Credit Card

Chase Slate Edge® Credit Card Review: Simplify Your Finances!

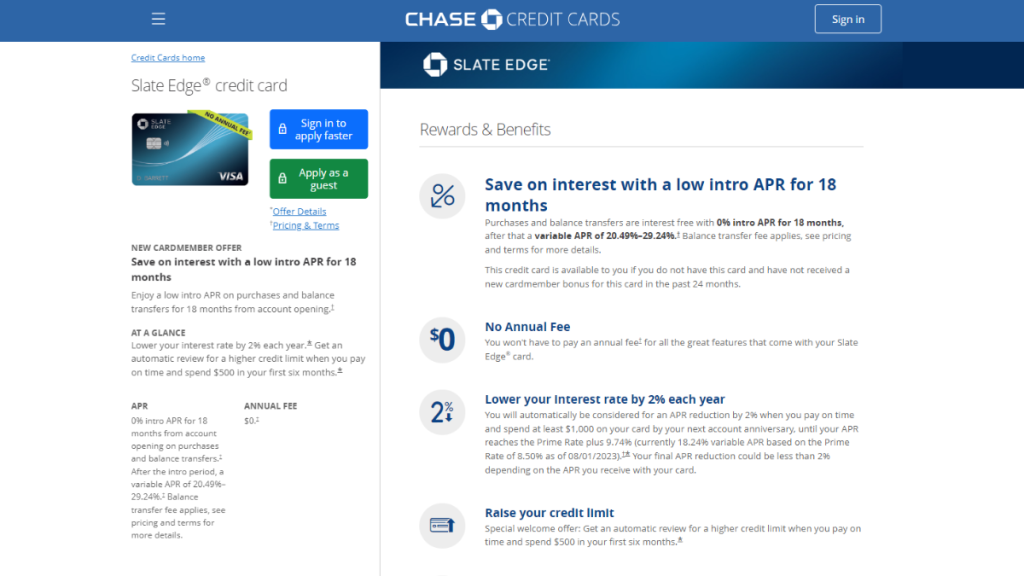

The Chase Slate Edge® Credit Card offers automatic credit limit increases and potential APR reductions for responsible use. Get ready to maximize your financial potential and enjoy a long period of 0% APR.

Advertisement

Get ahead financially and benefit from potential APR reduction for responsible card usage!

While rewards can add value to a credit card, having 0% APR helps people save big by transferring their debt. So, this Chase Slate Edge® Credit Card review is for you.

Apply for Chase Slate Edge® Credit Card

Show you’re a responsible cardholder and get increased credit lines and lower APR when you apply for Chase Slate Edge® Credit Card!

With a long period of zero interest rates, this credit card is ideal if you need to make balance transfers or even want to make a major purchase. Explore the card’s specifics and learn more!

- Credit Score: Although individual approval criteria may vary, it usually requires good to excellent credit.

- Annual Fee: Zero.

- Purchase APR: During the initial 18 months, you can enjoy an introductory interest rate of 0%. But after that, it ranges from 20.49% to 29.24%.

- Cash Advance APR: An average interest rate of 29.99% is applicable for any unexpected cash needs you might encounter.

- Rewards: Since it focuses on financial management, this card doesn’t have any traditional rewards.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Chase Slate Edge® Credit Card: Overview

With Chase Slate Edge® Credit Card, you’ll discover a financial instrument crafted to facilitate efficient credit management. Got a debt mistake piling up interest rates?

This card offers an extended period of zero interest on both purchases and balance transfers. This means you have a generous window to consolidate existing balances or make new purchases.

Additionally, you get automatic credit line increases. But only after spending $500. Plus, you need to do so in the first six months and make all payments on time, demonstrating reliability.

Moreover, by consistently making on-time payments and spending at least $1,000 on your card, you get the opportunity to lower your interest rate over time. This rewards responsible behavior!

Finally, beyond these features, the Chase Slate Edge® Credit Card emphasizes simplicity by charging zero annual fees. Overall, this is a valuable tool to manage credit wisely.

Analyzing the advantages and drawbacks of the Chase Slate Edge® Credit Card

While the Chase Slate Edge® Credit Card doesn’t offer common rewards, there are other benefits to review if you want to apply. Then you can be sure this is the right card for you.

Pros

- 0% on interest rates for a period of time;

- No annual charges;

- Enhance your credit line automatically;

- Reduce your interest charges over time;

- Convenience and security of contactless payment.

Cons

- No traditional rewards or cashback incentives;

- Balance transfers become variable after the initial period;

- Charges a fee for using the card abroad;

- Lack some of the premium perks.

Eligibility Requirements for the Chase Slate Edge® Credit Card

Considering applying for the Chase Slate Edge® Credit Card after reading this review? Then it’s important to keep track of its eligibility criteria to make sure you fit the profile.

Firstly, a strong credit history with a demonstrated record of responsible credit management is generally necessary for approval. Additionally, applicants must meet other criteria.

For example, you must be a U.S. citizen or resident, and be at least 18 years old. Plus having a valid Social Security number is required. But, meeting the requirements doesn’t guarantee approval.

Applying for the Chase Slate Edge® Credit Card: a manual

If you feel ready to get the Chase Slate Edge®, first you need to check the official website. Then, access the online form. But, if you prefer to apply in person, you can go to a bank branch.

Got some questions about the application process? Don’t worry! Explore a comprehensive guide and swiftly grasp the process to apply for the Chase Slate Edge® Credit Card!

Apply for Chase Slate Edge® Credit Card

Show you’re a responsible cardholder and get increased credit lines and lower APR when you apply for Chase Slate Edge® Credit Card!

Trending Topics

Construction Jobs: Start Your Career with Salaries from $17/hour

Explore construction jobs in the U.S.: Stable careers from $17/hour and growth opportunities in a booming industry.

Keep Reading

Chase Sapphire Preferred Credit Card: Premium Travel Rewards

Explore the Chase Sapphire Preferred Credit Card: travel rewards, dining perks, and flexible point redemption. Unlock premium benefits!

Keep Reading

Discover it® Chrome: Earn Cashback on Gas and Dining

Discover the benefits of the Discover it® Chrome Gas & Restaurant Credit Card, offering 2% cashback on gas and dining with no annual fee!

Keep ReadingYou may also like

Why Understanding Loan Terms and Interest Rates Helps You Plan Better

Master loan terms interest with actionable tips to compare offers, avoid hidden fees, and manage payments for smarter financial decisions.

Keep Reading

Ibotta App: Complete Review for Smart Savings

Unlock the world of smart savings with Ibotta app. Explore unique features and advantages, and make shopping a rewarding adventure.

Keep Reading