بطاقة إئتمان

مراجعة بطاقة Revvi: بطاقة Visa® لبناء تاريخ ائتماني!

بطاقة Revvi هي خيار من Visa® لبناء تاريخ ائتماني بالطريقة التي تناسبك. صُممت هذه البطاقة خصيصًا للأفراد ذوي التاريخ الائتماني المتفاوت، وتوفر إمكانية الوصول إلى تطبيق جوال سهل الاستخدام وميزات مريحة.

إعلان

سيتم تحويلك إلى موقع ويب آخر

استمتع بتقارير مكاتب الائتمان الشهرية، ومكافآت استرداد النقود، وخيارات استرداد سهلة!

هل ترغب في بناء تاريخ ائتماني وتحسين تصنيفك الائتماني دون التنازل عن المكافآت؟ إذن، استعرض مزايا بطاقة Revvi واكتشف كيف يمكن لهذه البطاقة الائتمانية أن تساعدك في إعادة تعريف إمكانية الحصول على الائتمان.

قدّم طلبك للحصول على بطاقة Revvi: ائتمان متاح!

تحكّم في أمورك المالية واستفد من موارد ائتمانية قيّمة مع بطاقة Revvi. استمتع بخيار بطاقة ائتمان Visa®، بغض النظر عن تاريخك الائتماني.

على الرغم من أن هذه البطاقة مصممة خصيصًا للأشخاص ذوي السجل الائتماني غير المثالي، إلا أنها لا تتطلب وديعة تأمين. بالإضافة إلى ذلك، يمكنك استخدام بطاقة فيزا.® احصل على البطاقة واستمتع بسهولة الوصول والراحة في بطاقة واحدة!

- التصنيف الائتماني: لا يتطلب هذا سجلاً ائتمانياً مثالياً للموافقة.

- الرسوم السنوية: سيُطلب منك دفع رسوم قدرها $75 خلال السنة الأولى من الاستخدام. ولكن بعد ذلك، ينخفض المبلغ إلى $48 سنويًا.

- معدل الفائدة السنوي للشراء: يبلغ سعره 35.99%.

- معدل الفائدة السنوية للسحب النقدي: أيضًا 35.99%.

- المكافآت: تقدم بطاقة Revvi مبادرة مكافآت تمنح المستخدمين استردادًا نقديًا بنسبة 11% على مدفوعاتهم. بالإضافة إلى ذلك، يمكنك بسهولة تتبع مكافآتك واستردادها من خلال تطبيق Revvi سهل الاستخدام للهواتف المحمولة.

بطاقة ريففي: نظرة عامة

على الرغم من أن بطاقة Revvi يمكن أن تكون إضافة قيمة إلى أدواتك المالية، إلا أنه يجب عليك مراجعة وفهم ميزاتها من أجل اتخاذ القرار الصحيح الذي يناسب ملفك الشخصي.

عند التفكير في بطاقة Revvi، ستجد حلاً ائتمانياً يناسب مختلف الخلفيات الائتمانية. إضافةً إلى ذلك، عملية التقديم سريعة، ويمكنك الحصول على رد في غضون ثوانٍ.

لكن بعد الموافقة، توقع رسوم برنامج لمرة واحدة قدرها $95. بالإضافة إلى ذلك، هناك رسوم سنوية قدرها $75 للسنة الأولى. بعد ذلك، انخفضت الرسوم إلى $48 سنويًا.

بالإضافة إلى ذلك، هناك رسوم خدمة شهرية قدرها $8.25. تُعفى هذه الرسوم مبدئيًا للسنة الأولى. مع أن هذه البطاقة خيار جيد لبناء تاريخ ائتماني جيد، إلا أن هناك بطاقات أخرى برسوم أقل.

إذا كنت تبحث عن مكافآت أثناء بناء تاريخك الائتماني، فإن بطاقة Revvi تمنحك استردادًا نقديًا بنسبة 11% على المدفوعات. كما أن تقديم تقارير دورية إلى مكاتب الائتمان يُسهّل تحسين وضعك الائتماني.

تحليل مزايا وعيوب بطاقة Revvi

كما هو الحال مع أي بطاقة ائتمان أخرى، يجب عليك مراجعة المزايا والعيوب للتأكد من اختيارك لبطاقة Revvi Visa المناسبة.® البطاقة هي الخيار الأمثل لوضعك المالي. لذا، تابع القراءة واكتشف المزيد!

الإيجابيات

- فيزا® حلول بطاقات الائتمان المصممة خصيصاً للأفراد ذوي السجلات الائتمانية المتنوعة؛

- مكافآت استرداد النقود؛

- يساعد المستخدمين في إنشاء أو تحسين ملفاتهم الائتمانية؛

- يوفر تطبيق الهاتف المحمول تجربة سلسة وبديهية؛

- خدمة عملاء سريعة الاستجابة ومفيدة.

السلبيات

- تأتي البطاقة برسوم كبيرة؛

- لديه معدل نسبة سنوية مرتفع؛

- عملية استرداد المكافآت مقيدة.

شروط الأهلية للحصول على بطاقة Revvi

على الرغم من أن بطاقة Revvi تقبل المستخدمين ذوي التصنيفات الائتمانية الأقل من الممتازة، إلا أن هناك معايير أهلية معينة يجب عليك مراجعتها قبل التقديم. أولاً، يجب أن يكون عمرك 18 عامًا على الأقل.

علاوة على ذلك، يجب أن يكون لديك رقم ضمان اجتماعي ساري المفعول وحساب جاري باسمك، حيث تتطلب بطاقة Revvi ربط حساب لإجراء المدفوعات والمعاملات.

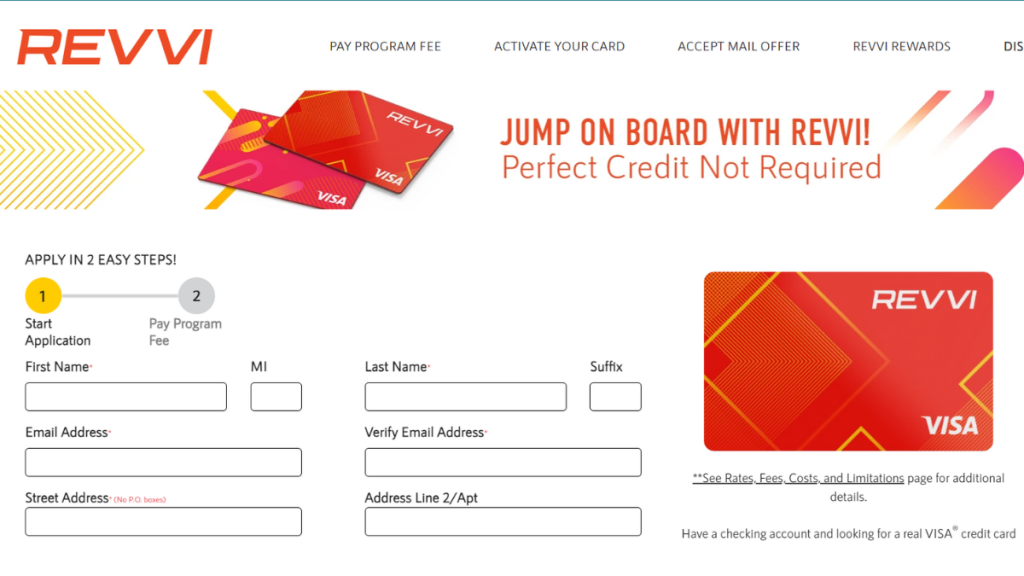

التقديم على بطاقة Revvi: دليل إرشادي

إذن، هل ترغب في الحصول على تأشيرة خاصة بك؟® هل تحتاج إلى بطاقة ائتمان؟ ما عليك سوى مراجعة الخطوات البسيطة لمعرفة كيفية التقديم على بطاقة Revvi. كما ذكرنا سابقًا، العملية سريعة وتتم عبر الإنترنت!

هذا يعني أنه في غضون دقائق معدودة، يمكنك الحصول على الموافقة على بطاقتك الائتمانية الجديدة! بدءًا من زيارة الموقع الإلكتروني الرسمي وحتى ملء النموذج، ستجد أدناه دليلًا بسيطًا للتقديم!

قدّم طلبك للحصول على بطاقة Revvi: ائتمان متاح!

تحكّم في أمورك المالية واستفد من موارد ائتمانية قيّمة مع بطاقة Revvi. استمتع بخيار بطاقة ائتمان Visa®، بغض النظر عن تاريخك الائتماني.

المواضيع الرائجة

وظائف في المطاعم ومطاعم الوجبات السريعة: رواتب تبدأ من 1 إلى 28,000 جنيه إسترليني سنويًا

اكتشف وظائف المطاعم ومطاعم الوجبات السريعة بأجور تبدأ من $10 بالساعة، مع فرص كبيرة لتطوير مسارك المهني!

تابع القراءة

مراجعة موقع فايفر: أطلق العنان لإمكانياتك في العمل الحر

استكشف موقع Fiverr، بوابتك نحو النجاح في العمل الحر. اكتشف الميزات والخصائص الفريدة التي تجعل Fiverr موقعًا متميزًا.

تابع القراءةقد يعجبك أيضاً

بطاقة كابيتال ون كويكسيلفر للمكافآت النقدية: استرداد نقدي بقيمة 1.51 تيرابايت على جميع المشتريات!

تابع القراءة

برنامج Ink Business Cash®: اربح مبالغ نقدية عالية مع مزايا أساسية للأعمال

اكتشف استراتيجيات إنفاق أكثر ذكاءً مع بطاقة Ink Business Cash®. اربح ما يصل إلى 5% كاسترداد نقدي على مشتريات مختارة - كل ذلك بدون رسوم سنوية!

تابع القراءة