Kreditkarte

Revvi Card-Test: Eine Visa®-Karte zum Aufbau von Kreditwürdigkeit!

Die Revvi Card ist eine Visa®-Option zum Aufbau von Krediten auf Ihre Art. Diese Karte ist auf Personen mit unterschiedlicher Kredithistorie zugeschnitten und bietet Zugriff auf eine benutzerfreundliche mobile App und praktische Funktionen.

Werbung

Sie werden auf eine andere Website weitergeleitet

Freuen Sie sich über monatliche Kreditauskunfteien, Cashback-Prämien und einfache Einlöseoptionen!

Möchten Sie Kredite aufnehmen und Ihre Bewertung verbessern, ohne auf Prämien verzichten zu müssen? Dann sehen Sie sich die Funktionen der Revvi Card an und erfahren Sie, wie diese Kreditkarte dazu beitragen kann, den Kreditzugang neu zu definieren.

Beantragen Sie die Revvi-Karte: Zugänglicher Kredit!

Übernehmen Sie die Kontrolle über Ihre Finanzen und greifen Sie mit der Revvi Card auf wertvolle Kreditressourcen zu. Genießen Sie eine Visa®-Kreditkartenoption, unabhängig von Ihrer Kredithistorie

Obwohl diese Karte auf Personen mit nicht ganz perfekter Bonität ausgerichtet ist, ist keine Kaution erforderlich. Außerdem können Sie eine Visa-Karte verwenden.® Karte und genießen Sie Zugänglichkeit und Komfort mit einer Karte.

- Kredit-Score: Für die Genehmigung ist keine perfekte Kredithistorie erforderlich.

- Jahresgebühr: Im ersten Nutzungsjahr müssen Sie eine Gebühr von $75 bezahlen. Danach beträgt der Betrag nur noch $48 pro Jahr.

- Kauf-APR: Der Wert liegt bei 35,99%.

- Effektiver Jahreszins für Barvorschüsse: Also 35.99%.

- Belohnungen: Die Revvi Card ist eine Prämieninitiative, die Benutzern 1% Cashback auf ihre Zahlungen gewährt. Außerdem können Sie Ihre Prämien ganz einfach über die benutzerfreundliche Revvi-App verfolgen und einlösen.

Revvi-Karte: Übersicht

Obwohl die Revvi Card eine wertvolle Ergänzung Ihres Finanzinstrumentariums sein kann, sollten Sie ihre Funktionen prüfen und verstehen, um die richtige Wahl für Ihr Profil zu treffen.

Wenn Sie die Revvi-Karte in Betracht ziehen, können Sie eine Kreditlösung für Personen mit unterschiedlichem Kredithintergrund erwarten. Außerdem ist der Antragsprozess schnell und Sie können innerhalb von Sekunden eine Antwort erhalten.

Nach der Genehmigung fällt jedoch nur eine Programmgebühr von $95 an. Außerdem fällt eine Jahresgebühr von $75 für das erste Jahr an. Danach verringert sich diese Gebühr jährlich auf $48.

Zusätzlich fallen jeden Monat $8,25 an. Diese monatliche Servicegebühr entfällt im ersten Jahr. Obwohl dies eine gute Möglichkeit ist, Kredite aufzubauen, gibt es andere Karten mit niedrigeren Gebühren.

Wenn Sie beim Aufbau Ihres Kredits nach Belohnungen suchen, erhalten Sie mit der Revvi Card 1% Cashback auf Zahlungen. Durch die Bereitstellung regelmäßiger Berichte an Kreditauskunfteien können Sie Ihre Kreditwürdigkeit verbessern.

Analyse der Vor- und Nachteile der Revvi Card

Wie bei jeder anderen Kreditkarte sollten Sie die Vor- und Nachteile prüfen, um sicherzugehen, dass die Revvi Visa® Card ist die richtige Option für Ihr Finanzprofil. Lesen Sie also weiter und erfahren Sie mehr!

Pro

- Visum® Kreditkartenlösung, die auf Personen mit unterschiedlicher Kredithistorie zugeschnitten ist;

- Cashback-Prämien;

- Hilft Benutzern beim Erstellen oder Verbessern ihres Kreditprofils;

- Die mobile App bietet ein nahtloses und intuitives Erlebnis;

- Reaktionsschneller und hilfreicher Kundensupport.

Nachteile

- Mit der Karte fallen erhebliche Gebühren an;

- Hat einen erhöhten effektiven Jahreszins;

- Der Einlöseprozess für Prämien ist restriktiv.

Berechtigungsvoraussetzungen für die Revvi-Karte

Obwohl die Revvi Card auch von Benutzern mit nicht ganz perfekter Kreditwürdigkeit akzeptiert wird, sollten Sie vor der Beantragung bestimmte Zulassungskriterien prüfen. Erstens müssen Sie mindestens 18 Jahre alt sein.

Darüber hinaus müssen Sie über eine gültige Sozialversicherungsnummer und ein Girokonto auf Ihren Namen verfügen, da für Zahlungen und Transaktionen mit der Revvi-Karte ein verknüpftes Konto erforderlich ist.

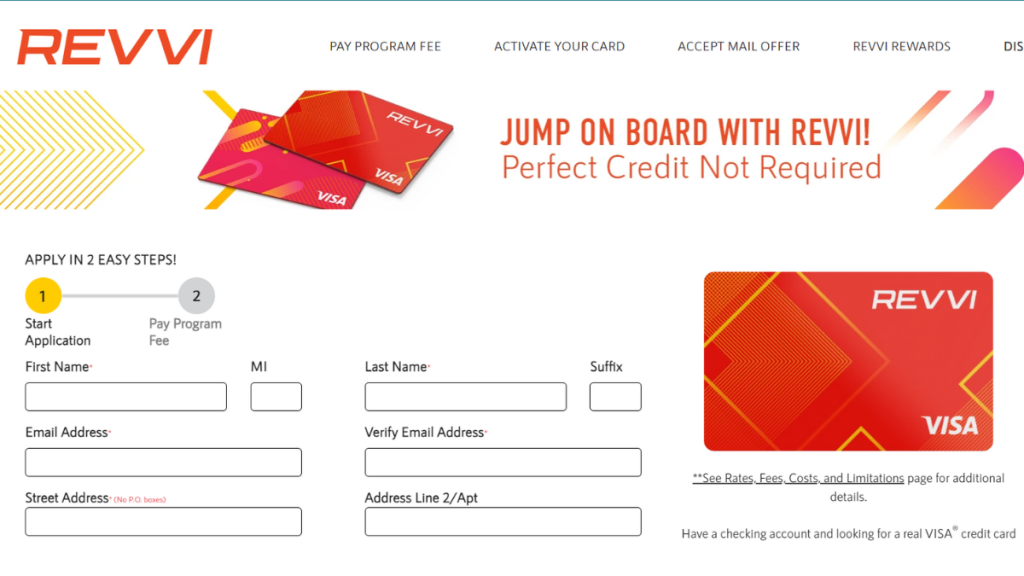

Beantragung der Revvi-Karte: eine Anleitung

Möchten Sie also Ihr eigenes Visum erhalten?® Kreditkarte? Dann lesen Sie einfach die einfache Schritt-für-Schritt-Anleitung, um zu erfahren, wie Sie die Revvi-Karte beantragen. Wie bereits erwähnt, ist der Vorgang schnell und online!

Das bedeutet, dass Sie in nur wenigen Minuten die Genehmigung für Ihre neue Kreditkarte erhalten können! Vom Besuch der offiziellen Website bis zum Ausfüllen des Formulars finden Sie unten eine einfache Anleitung zur Beantragung!

Beantragen Sie die Revvi-Karte: Zugänglicher Kredit!

Übernehmen Sie die Kontrolle über Ihre Finanzen und greifen Sie mit der Revvi Card auf wertvolle Kreditressourcen zu. Genießen Sie eine Visa®-Kreditkartenoption, unabhängig von Ihrer Kredithistorie

Trendthemen

EarnIn: Die freundliche Lösung für kleine Barvorschüsse

EarnIn ist eine innovative Lösung, die vielen Menschen bei der Bewältigung unerwarteter Ausgaben helfen kann. Erfahren Sie hier mehr über die App!

Weiterlesen

Fiverr-Rezension: Entfesseln Sie Ihr Potenzial als Freiberufler

Entdecken Sie Fiverr, Ihr Tor zum Erfolg als Freiberufler. Entdecken Sie einzigartige Funktionen und Vorteile, die Fiverr zu etwas Besonderem machen.

WeiterlesenDas könnte Ihnen auch gefallen

Ink Business Cash®: Verdienen Sie hohe Cashbacks mit wichtigen Geschäftsvorteilen

Setzen Sie mit Ink Business Cash® intelligentere Ausgabestrategien um. Erhalten Sie bis zu 51 TP3T Cashback auf ausgewählte Einkäufe – alles ohne Jahresgebühr!

Weiterlesen