Credit Card

Discover it® Chrome: Earn Cashback on Gas and Dining

Get 2% cashback on gas and dining with the Discover it® Chrome Card, no annual fee, and a first-year Cashback Match to double your rewards!

Advertisement

A credit card tailored for everyday savings

The Discover it® Chrome Gas & Restaurant Credit Card is a top-tier option for those who prioritize everyday spending, particularly on gas and dining.

With 2% cashback at gas stations and restaurants and no annual fee, this card provides excellent value for people who love simplicity and rewards that truly fit their lifestyle.

- Credit Score: Good to Excellent

- Annual Fee: $0

- Purchase APR: Variable, ranging from 18.74% to 27.74%, after an introductory 0% APR period for 15 months

- Cash Advance APR: 29,74%

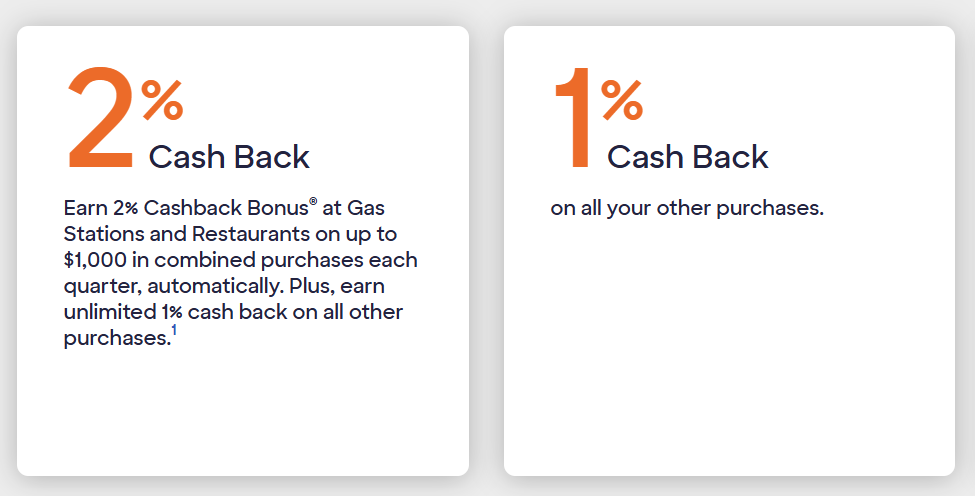

- Rewards: Earn 2% back on dining and fuel purchases, with an unlimited 1% cashback on everything else you buy

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Discover it® Chrome: Overview

The Discover it® Chrome is designed to simplify rewards while maximizing value in two essential spending categories: gas and dining.

Whether you’re a frequent commuter or someone who enjoys dining out often, this card delivers impressive benefits without the complexities often associated with premium credit cards.

Here’s what sets this card apart:

Cashback Rewards Structure

- Earn 2% cashback at gas stations and restaurants, making it ideal for those with frequent travel or dining-out habits.

- The quarterly cap of $1,000 in combined purchases ensures consistent rewards while promoting budgeting discipline.

- Beyond the cap, you’ll still earn 1% unlimited cashback on all other purchases, keeping things simple and transparent.

Introductory Offer

- Take advantage of a 0% APR for the first 15 months on both purchases and balance transfers.

- After the introductory period, the APR transitions to a variable rate of 18.74% to 27.74%.

Cashback Match

- New cardholders can enjoy Discover’s unique Cashback Match, doubling all rewards earned in the first year.

- After your first year, Discover will double every dollar of cashback you’ve earned, no limits or restrictions.

No Annual Fee

Additional Benefits

- Free FICO® Score Monitoring: Stay on top of your credit with free updates through the Discover app or online account portal.

- Freeze It® Feature: Instantly lock your card if misplaced, preventing unauthorized transactions.

- No Foreign Transaction Fees: Perfect for international travelers who want to avoid extra charges on overseas purchases.

Analyzing the advantages and drawbacks of the Discover it® Chrome

Before committing to any credit card, it’s essential to weigh the pros and cons carefully.

Pros of the Discover it® Chrome

The Discover it® Chrome Gas & Restaurant Credit Card offers several standout benefits that make it appealing for many consumers:

- Generous Rewards Program: Cashback on gas and dining caters directly to popular spending categories, delivering consistent value.

- Cashback Match Program: New users can effectively earn double rewards in their first year, maximizing the card’s earning potential.

- No Annual Fee: Keep more of your cashback rewards with no recurring fees to offset your earnings.

- Flexible Introductory APR: A 0% APR for 15 months provides breathing room for large purchases or balance transfers.

- Travel-Friendly Features: No foreign transaction fees make this card a smart companion for international travel.

- Robust Security Features: Instant card freezing and $0 liability for unauthorized purchases enhance peace of mind.

Cons of the Discover it® Chrome

Despite its strengths, this card may not be the best fit for everyone:

- Quarterly Cap on 2% Rewards: While the 2% cashback rate is generous, the $1,000 quarterly limit on combined purchases in gas and dining categories could feel restrictive for heavy spenders.

- Limited High-Reward Categories: Unlike some competitors, the Discover it® Chrome focuses on just two bonus categories, which may not suit those with more diverse spending habits.

- Credit Score Requirement: Applicants with less-than-excellent credit may face challenges qualifying for the card.

Applying for the card

Signing up for the Discover it® Chrome is simple and hassle-free from start to finish.

1. Visit Discover’s Website: Go to Discover’s official site and locate the application page for the Discover it® Chrome.

2. Check Prequalification: Check your eligibility with the prequalification tool, which won’t impact your credit score.

3. Submit Your Application: Fill out the online form with your personal information, including income and Social Security number.

4. Wait for Approval: Most applicants receive an approval decision in just a few minutes.

Eligibility Requirements

To qualify for the Discover it® Chrome Gas & Restaurant Credit Card, applicants must meet the following criteria:

- Credit Score: A solid credit history, typically with a score of 670 or higher, is recommended for approval.

- Income: Proof of sufficient income to cover credit obligations.

- U.S. Residency: Must be a U.S. citizen or permanent resident with a valid Social Security number.

Learn about other options: Here’s the American Express Blue Cash Everyday® Card

For those seeking broader rewards categories, the American Express Blue Cash Everyday® Card offers a compelling alternative to the Discover it® Chrome Gas & Restaurant Credit Card.

The Blue Cash Everyday® Card provides 3% cashback on groceries, gas, and online retail purchases, up to $6,000 per year in each category, along with 1% cashback on other purchases.

This card includes a 15-month 0% intro APR offer and has no annual fee to worry about.

This makes it particularly attractive for families or frequent online shoppers looking to maximize rewards on a wider range of spending categories.

However, it’s worth noting that the American Express card includes foreign transaction fees, which may be a disadvantage for those who frequently travel internationally—a feature where the Discover it® Chrome shines with no foreign transaction fees.

Ultimately, both cards offer excellent rewards and benefits tailored to different spending habits. Choose the one that best aligns with your lifestyle to maximize your cashback potential!

American Express Blue Cash Everyday®

Earn 3% cashback on essentials with no annual fee. Perfect for everyday savings!

Trending Topics

Freelancer Review: Platform for Freelance Opportunities

Discover Freelancer, a dynamic platform connecting freelancers and clients worldwide. Explore functionalities, advantages, and comparisons!

Keep ReadingYou may also like

Why Certifications Matter and How to Choose One for Your Career

Learn how to choose the right career certification with practical steps, market demand, and strategies for long-term career success.

Keep Reading

Best Budgeting Apps: Download and Manage Your Finances

Do you want to efficiently organize your finances? Read the article to discover the best budget apps to manage your financial life.

Keep Reading