Credit Card

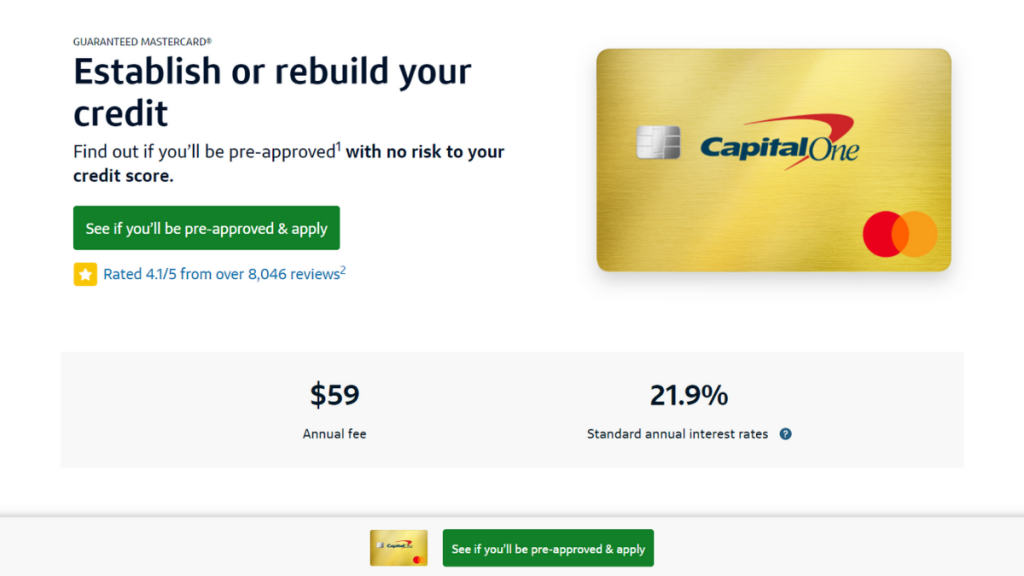

Capital One® Guaranteed Mastercard® Review: Rebuild your credit!

A card for Canadians seeking the opportunity to build or rebuild credit! The Capital One® Guaranteed Mastercard® requires a security deposit but provides access to a card with benefits! Come learn the details.

Advertisement

Meet the four requirements and obtain the Capital One® Guaranteed Mastercard®: simple and practical!

With our Capital One® Guaranteed Mastercard® review, you begin your journey to rebuild or build credit safely. With an affordable annual fee and a straightforward security deposit, you gain stability.

Apply for Capital One® Guaranteed Mastercard®

Apply for the Capital One® Guaranteed Mastercard® right now. All you need to do is meet all four established conditions, and this card is yours!

By making your payments on time, you can quickly establish yourself as a reliable customer. Thanks to the periodic reports that Capital One® sends to credit agencies, you enhance your credit score.

- Credit Score: All kinds of credit scores are acceptable;

- Annual Fee: $59;

- Purchase APR: 21.9%;

- Cash Advance APR: 21.9%;

- Rewards: Not available!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Capital One® Guaranteed Mastercard®: Overview

So, the main point of this Capital One® Guaranteed Mastercard® review is to show how the card functions in daily life and how it is ideal for rebuilding credit.

Firstly, this card accepts individuals with different credit levels. The process is simple; you just need to make purchases with the card and then make payments on time.

With these two steps, you already begin building positive credit. Therefore, do not lose control of your finances. Additionally, to be accessible to everyone, the Capital One® Guaranteed Mastercard® requires a security deposit.

However, this deposit is straightforward, and you receive the full amount back when closing your account, provided payments are up to date. Moreover, the amount is relative and depends on your credit score!

In conclusion, the process is simple, isn’t it? So, let’s check out more details about the Capital One® Guaranteed Mastercard®!

Analyzing the advantages and drawbacks of the Capital One® Guaranteed Mastercard®

In a Capital One® Guaranteed Mastercard® review, it is also necessary to highlight the positive and negative aspects the card offers. So, let’s review this information to help you make your decision.

Pros

With the Capital One® Guaranteed Mastercard®, you have access to benefits for daily purchases. Some of them include:

- Insurance in case of loss or damage to your purchase;

- Extended warranty;

- Insurance for accidents in rented cars;

Additionally, you have access to the card’s travel benefits, which include:

- Insurance in case of delayed or lost luggage;

- 24/7 travel assistance;

- Travel accident insurance;

Furthermore, there are exclusive Mastercard benefits:

- No liability in case of fraud;

- In case of a stolen or lost card, get an emergency card.

Cons

On the other hand, we must also point out in this review that there are negatives to opting for the Capital One® Guaranteed Mastercard®. Among them, the absence of rewards is the most glaring point.

Furthermore, the need for a security deposit and the C$ 59 annual fee may be a hindrance for those facing financial difficulties.

Eligibility Requirements for the Capital One® Guaranteed Mastercard®

Requirements are also an important aspect in the Capital One® Guaranteed Mastercard® review. Capital One guarantees only four requirements for you to have the card in hand!

The first requirement is to have the minimum age required according to your province. The second requirement is that you should not have applied for any Capital One card in the last 30 days.

The third requirement is not having any active application process with Capital One. Finally, the fourth requirement is not having any debts or accounts with pending issues with Capital One in the last year.

Applying for the Capital One® Guaranteed Mastercard®: a manual

Did you enjoy learning about the Capital One® Guaranteed Mastercard® with our review? If you’re interested in applying, you can complete the entire process virtually through the Capital One website.

However, if you want more details, you can access our post below. We’ve prepared a blueprint to help you join the Capital One® Guaranteed Mastercard® more easily! Come check it out.

Apply for Capital One® Guaranteed Mastercard®

Apply for the Capital One® Guaranteed Mastercard® right now. All you need to do is meet all four established conditions, and this card is yours!

About the author / Pedro Saynovich

Trending Topics

Why Understanding Loan Terms and Interest Rates Helps You Plan Better

Master loan terms interest with actionable tips to compare offers, avoid hidden fees, and manage payments for smarter financial decisions.

Keep Reading

American Express Blue Cash Everyday®: Rewards with No Annual Fee

Discover the American Express Blue Cash Everyday® Card: earn 3% cashback on essentials with no annual fee. Perfect for everyday savings.

Keep Reading