Credit Card

Delta SkyMiles® Gold: Elevate Your Travel with Tailored Rewards

See how the Delta SkyMiles® Gold Card rewards everyday spending and enhances your travel with Delta benefits.

Advertisement

Enhance every aspect of your travels with exclusive perks!

Designed for frequent flyers, the Delta SkyMiles® Gold Card pairs enhanced travel benefits with everyday rewards to elevate both your trips and daily purchases.

With perks like priority boarding and in-flight savings, it’s a must-have for Delta loyalists seeking value!

- Credit Score Requirement: A solid rating of 670-850 is necessary to get this card

- Annual Fee: Start with no charge in the first year, then transition to an annual fee of $150, offering substantial value for frequent travelers.

- Purchase APR: Variable rate between 20.24% and 29.24%

- Cash Advance APR: Expect a variable rate currently set at 29.74%, subject to change

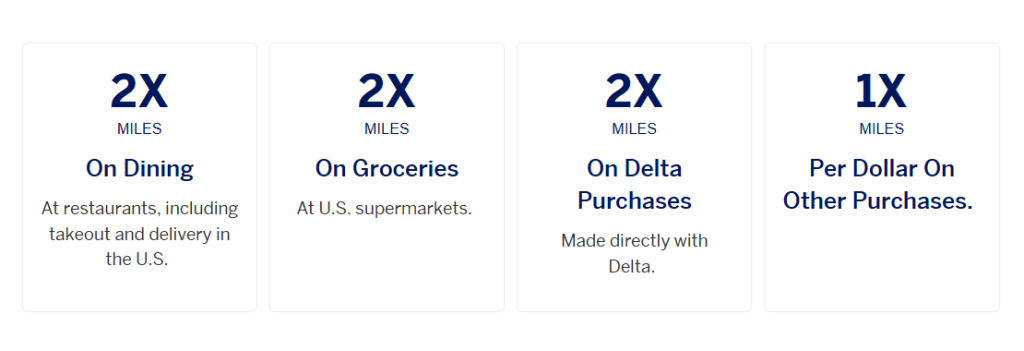

- Rewards:

- Earn 2 miles per dollar on qualifying Delta transactions, including flights and onboard purchases

- Enjoy 2 miles per dollar spent on dining globally, including takeout and delivery within the United States

- Receive 2 miles for every dollar spent shopping at U.S. grocery stores

- Gain 1 mile per dollar for all other eligible spending categories

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Delta SkyMiles® Gold: An in-depth review

Frequent Delta flyers will find the Delta SkyMiles® Gold Card perfectly suited for earning miles both in the air and through routine spending.

This card provides a straightforward rewards structure, allowing cardholders to earn miles on a variety of purchases, which can be redeemed for flights, seat upgrades, and more.

Who Is It For?

This card is ideal for travelers who:

- Regularly fly with Delta Air Lines: Frequent Delta flyers benefit from perks like free checked bags and priority boarding, saving both time and money.

- Want to earn miles on daily spending: Cardholders can accumulate miles on everyday purchases such as groceries, dining, and travel expenses, making it easy to earn rewards.

- Seek travel-related perks without a high annual fee: The introductory $0 annual fee for the first year and competitive $150 fee thereafter make this card accessible for budget-conscious.

Why Is It Special?

What makes the Delta SkyMiles® Gold Card truly exceptional is its array of benefits:

- First Checked Bag Free: Cardholders and up to eight companions on the same reservation can check their first bag for free on Delta flights, potentially saving dozens of dollars per round-trip per person.

- Priority Boarding: Enjoy Main Cabin 1 Priority Boarding, allowing you to settle in sooner and find space for your carry-on.

- $100 Delta Flight Credit: Reach $10,000 in annual spending and unlock a $100 Delta Flight Credit, perfect for offsetting future travel costs.

How SkyMiles work and how to maximize them

The Delta SkyMiles® program allows you to earn miles through purchases and use them toward travel expenses.

Your miles remain active indefinitely, allowing flexibility to redeem them when convenient.

How to Earn Miles:

- Book Delta flights: Earn additional miles on tickets booked through Delta.

- Everyday spending: Use your card for groceries, dining, and everyday purchases to steadily grow your balance.

Maximizing Your Miles:

- Use miles for Delta flights or with SkyTeam partners, optimizing their value.

- Plan in advance for award travel, as flights may require fewer miles when booked early.

- Look for Delta’s “Flash Sales” on award travel, which offer discounted mileage prices on select routes.

By leveraging these strategies, you can extract maximum value from your SkyMiles, stretching their utility beyond just flights.

Analyzing the advantages and drawbacks

Before deciding if this card aligns with your financial goals, it’s essential to weigh its pros and cons.

Pros

- Generous Rewards on Dining and Groceries: Earn 2 miles per dollar at restaurants worldwide and U.S. supermarkets, making it easy to accumulate miles through everyday spending.

- Exclusive Perks: Enjoy free checked luggage and priority boarding, designed to streamline your journey and save money.

- Travel Internationally: Avoid extra charges on purchases made overseas with no foreign transaction fees.

- Introductory Annual Fee Waiver: Enjoy the first year without an annual fee, allowing you to experience the card’s benefits before committing to the $150 fee in subsequent years.

Cons

- Limited Airline Focus: The card’s perks are primarily beneficial for those who frequently fly with Delta, offering less value to travelers who prefer other airlines.

- Annual Fee After First Year: While the first year is fee-free, the $150 annual fee applies thereafter, which may not be justifiable for infrequent Delta flyers.

- Variable APR: With a purchase APR ranging from 20.24% to 29.24%, carrying a balance can lead to significant interest charges.

Applying for the card

If you believe this card aligns with your travel and spending habits, here’s how to apply:

- Visit the Official Website: Head to the Amex website to start your Delta SkyMiles® Gold Card application process.

- Review the Card Details: Familiarize yourself with the card’s terms, benefits, and fees to ensure it meets your needs.

- Complete the Application: Submit your details through the online form, providing the necessary personal and financial information to apply.

- Submit and Await Decision: After submission, you’ll receive an approval decision, often within minutes.

Eligibility Requirements

Eligibility for the this credit card requires meeting specific criteria, including:

- Credit Requirements: Applicants should have a credit score in the good to excellent range, usually 670-850.

- Age Requirement: You need to be at least 18 years old to apply.

- Residency: Applicants must be U.S. citizens or permanent residents with a valid SSN.

- Income: A steady income source to support credit obligations.

Explore alternative options from Amex

While the Delta SkyMiles® Gold American Express Card offers valuable benefits for Delta enthusiasts, those seeking a broader range of travel perks might consider the American Express Platinum Card®.

This premium card offers exceptional travel rewards, including lounge access, airline credits, and elevated points on flights.

For those seeking top-tier travel perks across multiple airlines, the American Express Platinum Card® is a compelling alternative to consider.

American Express Platinum Card®

A luxurious card with exclusive benefits that will provide you with the best experiences wherever you are.

Trending Topics

Citi Simplicity® Card: Zero Fees and Ultimate Flexibility

Discover the Citi Simplicity® Credit Card: zero annual fees, no late fees, and up to 21 months of 0% APR. Enjoy unmatched flexibility!

Keep ReadingYou may also like

First Progress Prestige Mastercard®: Credit Building + Cash Back

With a low APR, 1% cash back on payments, and no credit score check, the First Progress Prestige Mastercard® is a smart choice!

Keep Reading

Ibotta App: Complete Review for Smart Savings

Unlock the world of smart savings with Ibotta app. Explore unique features and advantages, and make shopping a rewarding adventure.

Keep Reading