Kreditkarte

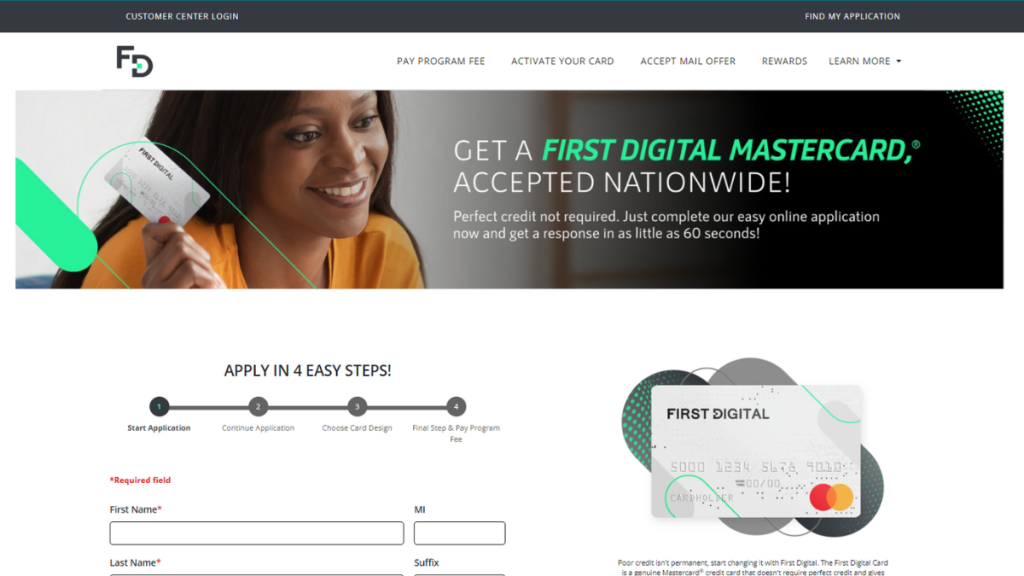

Erster Test der Digital Mastercard®: Steigern Sie Ihre Kreditwürdigkeit!

Mit der First Digital Mastercard® können Sie Ihre Kreditwürdigkeit verbessern. Diese echte Mastercard® wird landesweit akzeptiert und bietet Cashback auf alle Zahlungen. Beginnen Sie Ihren Weg zur Kreditwürdigkeitsverbesserung!

Werbung

Sie werden auf eine andere Website weitergeleitet

Erhalten Sie 1% Cashback, überschaubare Monatsraten und bauen Sie mit jedem Einkauf Kredit auf!

Wenn es um den Aufbau oder die Wiederherstellung Ihrer Kreditwürdigkeit geht, die erste digitale Mastercard® könnte eine gute Kreditkartenoption sein, die Sie sich ansehen sollten. Mit einigen überzeugenden Funktionen kann sie Ihnen helfen und gleichzeitig Prämien bieten.

Beantragen Sie die erste Digital Mastercard®

Mit der First Digital Mastercard® können Sie in wenigen Minuten online einen Antrag stellen! Entdecken Sie eine Kreditlösung, die alle Kredithistorien berücksichtigt!

Obwohl Karteninhaber Cashback auf Einkäufe erhalten können, ist die erste digitale Mastercard® erhebt im Laufe der Zeit einige Gebühren. Es ist daher eine gute Idee, die Funktionen zu verstehen, bevor Sie sich für eine Bewerbung entscheiden.

- Kredit-Score: Entwickelt, um Personen mit nicht ganz optimaler Kreditwürdigkeit entgegenzukommen und ihnen die Möglichkeit zu bieten, ihre Kreditwürdigkeit aufzubauen oder wiederherzustellen.

- Jahresgebühr: Neben einer Programmgebühr von $95 wird für diese Karte im ersten Jahr eine Jahresgebühr von $75 erhoben. Nach diesem Zeitraum beträgt die Jahresgebühr $48.

- Kauf-APR: 35.99%.

- Effektiver Jahreszins für Barvorschüsse: Ähnlich wie der effektive Jahreszins für Käufe beträgt der effektive Jahreszins für Barvorschüsse 35,991 TP3T.

- Belohnungen: Karteninhaber erhalten 1% Cashback auf alle Zahlungen, die auf ihr Konto geleistet werden. Sie erhalten am Ende jedes Abrechnungszeitraums Prämienpunkte.

Erste digitale Mastercard®: Übersicht

Im Gegensatz zu den meisten Kreditkarten, die First Digital Mastercard® erfordert keine Kaution, aber es ist wichtig, die Funktionen zu überprüfen, um sicherzustellen, dass es die richtige Option für Sie ist.

Erstens ist die Zugänglichkeit eines seiner herausragenden Merkmale, da für die Genehmigung keine perfekte Kreditwürdigkeit erforderlich ist.

Außerdem bietet es ein interessantes Prämienprogramm mit 1% Cashback auf alle Zahlungen, die auf Ihr Konto geleistet werden. Die Punkte können jedoch erst eingelöst werden, wenn Sie 500 Punkte erreicht haben.

Darüber hinaus werden die Daten der Karte monatlich an Kreditauskunfteien übermittelt. Diese Meldungen können sich positiv auf die Kreditwürdigkeit eines Benutzers auswirken, sofern dieser pünktlich zahlt.

Die First Digital Mastercard® wird von der Synovus Bank herausgegeben, einem renommierten Finanzinstitut mit Sitz in Columbus, GA, und bietet Benutzern Vertrauen bei ihren Finanztransaktionen!

Analyse der Vor- und Nachteile der ersten digitalen Mastercard®

Wie Sie in diesem Testbericht erfahren werden, die erste digitale Mastercard® bietet die Möglichkeit, einen erschwinglichen Kredit aufzubauen. Es ist jedoch wichtig, die Vor- und Nachteile abzuwägen, um eine fundierte Entscheidung treffen zu können.

Pro

- Erfordert für die Genehmigung keine perfekte Kreditwürdigkeit;

- Cashback auf alle Zahlungen zum Kontostand;

- Bequemer Bewerbungsprozess;

- Die Karte wirkt sich positiv auf die Kreditwürdigkeit der Benutzer aus.

- Karteninhaber können überschaubare monatliche Zahlungen leisten;

- Mobile App zur einfachen Kontoverwaltung.

Nachteile

- $95.00 Programmgebühr, die Sie bei Genehmigung zahlen müssen;

- Für diese Karte wird eine Jahresgebühr erhoben.

- Für die Einlösung von Prämienpunkten ist ein Minimum von 500 Punkten erforderlich.

- Aus Sicherheitsgründen ist die Nutzung der Karte an Tankautomaten nicht möglich.

Teilnahmevoraussetzungen für die erste digitale Mastercard®

Sind Sie also daran interessiert, diese Karte zu beantragen? Dann überprüfen Sie einige der Zulassungskriterien für die First Digital Mastercard®, die vom Herausgeber Synovus Bank festgelegt wurden.

Obwohl die Karte für eine Reihe von Kreditprofilen ausgelegt ist, müssen Einzelpersonen bestimmte gesetzliche Anforderungen erfüllen, einschließlich der Angabe der erforderlichen Identifikationsinformationen.

Hierzu können Angaben wie Name, Adresse, Geburtsdatum und weitere Informationen gehören, die der Bank eine angemessene Identifizierung des Antragstellers ermöglichen.

Beantragung der ersten digitalen Mastercard®: ein Handbuch

Wenn Sie nach dieser Überprüfung bereit sind, die erste digitale Mastercard zu beantragen®, freuen Sie sich auf einen unkomplizierten und bequemen Bewerbungsprozess! So erhalten Sie Ihre Antwort noch heute.

Schließlich können Sie mit vier einfachen Schritten und einer Antwortzeit von 60 Sekunden Ihre ganz persönliche erste digitale Mastercard erhalten® und beginnen Sie, Ihre Kreditwürdigkeit positiv zu beeinflussen. Entdecken Sie unten die Schritt-für-Schritt-Anleitung!

Beantragen Sie die erste Digital Mastercard®

Mit der First Digital Mastercard® können Sie in wenigen Minuten online einen Antrag stellen! Entdecken Sie eine Kreditlösung, die alle Kredithistorien berücksichtigt!

Trendthemen

Chase Sapphire Preferred-Kreditkarte: Premium-Reiseprämien

Entdecken Sie die Chase Sapphire Preferred-Kreditkarte: Reiseprämien, Restaurantvorteile und flexible Punkteeinlösung. Schalten Sie Premiumvorteile frei!

Weiterlesen

Wie man erschwingliche und qualitativ hochwertige Kurse zur beruflichen Weiterbildung findet

Finden Sie erschwingliche Weiterbildungskurse, die Ihnen praktische Fähigkeiten und Anwendungsbeispiele aus der realen Welt bieten, um Ihre Karriere voranzubringen, ohne Ihr Budget zu sprengen.

WeiterlesenDas könnte Ihnen auch gefallen

Bewertung der Costco Anywhere Visa® Card von Citi: Prämien in verschiedenen Kategorien für Costco-Mitglieder

Weiterlesen

Antrag für die Destiny Mastercard®: Wie bewerbe ich mich?

Öffnen Sie die Tür zu einer besseren Kreditwürdigkeit! Lesen Sie den Antragsleitfaden für die Destiny Mastercard® zum intelligenten Aufbau einer Kreditwürdigkeit.

Weiterlesen