Credit Card

Capital One Venture X Credit Card Review: Travel with Ease!

Few cards manage to offset maintenance costs with a robust rewards program, but the Capital One Venture X Credit Card is here to prove it's possible! Come find out more!

Advertisement

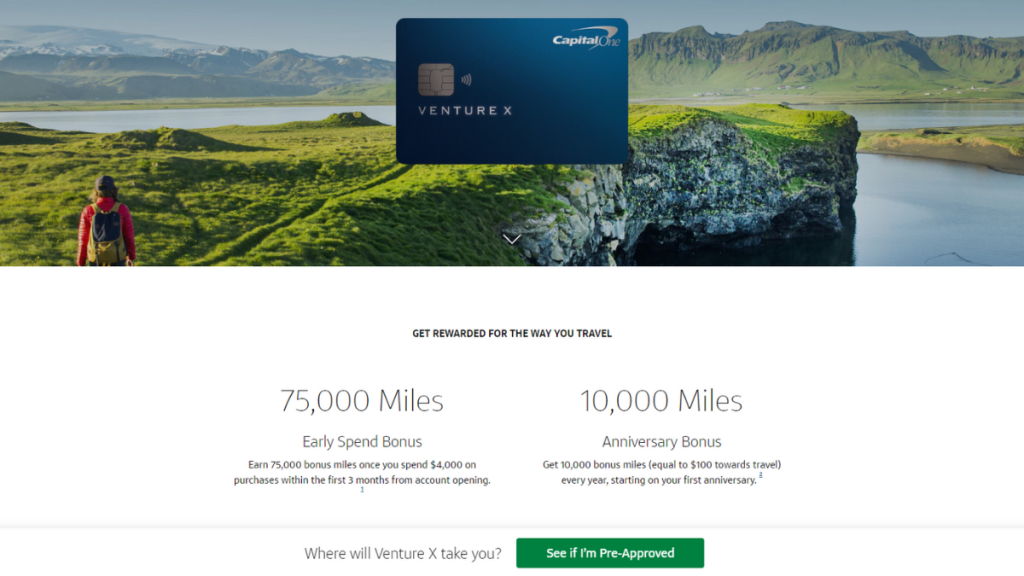

Capital One Venture X Credit Card: 75K bonus miles!

In the Capital One Venture X Credit Card review, learn how this card includes access to welcome bonuses, birthday gifts, and more!

Apply for Capital One Venture X Credit Card

You can apply for Capital One Venture X Credit Card without leaving your home! Fill out a virtual form quickly!

In any case, this is a card for travelers looking to leverage their excellent credit score to explore the world! Check it out!

- Credit Score: Excellent;

- Annual Fee: $395 per year;

- Purchase APR: 19.99% to 29.99%;

- Cash Advance APR: 29.99%;

- Rewards: 2 to 10 miles per dollar; Anniversary bonus; Welcome bonus.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Capital One Venture X Credit Card: Overview

Firstly, this Capital One Venture X Credit Card review is crucial for you to determine if the card is right for you! Thanks to its rewards, this is a perfect card for frequent travelers!

It’s essential to understand how the rewards bonus works and how it helps enhance your global travels. You earn 10 miles for every dollar spent on hotel and car reservations.

Additionally, you also earn 5 miles on flight reservations and 2 miles for each $1 spent on any purchase.

Moreover, you can redeem your miles in several ways. First, you can use your miles to book trips through the Capital One website. It’s also possible to transfer miles to partner airlines and hotels or use them for gift cards.

The transfer value is usually one cent per mile, but it’s essential to check the details on the Capital One website. Additionally, the card offers extra bonuses that can enhance your experience.

Analyzing the Advantages and Drawbacks of the Capital One Venture X Credit Card

For a perfect Capital One Venture X Credit Card review, we need to address the pros and cons. So check it out!

Pros:

- Rewards: As detailed, you can earn 2 to 10 miles for purchases!

- Redemption: Multiple and advantageous ways to redeem your miles for travelers!

- Lounge: Over 1,300 airport lounges globally for you to enjoy with the exclusivity of the Capital One Venture X Credit Card.

- Welcome Bonus: You can earn 75,000 miles if you spend $4,000 in the first three months, resulting in a bonus of approximately $750!

- Anniversary Bonus: You can earn miles and even dollars to spend on trips. Up to $300 per year in reservations and 10,000 miles after renewing your card!

Cons:

- High Annual Fee: The annual fee of the Capital One Venture X Credit Card can be high, but it easily compensates if you use the card to the fullest, taking advantage of the welcome bonus and anniversary rewards!

Eligibility Requirements for the Capital One Venture X Credit Card

The main requirement we can highlight is the need for an excellent credit score, limiting the card’s accessibility.

Additionally, you must be over 18 and have residence in the US territory. All information needs to be verified through relevant documentation when filling out the pre-qualification form.

Applying for the Capital One Venture X Credit Card: A Manual

Applying for this credit card is simple, and you can do it as soon as possible. Moreover, this card offers an online pre-qualification system!

Want to know more? Explore the blueprint we’ve prepared to guide you through the process!

Apply for Capital One Venture X Credit Card

You can apply for Capital One Venture X Credit Card without leaving your home! Fill out a virtual form quickly!

About the author / Pedro Saynovich

Trending Topics

Zelle: The Fast and Easy Way to Send Money to Your Friends

Discover the revolutionary Zelle app - a fast and easy way to send money to friends and family. Explore its features and advantages.

Keep Reading

The Best Strategies for Paying Off Loans Faster Without Sacrificing Your Lifestyle

Learn proven strategies to pay off loans faster, from setting achievable goals to using windfalls and budgeting, for financial freedom.

Keep Reading

American Express Blue Cash Everyday®: Rewards with No Annual Fee

Discover the American Express Blue Cash Everyday® Card: earn 3% cashback on essentials with no annual fee. Perfect for everyday savings.

Keep ReadingYou may also like

Delta SkyMiles® Gold: Elevate Your Travel with Tailored Rewards

Learn about the Delta SkyMiles® Gold Card's perks, like free checked bags and travel rewards for Delta flyers.

Keep Reading