بطاقة إئتمان

دلتا سكاي مايلز® جولد: ارتقِ بتجربة سفرك مع مكافآت مصممة خصيصًا لك

تعرف على كيف تكافئ بطاقة دلتا سكاي مايلز® الذهبية إنفاقك اليومي وتعزز سفرك بمزايا دلتا.

إعلان

سيتم تحويلك إلى موقع ويب آخر

عزز كل جانب من جوانب رحلاتك بمزايا حصرية!

صُممت بطاقة دلتا سكاي مايلز® الذهبية خصيصاً للمسافرين الدائمين، فهي تجمع بين مزايا السفر المحسّنة والمكافآت اليومية لتعزيز رحلاتك ومشترياتك اليومية.

بفضل مزايا مثل أولوية الصعود إلى الطائرة وتوفير المال أثناء الرحلة، فهي ضرورية لعملاء دلتا المخلصين الذين يبحثون عن قيمة!

- متطلبات درجة الائتمان: يلزم الحصول على تصنيف جيد يتراوح بين 670 و850 للحصول على هذه البطاقة

- الرسوم السنوية: ابدأ بدون رسوم في السنة الأولى، ثم انتقل إلى رسوم سنوية قدرها $150، مما يوفر قيمة كبيرة للمسافرين الدائمين.

- معدل الفائدة السنوي للشراء: معدل متغير بين 20.24% و 29.24%

- معدل الفائدة السنوية للسحب النقدي: من المتوقع أن يكون السعر متغيراً، وهو حالياً عند 29.74%، مع إمكانية التغيير.

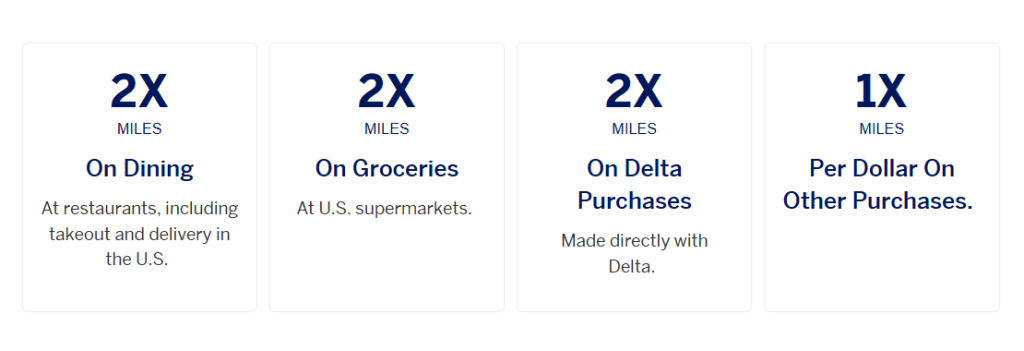

- المكافآت:

- اكسب ميلين لكل دولار تنفقه على معاملات دلتا المؤهلة، بما في ذلك الرحلات الجوية والمشتريات على متن الطائرة.

- استمتع بميلين لكل دولار تنفقه على تناول الطعام عالميًا، بما في ذلك الطلبات الخارجية والتوصيل داخل الولايات المتحدة.

- احصل على ميلين مقابل كل دولار تنفقه على التسوق في متاجر البقالة الأمريكية

- اكسب ميلًا واحدًا لكل دولار لجميع فئات الإنفاق المؤهلة الأخرى

دلتا سكاي مايلز® جولد: مراجعة شاملة

سيجد المسافرون الدائمون على خطوط دلتا أن بطاقة دلتا سكاي مايلز® الذهبية مناسبة تمامًا لكسب الأميال سواء في الجو أو من خلال الإنفاق الروتيني.

توفر هذه البطاقة هيكل مكافآت بسيط، مما يسمح لحاملي البطاقة بكسب أميال على مجموعة متنوعة من المشتريات، والتي يمكن استبدالها برحلات طيران وترقيات للمقاعد والمزيد.

لمن هذا المنتج؟

تُعد هذه البطاقة مثالية للمسافرين الذين:

- أسافر بانتظام مع خطوط دلتا الجوية: يستفيد المسافرون الدائمون على خطوط دلتا من مزايا مثل الأمتعة المسجلة المجانية وأولوية الصعود إلى الطائرة، مما يوفر الوقت والمال.

- هل ترغب في كسب أميال على مشترياتك اليومية؟ يمكن لحاملي البطاقات تجميع الأميال على المشتريات اليومية مثل البقالة وتناول الطعام ونفقات السفر، مما يسهل كسب المكافآت.

- ابحث عن مزايا متعلقة بالسفر بدون رسوم سنوية مرتفعة: إن الرسوم السنوية التمهيدية البالغة $0 للسنة الأولى والرسوم التنافسية البالغة $150 بعد ذلك تجعل هذه البطاقة في متناول الأشخاص المهتمين بالميزانية.

ما الذي يجعله مميزاً؟

ما يجعل بطاقة دلتا سكاي مايلز® الذهبية استثنائية حقاً هو مجموعة مزاياها:

- حقيبة الأمتعة الأولى المسجلة مجاناً: يمكن لحاملي البطاقات وما يصل إلى ثمانية مرافقين على نفس الحجز فحص حقيبتهم الأولى مجاناً على رحلات دلتا، مما قد يوفر عشرات الدولارات لكل رحلة ذهاب وعودة لكل شخص.

- أولوية الصعود إلى الطائرة: استمتع بأولوية الصعود إلى الطائرة في المقصورة الرئيسية رقم 1، مما يسمح لك بالاستقرار بشكل أسرع وإيجاد مساحة لحقيبة يدك.

- $100 رصيد رحلة دلتا: قم بتحقيق $10,000 في الإنفاق السنوي واحصل على رصيد رحلات دلتا بقيمة $100، وهو مثالي لتعويض تكاليف السفر المستقبلية.

كيف تعمل أميال سكاي مايلز وكيفية تحقيق أقصى استفادة منها

يتيح لك برنامج دلتا سكاي مايلز® كسب الأميال من خلال عمليات الشراء واستخدامها لتغطية نفقات السفر.

تبقى أميالك فعّالة إلى أجل غير مسمى، مما يتيح لك المرونة في استبدالها عندما يناسبك ذلك.

كيفية ربح الأميال:

- احجز رحلات دلتا: اكسب أميالاً إضافية على التذاكر المحجوزة عبر دلتا.

- الإنفاق اليومي: استخدم بطاقتك لشراء البقالة، وتناول الطعام، والمشتريات اليومية لزيادة رصيدك بشكل مطرد.

تحقيق أقصى استفادة من أميالك:

- استخدم الأميال لرحلات دلتا أو مع شركاء سكاي تيم، لتحقيق أقصى استفادة منها.

- خطط مسبقاً للسفر باستخدام الأميال، حيث قد تتطلب الرحلات الجوية أميالاً أقل عند الحجز المبكر.

- ابحث عن عروض "فلاش سيلز" من دلتا على رحلات المكافآت، والتي تقدم أسعارًا مخفضة للأميال على مسارات مختارة.

من خلال الاستفادة من هذه الاستراتيجيات، يمكنك استخلاص أقصى قيمة من أميال سكاي مايلز الخاصة بك، وتوسيع نطاق استخدامها إلى ما هو أبعد من مجرد الرحلات الجوية.

تحليل المزايا والعيوب

قبل اتخاذ قرار بشأن ما إذا كانت هذه البطاقة تتوافق مع أهدافك المالية، من الضروري الموازنة بين إيجابياتها وسلبياتها.

الإيجابيات

- مكافآت سخية على المطاعم والبقالة: اكسب ميلين لكل دولار في المطاعم حول العالم وفي محلات السوبر ماركت الأمريكية، مما يسهل عليك تجميع الأميال من خلال الإنفاق اليومي.

- مزايا حصرية: استمتع بشحن الأمتعة المجاني وأولوية الصعود إلى الطائرة، المصممة لتبسيط رحلتك وتوفير المال.

- السفر دولياً: تجنب الرسوم الإضافية على المشتريات التي تتم في الخارج، حيث لا توجد رسوم على المعاملات الأجنبية.

- إعفاء من الرسوم السنوية التمهيدية: استمتع بالسنة الأولى بدون رسوم سنوية، مما يتيح لك تجربة مزايا البطاقة قبل الالتزام برسوم $150 في السنوات اللاحقة.

السلبيات

- تركيز محدود على شركات الطيران: تُعد مزايا البطاقة مفيدة بشكل أساسي لأولئك الذين يسافرون بشكل متكرر مع دلتا، بينما تقدم قيمة أقل للمسافرين الذين يفضلون شركات طيران أخرى.

- الرسوم السنوية بعد السنة الأولى: بينما السنة الأولى مجانية، يتم تطبيق الرسوم السنوية $150 بعد ذلك، وهو ما قد لا يكون مبرراً للمسافرين غير المتكررين على خطوط دلتا الجوية.

- معدل الفائدة السنوي المتغير: مع معدل فائدة سنوي للشراء يتراوح من 20.24% إلى 29.24%، فإن الاحتفاظ برصيد يمكن أن يؤدي إلى رسوم فائدة كبيرة.

التقدم بطلب للحصول على البطاقة

إذا كنت تعتقد أن هذه البطاقة تتناسب مع عاداتك في السفر والإنفاق، فإليك كيفية التقديم:

- قم بزيارة الموقع الرسمي: توجه إلى موقع Amex الإلكتروني لبدء عملية تقديم طلب بطاقة Delta SkyMiles® الذهبية.

- مراجعة تفاصيل البطاقة: تعرّف على شروط البطاقة ومزاياها ورسومها للتأكد من أنها تلبي احتياجاتك.

- أكمل الطلب: قم بتقديم بياناتك عبر النموذج الإلكتروني، مع توفير المعلومات الشخصية والمالية اللازمة للتقديم.

- تقديم الطلب وانتظار القرار: بعد تقديم الطلب، ستتلقى قرار الموافقة، غالباً في غضون دقائق.

شروط الأهلية

يشترط للحصول على هذه البطاقة الائتمانية استيفاء معايير محددة، بما في ذلك:

- متطلبات الائتمان: يجب أن يكون لدى المتقدمين درجة ائتمانية تتراوح بين الجيدة والممتازة، وعادة ما تكون بين 670 و850.

- شرط السن: يجب أن يكون عمرك 18 عامًا على الأقل للتقديم.

- الإقامة: يجب أن يكون المتقدمون مواطنين أمريكيين أو مقيمين دائمين لديهم رقم ضمان اجتماعي ساري المفعول.

- دخل: مصدر دخل ثابت لدعم الالتزامات الائتمانية.

استكشف الخيارات البديلة من أمريكان إكسبريس

بينما تقدم بطاقة دلتا سكاي مايلز® الذهبية من أمريكان إكسبريس مزايا قيّمة لعشاق دلتا، فإن أولئك الذين يبحثون عن مجموعة أوسع من مزايا السفر قد يفكرون في بطاقة أمريكان إكسبريس البلاتينية.

تقدم هذه البطاقة المميزة مكافآت سفر استثنائية، بما في ذلك دخول الصالات، ورصيد شركات الطيران، ونقاط إضافية على الرحلات الجوية.

بالنسبة لأولئك الذين يبحثون عن مزايا سفر من الدرجة الأولى عبر شركات طيران متعددة، فإن بطاقة أمريكان إكسبريس البلاتينية® هي بديل جذاب يستحق التفكير فيه.

المواضيع الرائجة

أفضل الدورات التدريبية التي تساعدك على تطوير المهارات الأساسية للنمو الوظيفي

اكتشف أفضل الدورات التدريبية للنمو الوظيفي، مع استراتيجيات لتطوير المهارات التي ستجعلك متميزًا في هذا المجال.

تابع القراءة

كيفية تنزيل تطبيقات إدارة الميزانية؟

تعرّف على كيفية تنزيل تطبيقات إدارة الميزانية على جهازك المحمول. تمكّن من إدارة أموالك بسهولة وتنظيم أمورك المالية الشخصية.

تابع القراءة

مراجعة موقع Indeed: نصائح وميزات ورؤى

استكشف موقع Indeed، وهو محرك بحث قوي عن الوظائف لا يربط الباحثين عن عمل بالفرص فحسب، بل يوفر أيضًا موارد لكليهما.

تابع القراءةقد يعجبك أيضاً

فوائد الالتحاق بالدورات التدريبية عبر الإنترنت للتقدم الوظيفي

ارتقِ بمسارك المهني من خلال الدورات التدريبية عبر الإنترنت عن طريق اختيار البرامج المناسبة وتطبيق المهارات لتحقيق نمو حقيقي في العالم الواقعي.

تابع القراءة

تطبيق كاش: رفيقك المالي الأمثل للميزانية وإدارة الأموال

تطبيق كاش آب هو خدمة دفع عبر الهاتف المحمول تُسهّل معاملاتك المالية. تم تطويره بواسطة شركة سكوير.

تابع القراءة