بطاقة إئتمان

بطاقة ائتمان SoFi: اربح استرداد نقدي غير محدود بقيمة 2% بدون رسوم

مع بطاقة SoFi الائتمانية، ستستمتع بمكافآت استرداد نقدي غير محدودة، ورسوم سنوية صفرية، ولا توجد رسوم إضافية عند إجراء عمليات الشراء في الخارج.

إعلان

سيتم تحويلك إلى موقع ويب آخر

حل مالي بسيط ومجزٍ

تجمع بطاقة SoFi الائتمانية بين البساطة والقيمة، حيث تقدم استرداد نقدي غير محدود بنسبة 2% على جميع المشتريات وتلغي الرسوم مثل الرسوم السنوية أو تكاليف المعاملات الأجنبية.

صُمم هذا البرنامج للأفراد الذين يرغبون في الحصول على مكافآت ثابتة دون تعقيدات تتبع الفئات أو التعامل مع الرسوم الخفية.

- متطلبات درجة الائتمان: ممتاز

- الرسوم السنوية: صفر

- معدل الفائدة السنوي للشراء: متغير من 19.74% إلى 29.49%

- معدل الفائدة السنوية للسحب النقدي: 31.74%

- المكافآت: 2% استرداد نقدي غير محدود على جميع المشتريات؛ 3% استرداد نقدي على رحلات السفر المحجوزة عبر SoFi Travel

بطاقة ائتمان SoFi: نظرة فاحصة

بطاقة ائتمان SoFi، والتي تسمى رسميًا بطاقة ائتمان SoFi Unlimited 2%، هي منتج مالي متعدد الاستخدامات مصمم لتلبية احتياجات أولئك الذين يسعون للحصول على مكافآت مباشرة.

إن بساطتها وفعاليتها من حيث التكلفة تجعلها متميزة في سوق بطاقات الائتمان المزدحم.

تتكامل هذه البطاقة بسلاسة مع نظام SoFi البيئي، مما يسمح للمستخدمين باسترداد مكافآتهم في حسابات مثل SoFi Checking and Savings أو SoFi Invest، مما يزيد من إمكانات نموهم المالي.

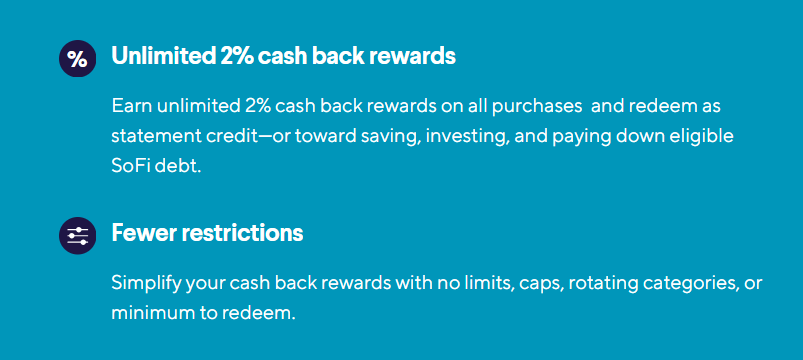

استرداد نقدي غير محدود

تتمثل الميزة الأساسية للبطاقة في استرداد نقدي ثابت بنسبة 2% على جميع المشتريات.

على عكس العديد من البطاقات التي تتطلب منك التنقل بين الفئات أو حدود الإنفاق، فإن بطاقة SoFi الائتمانية تحافظ على بساطة الأمور - فكل عملية شراء تكسب نفس النسبة العالية من المكافآت.

بالنسبة للمسافرين الدائمين، تقدم البطاقة مكافأة إضافية: استرداد نقدي بقيمة 3% على الرحلات المحجوزة من خلال SoFi Travel، المدعومة من Expedia.

بدون رسوم، بدون متاعب

تُزيل بطاقة SoFi الائتمانية الرسوم الشائعة التي تُسبب إحباطًا لحاملي البطاقات.

بفضل عدم وجود رسوم سنوية، يمكن للمستخدمين الاستمتاع بمزايا البطاقة دون القلق بشأن تكلفة سنوية إضافية.

كما أنه يلغي رسوم المعاملات الأجنبية، مما يجعله رفيقًا موثوقًا به لأولئك الذين يتسوقون أو يسافرون إلى الخارج بشكل متكرر.

من المستفيد الأكبر؟

هذه البطاقة مثالية للأفراد الذين:

- هل ترغب في الحصول على مكافآت استرداد نقدي بسيطة على مشترياتك اليومية، بمعدل ثابت يزيل عناء تتبع الفئات أو المكافآت المتغيرة؟

- نُقدّر الأدوات المالية التي تتكامل بسلاسة مع نظام بيئي أوسع، مما يتيح إدارة سهلة للمكافآت والحسابات.

- يفضل تجنب الرسوم السنوية وتكاليف المعاملات الأجنبية والرسوم الإضافية مع تحقيق أقصى استفادة من مكافآتهم دون حدود أو قيود.

الإيجابيات والسلبيات

قبل التقدم بطلب للحصول على أي بطاقة ائتمان، من المهم دراسة مزاياها وعيوبها المحتملة.

الإيجابيات

- استرداد نقدي ثابت بقيمة 2%: سعر سخي على جميع المشتريات بدون قيود أو حدود قصوى على الفئات.

- مزايا سفر حصرية: احصل على استرداد نقدي بقيمة 3% عند التخطيط لرحلاتك من خلال منصة SoFi Travel.

- الرسوم السنوية؟ ليس مع هذه البطاقة - استمتع بمزاياها دون أي تكاليف سنوية.

- التسوق في الخارج: ودّع الرسوم الإضافية أثناء التسوق دوليًا، حيث تأتي بطاقة SoFi الائتمانية بدون أي رسوم على المعاملات الأجنبية.

- حماية الهاتف المحمول: حافظ على أمان هاتفك مع تغطية تصل إلى $1,000 دولار أمريكي ضد السرقة أو التلف، وذلك ببساطة عن طريق دفع فاتورتك الشهرية باستخدام بطاقة ائتمان SoFi.

السلبيات

- خيارات محدودة لاسترداد المكافآت: يجب استبدال المكافآت في حسابات SoFi لتحقيق أقصى قيمة لها.

- عروض بدون مقدمات: بخلاف بعض المنافسين، لا تتضمن هذه البطاقة عروض معدل الفائدة السنوي 0% للمشتريات أو تحويلات الرصيد.

- لا يوجد مكافأة ترحيبية: تفتقر البطاقة إلى حافز مسبق، على عكس بعض المنافسين.

كيفية التقديم للحصول على البطاقة

يُعد التقديم للحصول على بطاقة ائتمان SoFi Unlimited 2% بسيطًا ورقميًا بالكامل، مما يضمن عملية خالية من المتاعب.

دليل خطوة بخطوة

- قم بزيارة موقع SoFi الإلكتروني: انتقل إلى صفحة بطاقة ائتمان SoFi.

- ابدأ التطبيق: انقر على زر "ابدأ" للبدء.

- تقديم المعلومات الشخصية: أدخل التفاصيل مثل اسمك ورقم الضمان الاجتماعي ودخلك وعنوانك.

- الموافقة على الشروط: يرجى مراجعة شروط وأحكام البطاقة بعناية قبل تقديم الطلب.

- قدّم طلبك: أكمل العملية وانتظر حتى تقوم شركة SoFi بمراجعة بياناتك.

- الحصول على قرار: يتلقى معظم المتقدمين قراراً في غضون دقائق.

الأهلية

يجب على المتقدمين استيفاء متطلبات أهلية معينة للحصول على الموافقة على بطاقة ائتمان SoFi.

- التصنيف الائتماني: ستحتاج إلى درجة ائتمانية قوية، عادةً ما تكون في النطاق الجيد إلى الممتاز، للتأهل.

- الإقامة: لا يحق التقدم بطلب للحصول على هذه البطاقة إلا للمواطنين الأمريكيين أو المقيمين الدائمين.

- عمر: يجب أن يكون عمر المتقدمين 18 عامًا أو أكثر لاستيفاء الحد الأدنى لمتطلبات السن.

- دخل: إثبات وجود دخل كافٍ للوفاء بالتزامات الائتمان أمر ضروري.

الاستفادة القصوى من بطاقة SoFi الخاصة بك

لتحقيق أقصى استفادة من بطاقة ائتمان SoFi، من الضروري استخدام ميزاتها بشكل استراتيجي.

استبدل المكافآت بفعالية

حقق أقصى استفادة من مكافآتك عن طريق استرداد أموالك النقدية مباشرة إلى حسابات SoFi.

يمكنك إيداع المكافآت في حسابات SoFi الجارية والتوفيرية، أو استخدامها للاستثمار في SoFi Invest، أو حتى تطبيقها على قرض شخصي من SoFi.

لا يعزز هذا النهج مرونتك المالية فحسب، بل يتوافق أيضًا مع النظام المالي الأوسع لشركة SoFi.

استفد من مزايا السفر

بالنسبة للمسافرين، يُعد الحجز عبر SoFi Travel طريقة ذكية لكسب 3% كاسترداد نقدي. هذه الميزة الإضافية تجعل البطاقة جذابة بشكل خاص لمن يخططون لرحلاتهم.

قم بتأمين جهازك المحمول

احصل على تغطية تصل إلى 1000 دولار أمريكي ضد السرقة أو التلف لهاتفك المحمول بمجرد استخدام بطاقة ائتمان SoFi لدفع فاتورة هاتفك الشهرية.

مقارنة بطاقة ائتمان SoFi بخيارات استرداد النقود الأخرى

تشتهر بطاقة SoFi الائتمانية بمكافآتها المباشرة وعدم وجود رسوم، مما يجعلها جديرة بالمقارنة مع خيارات استرداد النقود الشائعة الأخرى.

يقدم العديد من المنافسين مكافآت متدرجة، مما يتطلب منك تتبع فئات محددة مثل تناول الطعام أو البقالة.

في المقابل، فإن معدل SoFi الثابت البالغ 2% يجعل من السهل كسب مكافآت عالية باستمرار دون بذل جهد إضافي.

بالإضافة إلى ذلك، فإن عدم وجود رسوم - وخاصة عدم وجود رسوم على المعاملات الأجنبية - يجعله أكثر فعالية من حيث التكلفة للاستخدام الدولي.

ما الذي يجعل بطاقة ائتمان SoFi Unlimited 2% خيارًا ذكيًا؟

تُعد بطاقة SoFi الائتمانية خيارًا عمليًا لأي شخص يبحث عن مكافآت مباشرة دون عبء الرسوم.

يضمن استرداد النقود غير المحدود 2% أرباحًا ثابتة، كما أن مكافآت السفر الإضافية والتكامل مع حسابات SoFi تجعله أداة مالية متكاملة.

إذا كنت تبحث عن بطاقة ائتمان سهلة الاستخدام مع مكافآت كبيرة، فإن بطاقة SoFi الائتمانية تقدم قيمة استثنائية.

بالنسبة لأولئك الذين يعطون الأولوية للمزايا الخاصة بشركات الطيران، قد يكون من المفيد التفكير في بطاقة Delta SkyMiles® Gold، على الرغم من أنها تأتي بتكاليف قد تفوق مزاياها للمسافرين غير المتكررين.

خذ لحظة لتقييم احتياجاتك وأهدافك المالية، واختر البطاقة التي تتناسب بشكل أفضل مع نمط حياتك!

دلتا سكاي مايلز® جولد

تعرف على مزايا بطاقة دلتا سكاي مايلز® الذهبية، مثل الأمتعة المسجلة المجانية ومكافآت السفر لمسافري دلتا.

المواضيع الرائجة

حسّن إنتاجيتك مع Notion

Notion أداة متعددة الاستخدامات تدمج تطبيقات العمل اليومية في مساحة عمل موحدة وقابلة للتخصيص. تتيح لك تدوين الملاحظات، وإضافة المهام، وإدارة المشاريع، وإنشاء قاعدة معارفك، كل ذلك أثناء التعاون مع فريقك.

تابع القراءةقد يعجبك أيضاً

بطاقة Truist Enjoy Cash Secured: ابنِ تاريخًا ائتمانيًا مع استرداد نقدي

عزز سجلك الائتماني مع بطاقة Truist Enjoy Cash Secured Card، التي تقدم مكافآت وحدود ائتمانية مرنة. خطوة ذكية لتعزيز مستقبلك المالي!

تابع القراءة