بطاقة إئتمان

مراجعة بطاقة ماستركارد الرقمية الأولى: عزز رصيدك الائتماني!

بإمكانك تحسين سجلك الائتماني مع بطاقة ماستركارد الرقمية الأولى. هذه البطاقة الأصلية مقبولة في جميع أنحاء البلاد، وتوفر لك استردادًا نقديًا على جميع مدفوعاتك. ابدأ رحلتك نحو تعزيز قدرتك الائتمانية!

إعلان

سيتم تحويلك إلى موقع ويب آخر

احصل على استرداد نقدي بقيمة 1%، وأقساط شهرية ميسرة، وقم ببناء تاريخ ائتماني مع كل عملية شراء تقوم بها!

عندما يتعلق الأمر ببناء أو إعادة بناء سجلك الائتماني، فإن بطاقة ماستركارد الرقمية الأولى® قد تكون هذه البطاقة الائتمانية خيارًا جيدًا يستحق المراجعة. فهي تتميز ببعض الخصائص الجذابة، ويمكنها مساعدتك مع تقديم مكافآت.

قدّم طلبك للحصول على بطاقة ماستركارد الرقمية الأولى®

مع بطاقة ماستركارد الرقمية الأولى، يمكنك التقديم عبر الإنترنت في دقائق! اكتشف حلاً ائتمانياً يناسب جميع أنواع السجلات الائتمانية!

على الرغم من أن حاملي البطاقات يمكنهم استرداد النقود على المشتريات، فإن بطاقة ماستركارد الرقمية الأولى® يفرض بعض الرسوم خلال العملية. لذا، من الأفضل فهم الميزات قبل اتخاذ قرار التقديم.

- التصنيف الائتماني: صُممت هذه البرامج لتناسب الأفراد ذوي السجل الائتماني غير المثالي، مما يوفر فرصة لبناء أو إعادة بناء تاريخهم الائتماني.

- الرسوم السنوية: بالإضافة إلى رسوم البرنامج البالغة $95، تفرض هذه البطاقة رسومًا سنوية قدرها $75 للسنة الأولى. بعد ذلك، تصبح الرسوم السنوية $48.

- معدل الفائدة السنوي للشراء: 35.99%.

- معدل الفائدة السنوية للسحب النقدي: على غرار معدل الفائدة السنوي للشراء، فإن معدل الفائدة السنوي للسحب النقدي هو 35.99%.

- المكافآت: يحصل حاملو البطاقات على استرداد نقدي بقيمة 1% على جميع المدفوعات التي تُسدد رصيد حساباتهم. كما تحصل على نقاط مكافآت في نهاية كل دورة فوترة.

بطاقة ماستركارد الرقمية الأولى®: ملخص

على عكس معظم بطاقات بناء الائتمان، فإن بطاقة ماستركارد الرقمية الأولى® لا يتطلب وديعة تأمين، ولكن من الضروري مراجعة ميزاته للتأكد من أنه الخيار المناسب لك.

أولاً، من أبرز ميزاته سهولة الوصول التي يوفرها، حيث أنه لا يتطلب درجة ائتمانية مثالية للموافقة.

إضافةً إلى ذلك، يقدم البرنامج مكافآت مميزة بقيمة 1% تُسترد نقداً على جميع المدفوعات التي تُسدد رصيد حسابك. مع ذلك، لا يُمكن استبدال النقاط إلا بعد الوصول إلى 500 نقطة.

بالإضافة إلى ذلك، تُرسل البطاقة تقارير شهرية إلى مكاتب الائتمان. ويمكن أن يكون لهذا التقرير أثر إيجابي على السجل الائتماني للمستخدم، شريطة أن يسدد المدفوعات في الوقت المحدد.

تُصدر بطاقة First Digital Mastercard® من قبل بنك Synovus، وهو مؤسسة مالية مرموقة مقرها في كولومبوس، جورجيا، وتمنح المستخدمين الثقة في معاملاتهم المالية!

تحليل مزايا وعيوب بطاقة ماستركارد الرقمية الأولى®

كما ستجد في هذه المراجعة، فإن بطاقة ماستركارد الرقمية الأولى® يُتيح ذلك فرصةً لبناء سجل ائتماني ميسور التكلفة. ولكن من المهم دراسة الإيجابيات والسلبيات لاتخاذ قرار مدروس.

الإيجابيات

- لا يشترط الحصول على درجة ائتمانية مثالية للموافقة؛

- استرداد نقدي على جميع المدفوعات التي تتم لسداد رصيد الحساب؛

- عملية تقديم طلبات مريحة؛

- تساهم البطاقة بشكل إيجابي في السجلات الائتمانية للمستخدمين؛

- بإمكان حاملي البطاقات سداد دفعات شهرية ميسرة؛

- تطبيق جوال لإدارة الحساب بسهولة.

السلبيات

- رسوم البرنامج $95.00 التي يجب عليك دفعها عند الموافقة؛

- تفرض هذه البطاقة رسومًا سنوية؛

- يخضع استبدال نقاط المكافآت لحد أدنى قدره 500 نقطة؛

- لأسباب أمنية، لا يمكنك استخدام البطاقة في مضخات الوقود الآلية.

شروط الأهلية للحصول على بطاقة ماستركارد الرقمية الأولى®

هل ترغب في التقدم بطلب للحصول على هذه البطاقة؟ إذاً، راجع بعض معايير الأهلية للحصول على بطاقة First Digital Mastercard®، التي وضعها البنك المُصدر، Synovus Bank.

على الرغم من أن البطاقة مصممة لتناسب مجموعة من الملفات الائتمانية، إلا أنه يجب على الأفراد الامتثال لمتطلبات قانونية معينة، بما في ذلك تقديم معلومات الهوية اللازمة.

قد يشمل ذلك تفاصيل مثل الاسم والعنوان وتاريخ الميلاد ومعلومات أخرى تسمح للبنك بتحديد هوية مقدم الطلب بشكل معقول.

التقدم بطلب للحصول على بطاقة ماستركارد الرقمية الأولى®دليل

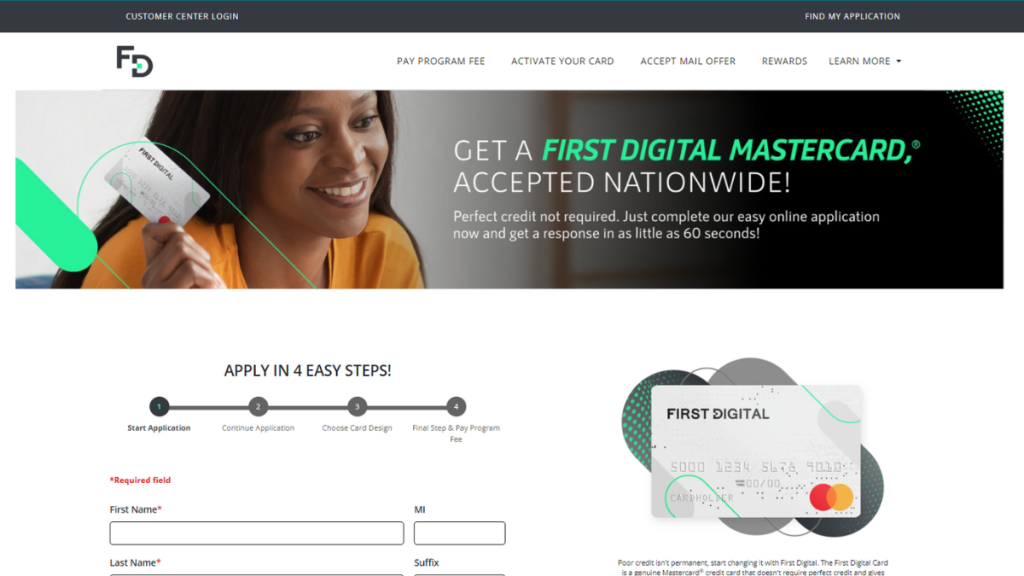

إذا كنت مستعدًا بعد هذه المراجعة للتقدم بطلب للحصول على بطاقة ماستركارد الرقمية الأولى®استعد لعملية تقديم طلب سهلة ومريحة! هذا يعني أنه يمكنك الحصول على ردك اليوم.

في النهاية، بأربع خطوات سهلة واستجابة لا تتجاوز 60 ثانية، يمكنك الحصول على بطاقة ماستركارد الرقمية الأولى الخاصة بك® وابدأ بتحسين وضعك الائتماني. اكتشف الخطوات التفصيلية أدناه!

قدّم طلبك للحصول على بطاقة ماستركارد الرقمية الأولى®

مع بطاقة ماستركارد الرقمية الأولى، يمكنك التقديم عبر الإنترنت في دقائق! اكتشف حلاً ائتمانياً يناسب جميع أنواع السجلات الائتمانية!

المواضيع الرائجة

أفضل الدورات التدريبية التي تساعدك على تطوير المهارات الأساسية للنمو الوظيفي

اكتشف أفضل الدورات التدريبية للنمو الوظيفي، مع استراتيجيات لتطوير المهارات التي ستجعلك متميزًا في هذا المجال.

تابع القراءة

كيفية تحقيق أقصى استفادة من تجربة التعلم في الدورات المهنية

حقق أقصى استفادة من الدورات التعليمية من خلال أطر عمل شخصية، وروتين يومي، ومشاركة فعالة لضمان نمو مهني مستدام.

تابع القراءةقد يعجبك أيضاً

كيفية الحفاظ على الحافز أثناء الالتحاق بدورات مهنية طويلة الأمد

حافظ على مستوى عالٍ من التحفيز طوال الدورات المهنية الطويلة من خلال استراتيجيات مثل تحديد المعالم الرئيسية، والروتين، ودعم المجتمع.

تابع القراءة