia.

- Comprobación de seguridad: ingrese su número de seguro social y fecha de nacimiento. Estos datos cruciales agregan una capa de seguridad y confirman su identidad en el vasto mundo digital.

- Revise y acepte: revise atentamente los términos y condiciones. Acepte los aspectos legales de su nueva herramienta financiera entendiendo el acuerdo entre usted y Chase.

- Envíe su solicitud a Destiny: presione el botón “Enviar”. Con un solo clic, enviará su solicitud al mundo digital, donde será revisada por los representantes financieros de Chase.

- Espere el veredicto: espere la aprobación. Chase evaluará su solicitud, un proceso que puede tardar unos minutos o unos días, y que dará lugar a una decisión comunicada por correo electrónico o correo postal.

Cómo presentar la solicitud personalmente en una sucursal bancaria

- Visita tu sucursal local de Chase: comienza por buscar y visitar la sucursal de Chase más cercana. Es una forma sencilla de presentar una solicitud y recibir asistencia personalizada.

- Habla con un representante del banco: una vez allí, pide hablar con un representante sobre cómo solicitar la tarjeta de crédito Chase Freedom Unlimited®. Te guiarán a través del proceso.

- Proporcionar la información necesaria: El representante le pedirá información personal y financiera, incluido su nombre, dirección, ingresos y número de seguro social, para completar la solicitud.

- Verifique su identidad: Deberá presentar una forma válida de identificación, como una licencia de conducir o un pasaporte, para verificar su identidad como parte del proceso de solicitud.

- Revise la solicitud: revise los detalles de la solicitud con el representante para asegurarse de que toda la información sea correcta y completa.

- Presentar la solicitud: El representante del banco presentará la solicitud por usted. Usted ya hizo su parte; ahora le toca al banco procesarla.

- Espere la aprobación: después de enviar su solicitud, deberá esperar a que el banco la revise. Chase le notificará su decisión por correo postal o electrónico.

¿Quieres conocer otras opciones? Aquí tienes la tarjeta de crédito Chase Freedom Flex®

Digamos que no está completamente seguro de si solicitar o no la tarjeta de crédito Chase Freedom Unlimited®, pero desea una opción similar y realmente no le importa realizar un seguimiento de su categoría de recompensas.

Entonces, tal vez la tarjeta Chase Freedom Flex® le resulte igual de útil. Sus características son básicamente las mismas que las de su compañera Freedom Unlimited®, pero puede ganar más en categorías de bonificación.

Por lo tanto, si normalmente gastas más en comestibles, streaming, etc., ganarás más en esos segmentos con esta tarjeta una vez que actives tus recompensas. Además, tampoco hay tarifa anual.

¿Quiere saber más sobre la alternativa Freedom Flex®? Entonces, consulte el siguiente enlace para saber cómo puede disfrutar al máximo de una serie de increíbles beneficios y, al mismo tiempo, obtener valiosas recompensas.

Solicite la tarjeta de crédito Chase Freedom Flex®

Solicite la tarjeta de crédito Chase Freedom Flex® y disfrute de reembolsos en gastos diarios como gasolina y comestibles.

Tendencias

Ink Business Cash®: obtenga grandes reembolsos en efectivo con beneficios comerciales esenciales

Descubra estrategias de gasto más inteligentes con Ink Business Cash®. ¡Obtenga hasta $5% de reembolso en compras seleccionadas, todo sin cargo anual!

Continúe LeyendoTambién te puede interesar

Puestos vacantes en Amazon: Empieza con más de $18 por hora y más beneficios

Explora empleos en Amazon desde $18/hora. ¡Puestos de nivel inicial con beneficios y oportunidades reales de crecimiento profesional en EE. UU.!

Continúe Leyendo