Credit Card

Chase Freedom Flex® Credit Card Review: Focus on Rewards!

From cashback on groceries and gas to no annual fee, that’s just a glimpse of what the Chase Freedom Flex® Credit Card can bring to the table! Get access to range of benefits and maximize your daily spending!

Advertisement

Discover the power of cashback, introductory bonus and travel perks all in one credit card!

When you look for a rewards-focused credit card, it’s common to expect high fees and APR. And that’s why you should review the Chase Freedom Flex® Credit Card and its features.

Apply for Chase Freedom Flex® Credit Card

Apply for Chase Freedom Flex® Credit Card and enjoy reimbursements on daily spending such as gas and groceries.

Although the rewards program might be a bit complicated, this card offers a wide range of benefits with no annual fees attached! Once you understand how it works, you’ll want to apply right away!

- Credit Score: A credit score of 670 or higher is recommended.

- Annual Fee: Zero.

- Purchase APR: If you’re a new cardholder, for the first 15 months you can enjoy waived APR. But afterwards, it ranges from 20.49% to 29.24%.

- Cash Advance APR: 29.99%.

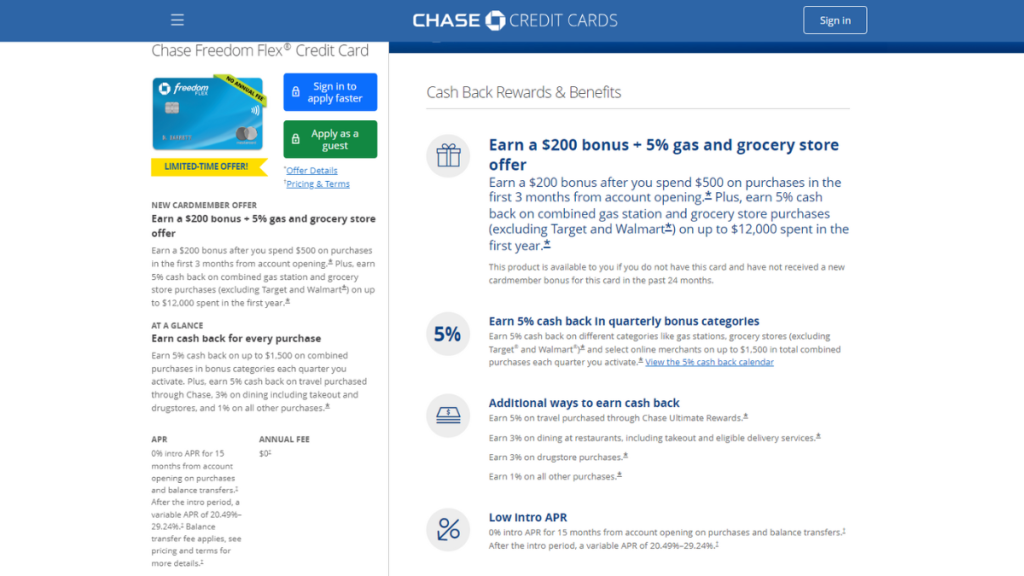

- Rewards: If you’ve just opened your account, by spending $500 in the first 3 months you get a bonus of $200. Besides, this card offers a rotating rewards program that gives 5% back on combined purchases, but you need to activate it. Moreover, you get that same amount of rebate on groceries, gas and even travel. The latter must be purchased through Chase’s very own rewards program. Finally, you also get 3% and 1% cash back on drugstore and other purchases respectively.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Chase Freedom Flex® Credit Card: Overview

Once you review and understand the rewards program of the Chase Freedom Flex® Credit Card, it’s hard to get your mind off this financial tool. After all, the amount of cashback is quite compelling!

With this card, you’ll get a substantial welcome bonus with a minimum spending threshold, and rewards rates ranging from 1% to 5% cash back as mentioned before.

Moreover, you get an introductory APR of 0%. However, after the introductory period, a variable APR will apply. And depending on your creditworthiness, it might be quite high.

While there’s no annual fee, there are still associated fees such as a balance transfer fee and foreign transaction fees, which can impact the overall cost of using the card.

In summary, the Chase Freedom Flex® Card provides a comprehensive rewards program. As with any credit card, there are fees to consider, but its benefits make this card an attractive option.

Analyzing the advantages and drawbacks of the Chase Freedom Flex® Credit Card

Although the Chase Freedom Flex® Credit Card offers enticing benefits, it’s also important to review and weigh possible drawbacks in order to manage the card responsibly. Check out below!

Pros

- New cardholders can earn a generous bonus

- No need to worry about recurring costs

- Ongoing and rotating cash back rewards

- Travel-related perks

- Various redemption options

Cons

- Forgetting to activate rewards can result in missed rewards opportunities

- Cashback on rotating categories is limited

- Charges overseas transaction fees

- Limited travel benefits

Eligibility Requirements for the Chase Freedom Flex® Credit Card

As you can expect after reading this review, the Chase Freedom Flex® Credit Card requires an excellent credit score for approval. So, if your score is lower than 670, you might not be eligible.

Additionally, as with many other credit cards, applicants must be at least 18 years old and have a valid Social Security number. The bank may also consider other factors for approval.

For example, your income, employment status and existing credit accounts. Meeting these eligibility requirements increases the likelihood of approval for this card.

Applying for the Chase Freedom Flex® Credit Card: a manual

So, are you ready to enjoy all those benefits and start maximizing your daily spending? Then it’s time to review a complete guide to learn how to apply for the Chase Freedom Flex® Credit Card.

Although the online application is easier and straightforward, applicants can also go to a Chase branch to apply in person. Check out below and find out how the process works in both cases!

Apply for Chase Freedom Flex® Credit Card

Apply for Chase Freedom Flex® Credit Card and enjoy reimbursements on daily spending such as gas and groceries.

Trending Topics

How to Choose a Loan That Matches Your Financial Goals

Learn how to choose loan goals that fit your financial priorities with tips on loan types, repayment strategies, and long-term success.

Keep ReadingYou may also like

How to Make the Most of Free Online Courses for Skill Development

Maximize free online courses by setting clear goals, building consistent study habits, and applying skills for real-world career growth.

Keep Reading

How to Manage Loan Repayments and Avoid Debt

Learn how to manage loan repayments effectively with budgeting, reminders, and strategies to stay motivated for financial stability.

Keep Reading