Credit Card

Chase Freedom Unlimited® Credit Card Review: Earn Effortlessly

Every swipe is a rewarding opportunity with the Chase Freedom Unlimited® Credit Card. From cash back to travel benefits, learn how this comprehensive financial solution can be a game-changer in your wallet.

Advertisement

Unlock seamless rewards on daily expenses with unmatched ease

A card that combines convenience and rewards with the incentive of no annual fees is hard to find. But when you review the Chase Freedom Unlimited® Credit Card, you learn it’s possible.

Apply for Chase Freedom Unlimited® Credit Card

Make every transaction count when you apply for Chase Freedom Unlimited® Credit Card. Benefit from no annual fee and fraud protection.

Undoubtedly one of the most accomplished cards in its segment, the Freedom Unlimited® has everything. Once you learn how it all plays out, you won’t want another card in your wallet.

- Credit Score: Ideal for those with Good to Excellent scores, aiming for a smooth approval process.

- Annual Fee: $0, making it a cost-effective choice for savvy cardholders.

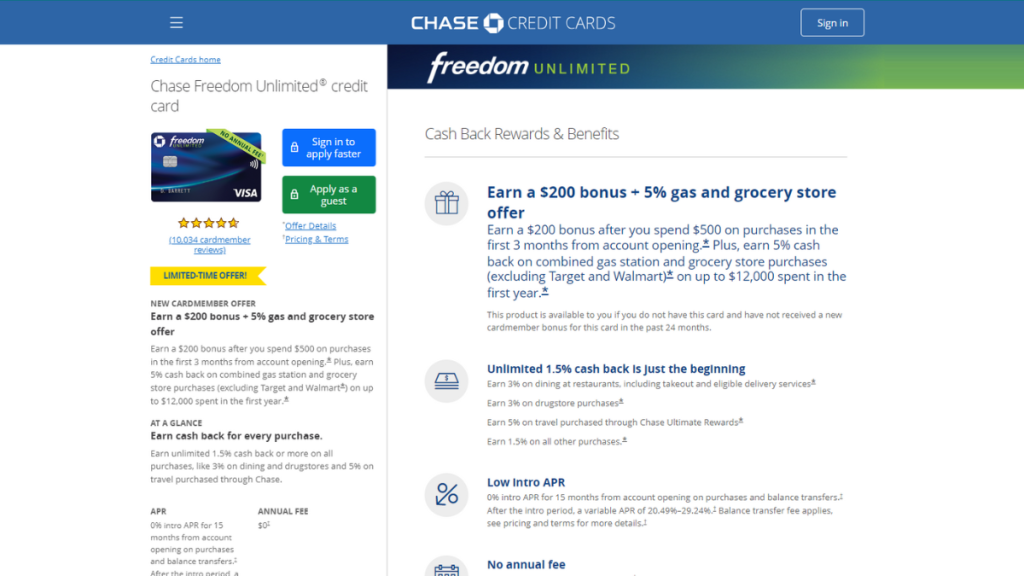

- Purchase APR: For the first 15 months from opening the account, new members have the opportunity to enjoy a zero percent APR on new purchases and balance transfers (terms apply). After that it transitions to a competitive variable between 20.49% and 29.24%;

- Cash Advance APR: 29.99% variable, reflecting the convenience of immediate cash access.

- Rewards: A robust rewards program that includes cash back on every purchase, with enhanced rates on travel, dining, and more, going between 1.5% and 5%, and ensuring your spending always earns something extra.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Chase Freedom Unlimited® Credit Card: Overview

Once you review every feature attached to the Chase Freedom Unlimited® Credit Card, you understand why it’s such a big name in the market. It’s inexpensive to own and very rewarding.

Getting this credit card means you’ll earn right off the bat with an easy-to-get welcome bonus worth $200, plus enhanced rebates. Moreover, every swipe brings money back up to 5% on travel.

Evidently, the higher caps are attached to Chase’s internal rewards programs, but you can still earn up to 3% when you dine out or in, and everything else you enjoy buying gives back 1.5%.

For those looking for a financial breather, a quick review of the Chase Freedom Unlimited® Credit Card low intro APR should be determinant. Once the account is open, you have 15 months to enjoy it.

Lastly, the lack of annual fees, extensive security and insurance coverage, and the ability to use a digital card right after it is approved are the cherry on top of an already outstanding card.

Analyzing the advantages and drawbacks of the Chase Freedom Unlimited® Credit Card

Even though you’ll find an incredible set of advantages when you review the Chase Freedom Unlimited® Credit Card, knowing the potential pitfalls are paramount.

Learn more about both below!

Pros

- Keep more money in your pocket without worrying about yearly charges.

- Enjoy over a year of interest-free purchases and balance transfers.

- Earn on every purchase, with extra value in select categories.

- Digital access to your card means instant spending power!

- Benefit from fraud monitoring and purchase insurance at all times for peace of mind.

- Travel insurance adds a layer of comfort on future adventures.

- Flexibility to redeem your rewards, with no minimums for maximum enjoyment.

Cons

- Higher APR on cash advances signals costly cash borrowing.

- International buys come with a 3% fee, dampening travel spending.

- Bonus cash back has its limits; not all spending is equal.

- Earning more means hitting a cap in some categories.

- Not everywhere accepts digital, checking your initial tech-savvy spend.

- Protection perks have their ceilings, guarding up to a point.

Eligibility Requirements for the Chase Freedom Unlimited® Credit Card

As you might have anticipated while reading this Chase Freedom Unlimited® Credit Card review, all of these benefits are not available to everyone, meaning you need at least a 690 rating.

What’s more, many other requirements come into play. For instance, being a legal adult and having a solid income are factored in your application. Having an US address and valid IDs are imperative.

Additionally, meeting all of these requirements still does not guarantee you’ll pocket a Freedom Unlimited®. However, they certainly increase your chances of approval.

Applying for the Chase Freedom Unlimited® Credit Card: a manual

So if you believe that you meet all the qualifying criteria after this review of the Chase Freedom Unlimited® Credit Card, why not take the next step? And with our guidance, the process is easier.

Whereas the online application is the easier route, there is another way to secure your Freedom Unlimited®. Explore the following link to learn how both procedures work step-by-step.

Apply for Chase Freedom Unlimited® Credit Card

Make every transaction count when you apply for Chase Freedom Unlimited® Credit Card. Benefit from no annual fee and fraud protection.

Trending Topics

Venmo: The Fun and Convenient Way to Split Bills and Share Expenses!

Embark on a journey toward smarter money management and hassle-free transactions. Get ready to experience the ease of Venmo!

Keep Reading

Delta SkyMiles® Gold: Elevate Your Travel with Tailored Rewards

Learn about the Delta SkyMiles® Gold Card's perks, like free checked bags and travel rewards for Delta flyers.

Keep Reading

The Best Courses for a Smooth Career Transition: Standout Paths for Success

Discover actionable strategies and the best career transition courses to help you smoothly switch careers and achieve long-term growth.

Keep ReadingYou may also like

Indeed Review: Tips, Features, and Insights

Explore Indeed, a powerhouse job search engine that not only connects job seekers with opportunities but also provides resources for both

Keep Reading

The Best Strategies for Paying Off Loans Faster Without Sacrificing Your Lifestyle

Learn proven strategies to pay off loans faster, from setting achievable goals to using windfalls and budgeting, for financial freedom.

Keep Reading