Credit Card

Citi Simplicity® Card: Zero Fees and Ultimate Flexibility

The Citi Simplicity® Credit Card offers no annual fees, no late penalties, and up to 21 months of 0% intro APR.

Advertisement

A smart choice for saving money

The Citi Simplicity® Credit Card offers a no-annual-fee experience with a focus on transparency.

With a lengthy introductory APR for balance transfers and purchases, it’s designed to give users a break from high-interest charges.

The card eliminates common pain points by waiving late fees, penalty APRs, and annual fees, making it a standout choice for those seeking financial flexibility and peace of mind.

- Credit Score: Good or better

- Annual Fee: $0

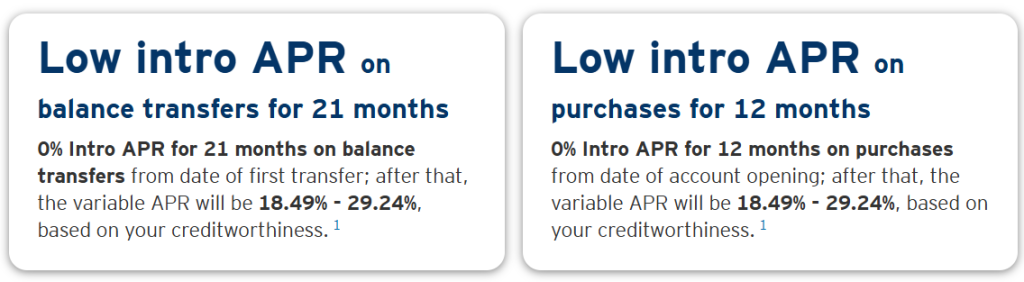

- 0% Introductory APR: 21 months for balance transfers and 12 months for purchases

- Purchase APR: Variable, ranging from 18.49% to 29.24% after the intro period

- Cash Advance APR: 29.74%

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Citi Simplicity®: Overview

The Citi Simplicity® Credit Card delivers on its promise of straightforward benefits and ease of use. Here’s how it stands out:

- User-Friendly Policies: Designed to reduce stress, this card simplifies credit card management with transparent terms and no hidden surprises.

- Long 0% APR Periods: It offers one of the market’s most extended interest-free periods—21 months on balance transfers and 12 months on purchases—ideal for debt consolidation or large expenses.

- No Late Payment Penalties: Forgetting a payment date doesn’t result in late fees or higher interest rates, making it one of the most forgiving options available.

- Balance Transfer Benefits: Despite a 5% or $5 transfer fee, the extended interest-free period can result in significant savings for those transferring high-interest balances.

- No Annual Fee: The card is low-maintenance and cost-effective, as there’s no annual fee to worry about, allowing you to focus on your financial goals.

These features make the Citi Simplicity® Credit Card an excellent choice for individuals seeking relief from high-interest debts, better payment flexibility, and a cost-effective financial tool.

Analyzing the advantages and drawbacks of the Citi Simplicity® Credit Card

The Citi Simplicity® Credit Card has several advantages that cater to specific financial needs, but it’s essential to weigh these against its limitations.

Pros

The Citi Simplicity® Credit Card provides significant perks, especially for individuals focused on saving money and avoiding unnecessary fees.

- No Annual Fee: A $0 annual fee ensures you’re not burdened with extra costs just to hold the card.

- Extended Introductory APR Periods: With 21 months of 0% APR on balance transfers and 12 months on purchases, the card offers one of the longest intro APR periods in the industry.

- No Late Fees or Penalty APR: Flexibility in managing payments is a standout feature. Forgetting a payment doesn’t result in penalties, which is rare in the credit card world.

- Straightforward Terms: With no rewards program or complicated structures, this card is easy to understand and use.

- Debt Consolidation Benefits: Ideal for paying down balances from higher-interest cards without incurring additional interest for nearly two years.

Cons

While the Citi Simplicity® Credit Card excels in many areas, it may not be the right fit for everyone.

- Balance Transfer Fee: The $5 or 5% fee for each transfer may outweigh the savings for smaller balances.

- Lack of Rewards Program: This card does not include cashback, points, or travel rewards, focusing instead on fee savings and interest-free periods.

- High Post-Intro APR: Once the introductory period ends, the variable APR can climb as high as 29.24% for purchases, which is steep for some users.

- Limited Long-Term Value: The card’s main appeal lies in its introductory offers, so it may lack benefits for those who don’t need balance transfers or interest-free financing.

- Not Ideal for Everyday Spenders: Without rewards, frequent users may find more value in cashback or travel-focused cards.

Applying for the credit card

The application process for the Citi Simplicity® Credit Card is quick and easy. Citi allows prospective cardholders to apply online with minimal effort.

Follow the next steps to apply:

- Visit the Credit Card’s Official Page: Navigate to the official Citi website to access the card’s application page.

- Check Prequalification: Citi offers a prequalification tool that lets you see your chances of approval without affecting your credit score.

- Complete the Application Form: Provide accurate personal details, including your income, employment status, and address. This information helps Citi evaluate your eligibility.

- Submit Your Application: After filling out the form, submit your application. Citi typically responds with an approval decision within minutes, though some cases may take longer.

- Activate Your Card Upon Approval: Once approved, activate your Citi Simplicity® Credit Card through the Citi website or mobile app and start using it immediately.

Eligibility Requirements

Before submitting your application, make sure you fulfill the necessary eligibility requirements.

- Credit Score: Typically, approval is more likely with a credit score of 670 or above.

- Age Requirement: You must be at least 18 years old to apply.

- Income: Proof of stable income sufficient to manage credit card payments is required.

- Residency: Applicants need to reside in the U.S. and possess a valid Social Security number.

Learn about other options: Petal® 1 Credit Card

The Citi Simplicity® Credit Card is a top choice for anyone seeking financial relief through extended interest-free periods and forgiving fee policies.

Its focus on transparency makes it particularly attractive for users consolidating debt or needing flexibility with payments.

But while the Citi Simplicity® Credit Card is excellent for minimizing fees and managing debt, it might not meet the needs of everyone.

For those with limited credit histories or looking for a rewards program, the Petal® 1 Credit Card is a strong alternative.

The Petal® 1 Credit Card is known for its user-friendly and inclusive approach.

It’s designed for individuals with fair credit or no credit history, offering a unique opportunity to build credit responsibly.

With no annual fees and the chance to earn cashback on purchases, it appeals to a different audience.

For users focused on rewards or building credit from scratch, the Petal® 1 Credit Card provides a competitive option.

Take a look at the next article to learn more about the Petal® 1 Card before making your decision!

Petal® 1: Reliable Credit

See how you can build a solid credit foundation while earning cash back and taking advantage of no annual fees.

Trending Topics

Why Certifications Matter and How to Choose One for Your Career

Learn how to choose the right career certification with practical steps, market demand, and strategies for long-term career success.

Keep Reading

Restaurant and Fast Food Jobs: Starting Salaries from $28,000/Yr

Discover Restaurant and Fast Food jobs with hourly wages starting at $10 and plenty of room to grow your career!

Keep Reading

How to Balance Work and Study When Taking Career Focused Courses

Learn to balance work and study effectively with strategies for setting routines, prioritizing tasks, and maintaining motivation.

Keep ReadingYou may also like

First Progress Prestige Mastercard®: Credit Building + Cash Back

With a low APR, 1% cash back on payments, and no credit score check, the First Progress Prestige Mastercard® is a smart choice!

Keep Reading