بطاقة إئتمان

برنامج Ink Business Cash®: اربح مبالغ نقدية عالية مع مزايا أساسية للأعمال

يقدم برنامج Ink Business Cash® استرداد نقدي بنسبة 5%، ومكافأة ترحيبية، وبدون رسوم سنوية - وهو مثالي لزيادة الإنفاق التجاري إلى أقصى حد.

إعلان

سيتم تحويلك إلى موقع ويب آخر

وفر الكثير من نفقات العمل!

صُممت بطاقة Ink Business Cash® مع وضع الشركات الصغيرة في الاعتبار، وهي تقدم مكافآت كبيرة على النفقات الروتينية.

تمنحك هذه البطاقة التي لا تفرض رسومًا سنوية فرصة الحصول على ما يصل إلى $750 كمكافأة نقدية.

- التصنيف الائتماني: جيد إلى ممتاز (عادةً 670 أو أعلى)

- الرسوم السنوية: $0

- معدل الفائدة السنوي للشراء: معدل فائدة سنوي تمهيدي 0% للأشهر الـ 12 الأولى. بعد ذلك، معدل فائدة متغير يتراوح بين 17.74% و 25.74%

- معدل الفائدة السنوية للسحب النقدي: 29.49% متغير

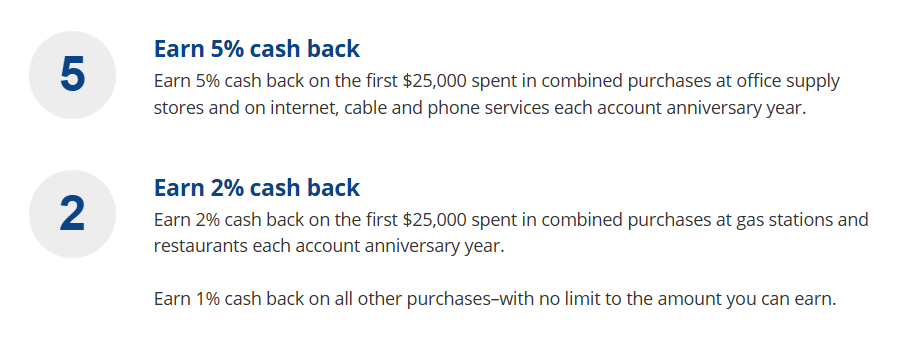

- المكافآت: استرداد نقدي يصل إلى 5% على فئات مختارة، واسترداد نقدي غير محدود بقيمة 1% على جميع المشتريات الأخرى

إنك بيزنس كاش®: ما تحتاج إلى معرفته

تم تصميم بطاقة Ink Business Cash® الائتمانية خصيصًا لتلبية احتياجات أصحاب الأعمال الصغيرة، حيث توفر برنامجًا قويًا لاسترداد النقود للمساعدة في توفير النفقات الأساسية.

بفضل نظام المكافآت المتدرج، تقدم البطاقة معدلات استرداد نقدي مرتفعة لنفقات أعمال محددة ومعدل قياسي لجميع المشتريات الأخرى.

يتوافق هذا الهيكل مع الإنفاق التجاري النموذجي، مما يجعله خيارًا فعالًا من حيث التكلفة لإدارة النفقات التشغيلية مع تحقيق مكافآت مجزية.

بالإضافة إلى ذلك، فإن عدم وجود رسوم سنوية ونسبة الفائدة السنوية التمهيدية 0% على المشتريات لمدة 12 شهرًا يعزز قيمتها بشكل أكبر، مما يسمح للشركات بإدارة التدفق النقدي بشكل أكثر فعالية.

لمن هذا المنتج؟

تُعد هذه البطاقة مثالية لأصحاب الأعمال الصغيرة الذين ينفقون بشكل متكرر على اللوازم المكتبية والإنترنت والتلفزيون الكبلي وخدمات الهاتف والوقود وتناول الطعام.

يُعد هذا الأمر مفيدًا بشكل خاص لأولئك الذين يبحثون عن بطاقة بدون رسوم سنوية مع فرص استرداد نقدي كبيرة.

ما الذي يجعله مميزاً؟

تتميز هذه البطاقة بنسب استرداد نقدي عالية في فئات محددة ومكافأة تسجيل سخية.

بالإضافة إلى ذلك، فإنه يقدم معدل فائدة سنوي تمهيدي قدره 0% على المشتريات خلال الأشهر الـ 12 الأولى، مما يساعد في إدارة التدفق النقدي.

تحليل المزايا والعيوب

على الرغم من أن بطاقة Ink Business Cash® الائتمانية تقدم العديد من المزايا، إلا أنه من الضروري مراعاة نقاط قوتها وقيودها.

الإيجابيات

- معدلات استرداد نقدي سخية: اكسب 5% و 2% كاسترداد نقدي في فئات تتوافق مع نفقات الأعمال النموذجية.

- لا توجد رسوم سنوية: عدم وجود رسوم سنوية يعني أن كل دولار يتم توفيره يبقى في جيب شركتك.

- مكافأة تسجيل كبيرة: إمكانية ربح ما يصل إلى $750 كمكافأة نقدية عند استيفاء عتبات الإنفاق.

- فترة تمهيدية بدون فوائد: استمتع بمعدل فائدة سنوي قدره 0% لمدة عام واحد، وهو مثالي لتمويل عمليات الشراء الكبيرة أو توحيد الأرصدة الحالية.

- بطاقات الموظفين بدون تكلفة إضافية: إصدار بطاقات إضافية للموظفين بدون رسوم إضافية، مع إمكانية تحديد حدود إنفاق فردية.

نصائح لتحقيق أقصى قدر من المكافآت

لتحقيق أقصى استفادة من هذه الميزة، ركّز إنفاقك على الفئات ذات معدلات استرداد النقود الأعلى. إليك بعض النصائح القيّمة:

- إعطاء الأولوية لفئات المكافآت: استخدم البطاقة لشراء اللوازم المكتبية والإنترنت ونفقات الطعام لكسب استرداد نقدي بقيمة 5% و2%.

- تتبع حدود الإنفاق: راقب الحد السنوي البالغ $25,000 لفئات استرداد النقود المرتفعة وقم بتعديل الإنفاق لزيادة المكافآت إلى أقصى حد دون تجاوز الحد.

- اجمع المكافآت: اربط البطاقة ببرنامج Chase Ultimate Rewards® لتجميع أرباح الاسترداد النقدي وتعزيز القيمة، مثل تحويل النقاط للسفر.

- استخدام بطاقات الموظفين: قم بمركزة الإنفاق من خلال بطاقات الموظفين لتوحيد المكافآت بشكل أكثر فعالية مع تبسيط تتبع الميزانية.

السلبيات

- حدود الإنفاق على فئات المكافآت: تنطبق معدلات استرداد النقود المرتفعة فقط على أول $25,000 يتم إنفاقها سنويًا في كل فئة من فئات المكافآت؛ أما الإنفاق اللاحق فيكسب 1% استردادًا نقديًا.

- رسوم المعاملات الدولية: يتم تطبيق رسوم قدرها 3% على أي مشتريات تتم خارج الولايات المتحدة.

- مزايا السفر البسيطة: يفتقر إلى مزايا السفر المميزة الموجودة في بطاقات ائتمان الشركات الأخرى.

كيف تدعم هذه البطاقة توسع الشركات الصغيرة

تُقدّم بطاقة Ink Business Cash® الائتمانية ميزات أساسية تُمكّن الشركات من إدارة نفقاتها بكفاءة مع إعادة استثمار المدخرات في النمو. إليك الطريقة:

- توفير نقدي: احصل على استرداد نقدي يصل إلى 5% على لوازم المكتب، وخدمات الإنترنت، والكابل، والهاتف - وهي نفقات تحتاجها كل شركة. يمكن إعادة استثمار هذه المدخرات في توسيع العمليات أو شراء المعدات.

- 0% معدل الفائدة السنوي التمهيدي: استمتع خلال الأشهر الـ 12 الأولى بمعدل فائدة سنوي قدره 0% على المشتريات، مما يسهل تمويل السلع باهظة الثمن دون تكاليف فائدة فورية.

- لا توجد رسوم سنوية: بإمكان الشركات توفير المال سنوياً، والحفاظ على انخفاض التكاليف مع تحقيق أقصى قدر من الفوائد.

- بطاقات الموظفين: قم بتزويد أعضاء الفريق بالبطاقات بدون أي تكلفة إضافية، مما يسهل تتبع الإنفاق وتخصيص الميزانيات للمبادرات التي تركز على النمو.

تبسيط نفقات الموظفين

يمكن إدارة نفقات الموظفين بكفاءة عالية بفضل مزايا بطاقة Ink Business Cash® الائتمانية. تضمن هذه الأدوات التحكم مع تعزيز إنتاجية الفريق.

- الحدود الفردية: قم بتعيين حدود إنفاق مخصصة لكل بطاقة موظف لمنع الإنفاق الزائد والحفاظ على الميزانيات.

- التقارير المركزية: تتبع جميع معاملات الموظفين في مكان واحد، مما يبسط تقارير المصروفات ويحدد اتجاهات الإنفاق.

- لا توجد رسوم إضافية: توفير بطاقات للموظفين بدون رسوم إضافية، مما يضمن إدارة فعالة من حيث التكلفة لنفقات العمل.

- بيانات تفصيلية: احصل على رؤى حول عمليات شراء محددة، مما يساعد الشركات على ضمان توافق الإنفاق مع أهداف الشركة.

كيفية التقديم للحصول على البطاقة

يُعد التقديم للحصول على Ink Business Cash® عملية مباشرة يمكن إكمالها عبر الإنترنت في غضون دقائق قليلة.

لضمان تجربة سلسة، يرجى جمع معلومات عملك ومعلوماتك الشخصية مسبقاً.

- قم بزيارة الموقع الرسمي: توجه إلى موقع Chase الإلكتروني وابحث عن صفحة طلب Ink Business Cash®.

- ابدأ عملية التقديم: انقر على زر "التقديم الآن" لبدء العملية.

- تقديم معلومات العمل: أدخل تفاصيل مثل اسم شركتك وعنوانها ونوعها وإيراداتها السنوية.

- تقديم المعلومات الشخصية: يرجى تضمين اسمك وعنوانك ورقم الضمان الاجتماعي وإجمالي دخلك السنوي.

- مراجعة وتقديم: تأكد من صحة بياناتك قبل إتمام عملية تقديم الطلب.

بعد تقديم طلبك، ستقوم شركة تشيس بمراجعته وإبلاغك بالقرار، عادةً في غضون بضعة أيام عمل.

تعرف على الخيارات الأخرى

في حين أن بطاقة Ink Business Cash® الائتمانية توفر فرصًا قيّمة لاسترداد النقود لنفقات العمل، فإن أولئك الذين يسعون للحصول على مكافآت السفر قد يفكرون في بطاقة Chase Sapphire Preferred.

توفر هذه البطاقة خيارات مرنة لاستبدال النقاط، بما في ذلك التحويلات إلى مختلف شركاء السفر.

وختاماً، يُعدّ Ink Business Cash® خياراً قيماً لرواد الأعمال الذين يتطلعون إلى تحسين إنفاقهم اليومي.

لكن إذا كنت تركز على مكافآت السفر، فقد تكون بطاقة Chase Sapphire Preferred أنسب لأهدافك. تعرف على المزيد عبر الرابط أدناه، واستكشف مزايا وفوائد البطاقة!

بطاقة تشيس سافاير المفضلة

استكشف بطاقة الائتمان المفضلة من تشيس سافاير: مكافآت السفر، ومزايا تناول الطعام، وإمكانية استبدال النقاط بمرونة.

المواضيع الرائجة

بطاقة سيتي سيمبليسيتي®: بدون رسوم ومرونة فائقة

اكتشف بطاقة سيتي سيمبليسيتي® الائتمانية: بدون رسوم سنوية، بدون رسوم تأخير، وفترة سداد تصل إلى 21 شهرًا بفائدة سنوية قدرها 0%. تمتع بمرونة لا مثيل لها!

تابع القراءة

طلب الحصول على بطاقة ديستني ماستركارد®: كيف يتم التقديم؟

افتح الباب أمام سجل ائتماني أفضل! اطلع على دليل التقديم لبطاقة ديستني ماستركارد® لبناء سجل ائتماني ذكي.

تابع القراءةقد يعجبك أيضاً

بطاقة Petal 2 Visa: بطاقة ائتمان مجانية لبناء تاريخ ائتماني مع استرداد نقدي

تعرّف على كيف تساعدك بطاقة Petal 2 Visa في بناء تاريخ ائتماني جيد بدون رسوم، مع استرداد نقدي يصل إلى 1.51 دولار. خيار ذكي وشامل لتحقيق النمو المالي.

تابع القراءة

كيفية استخدام القرض للاستثمار في تطوير مسارك المهني

تعرف على كيفية تمويل قرض تطوير المسار الوظيفي لنموك، مع استراتيجيات للسداد بكفاءة وتعزيز آفاقك المهنية.

تابع القراءة

استكشاف باي بال: ثورة الدفع الإلكتروني

اكتشف كيف يُحدث باي بال ثورة في طريقة إرسال واستلام الأموال. جرّب طريقة أكثر أمانًا وسرعة لإدارة أموالك.

تابع القراءة