Credit Card

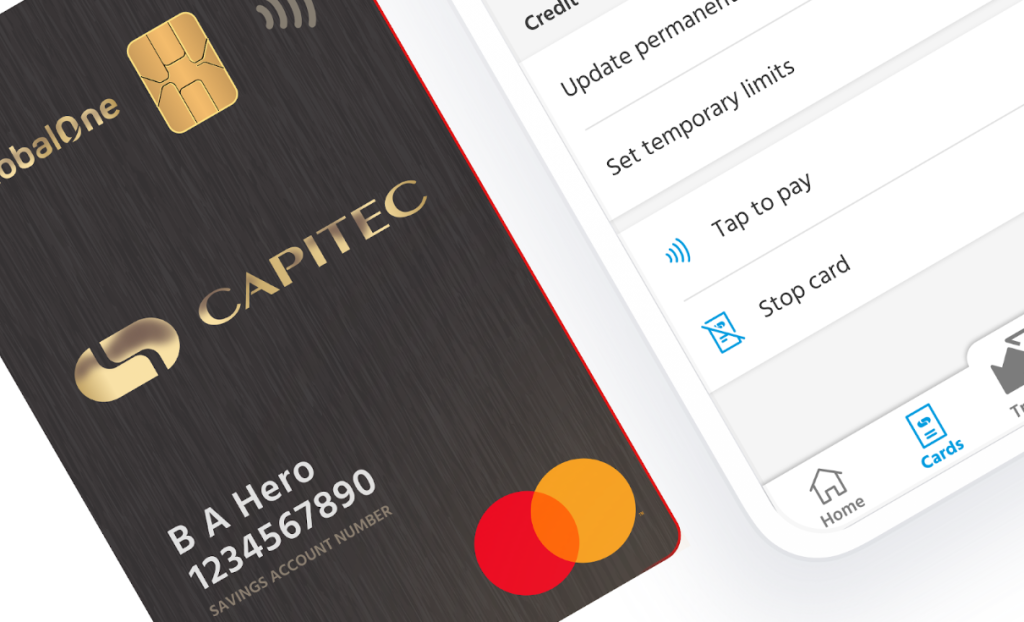

Capitec Credit Card: Up to R500,000 Limit with Cash Back Rewards

The Capitec Credit Card offers a high credit limit, cash back on all spending, and no extra fees on foreign transactions. Plus, take advantage of up to 55 days without interest!

Advertisement

Earn cash back while making international purchases without extra charges

The Capitec Credit Card offers South African consumers a robust financial tool, providing a credit limit of up to R500,000 with interest rates starting from the prime lending rate.

This card is designed to enhance your purchasing power while delivering a suite of benefits tailored to modern financial needs.

- Credit Score Requirement: Applicants should have a healthy credit history.

- Monthly Fee: A monthly service fee of R50 applies.

- Interest rates: From 11.00% to 21.50%, contingent on your credit profile.

- Rewards: Get 1% cash back on every purchase and spend abroad without paying currency conversion fees.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Capitec Credit Card: Main features

Designed for convenience and savings, the Capitec Credit Card adapts to your financial needs.

With a substantial credit limit reaching R500,000, it caters to a wide array of financial requirements.

The card features competitive interest rates starting from the prime rate, ensuring affordability for users.

Additionally, Capitec offers free card delivery, adding convenience to the application process.

With up to 55 days free of interest, cardholders can manage their cash flow more efficiently. The card also supports building a positive credit record through responsible usage.

Who is it for?

The Capitec Credit Card is ideal for individuals seeking a versatile credit solution with attractive benefits. It suits:

- Frequent Travelers: The credit card offers free travel insurance up to R5 million and no extra charges on foreign transactions.

- Regular Shoppers: Individuals who make frequent purchases can take advantage of the 1% cash back on all spending.

- Credit Builders: Those aiming to establish or improve their credit history will find this card beneficial due to its credit-building features.

What makes it special?

Several features distinguish the Capitec Credit Card from its competitors:

- High Credit Limit: Offers up to R500,000, accommodating significant financial needs.

- Cash Back Rewards: Provides 1% cash back on all expenditures, enhancing savings on everyday purchases.

- Zero Currency Conversion Fees: Eliminates additional costs when spending overseas, making it cost-effective for international use.

- Complimentary Travel Insurance: Includes free travel insurance coverage up to R5 million, adding peace of mind for travelers.

Things to consider before applying

Despite its many advantages, the Capitec Credit Card does have a few drawbacks to keep in mind:

- High Credit Requirements: Approval depends on a strong credit profile, making it less accessible for individuals with poor credit history.

- Income Requirement: A minimum salary of R5,000 may be restrictive for low-income earners.

- Monthly Fee: The R50 service fee, along with a R100 initiation fee, adds to the cost of maintaining the card.

- Limited Rewards Program: The 1% cash back is beneficial but not as extensive as some competitor rewards programs.

Is the Capitec Bank reliable?

Capitec Bank is a well-established financial institution in South Africa, adhering to stringent regulatory standards.

To safeguard transactions, the Capitec Credit Card features chip and PIN technology along with other advanced security measures.

The bank maintains transparency in its terms and conditions, ensuring customers are well-informed about fees, interest rates, and benefits.

Additionally, Capitec offers credit insurance options for those without existing coverage, providing an extra layer of financial security.

Practical uses of the credit card

The Capitec Credit Card is versatile, suitable for various financial activities:

- Everyday Purchases: Use it for daily expenses like groceries and fuel, earning cash back on each transaction.

- Online Shopping: Make secure online purchases without transaction fees, ideal for e-commerce enthusiasts.

- Travel Expenses: Pay for international travel costs without incurring currency conversion fees, and benefit from included travel insurance.

- Emergency Funds: Access immediate funds for unexpected expenses, with manageable repayment options.

Steps to apply for the credit card

The Capitec Credit Card application process is simple and available through various methods:

- Online Application:

- Go to the official Capitec Bank website.

- Find the credit card section and select the “Apply Now” option.

- Fill out the online form with your personal and financial information.

- Upload the required documents.

- Mobile App:

- Get the Capitec Bank mobile app on your smartphone through Google Play Store, Apple App Store, or Huawei AppGallery and install it.

- Register or log in to your account.

- Choose the credit card application feature in the app.

- Fill in the necessary information and upload the required documents.

- In-Branch Application:

- Head to the closest Capitec Bank branch for in-person assistance.

- Ensure you have the necessary documents with you.

- A consultant will assist you with the application process.

Requirements

Applicants must fulfill certain eligibility requirements to obtain the Capitec Credit Card, including being at least 18 years old.

Additionally, a minimum monthly salary of R5,000 is required, ensuring that applicants have a stable source of income to manage credit repayments effectively.

Employment status also plays a crucial role in the approval process. Applicants should be permanently employed, self-employed with a steady income, or receiving a pension.

This requirement ensures financial stability and the ability to meet monthly repayment obligations.

Furthermore, certain documents are necessary to complete the application.

Applicants must provide an original South African ID document, their latest salary slip, and a bank statement reflecting the last three consecutive salary deposits.

These documents help verify identity, income level, and financial standing, ensuring responsible lending practices.

Looking for another option? Take a look at the Nedbank Gold Credit Card

While the Capitec Credit Card provides a range of attractive benefits, exploring alternative options can help ensure the best financial fit.

The Nedbank Gold Credit Card is another strong contender, offering valuable perks for cardholders.

One of its standout features is the Greenbacks Rewards Program, which allows users to earn points on eligible purchases.

These points can be redeemed for various rewards, adding extra value to everyday spending.

In conclusion, the Capitec Credit Card remains a solid choice with its high credit limit, competitive interest rates, and useful benefits designed to support diverse financial needs.

However, considering alternatives like the Nedbank Gold Credit Card can help consumers find a solution that best aligns with their spending habits and financial goals.

To explore whether the Nedbank Gold Credit Card is the right choice for you, continue reading and discover its benefits in detail!

Nedbank Gold Credit Card

Get the Nedbank Gold Credit Card for an affordable R60 per month and enjoy up to 55 interest-free days, and secure digital banking!

Trending Topics

Fiverr Review: Unleash Your Freelancing Potential

Explore Fiverr, your gateway to freelancing success. Discover unique functionalities and advantages that make Fiverr a standout.

Keep Reading

SoFi Credit Card: Earn Unlimited 2% Cash Back Without Fees

Discover the SoFi Credit Card: unlimited 2% cash back on all purchases, no annual fee, and seamless integration with SoFi accounts.

Keep ReadingYou may also like

Improve your Productivity with Notion

Notion is a versatile tool that merges everyday work apps into a unified, customizable workspace. It allows you to take notes, add tasks, manage projects, and create your knowledge base, all while collaborating with your team.

Keep Reading

Venmo: The Fun and Convenient Way to Split Bills and Share Expenses!

Embark on a journey toward smarter money management and hassle-free transactions. Get ready to experience the ease of Venmo!

Keep Reading