بطاقة إئتمان

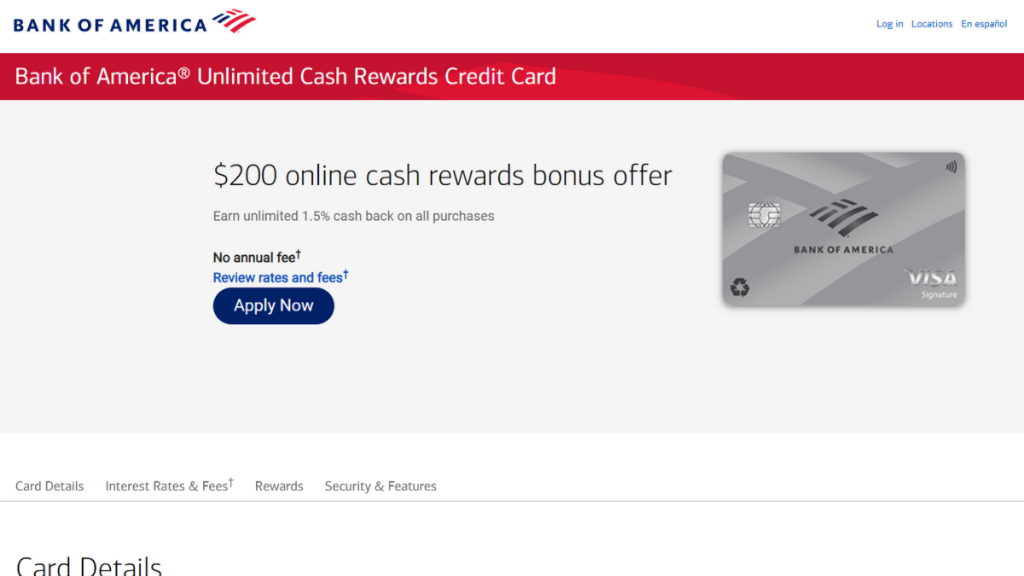

بطاقة مكافآت بنك أوف أمريكا® النقدية غير المحدودة: اربح المزيد!

اربح مكافآت لا حصر لها مع بطاقة ائتمان بنك أوف أمريكا® للمكافآت النقدية غير المحدودة. استمتع باسترداد نقدي غير محدود بقيمة 1.51 تريليون دولار أمريكي ورسوم سنوية مخفضة بقيمة 1 تريليون دولار أمريكي فقط لمشترياتك.

إعلان

سيتم تحويلك إلى موقع ويب آخر

احصل على مكافآت لا حصر لها مع كل تمريرة، وكل ذلك بدون رسوم سنوية.

إذا كنت تبحث عن بطاقة ائتمان سهلة الاستخدام ومجزية وغير مكلفة، فإن مراجعة بطاقة المكافآت النقدية غير المحدودة من بنك أوف أمريكا® هذه مصممة خصيصًا لك.

قدّم طلبك للحصول على مكافآت نقدية غير محدودة من بنك أوف أمريكا®

استمتع بإمكانيات ربح غير محدودة وبدون رسوم سنوية عند التقدم بطلب للحصول على بطاقة مكافآت بنك أوف أمريكا النقدية غير المحدودة!

بفضل تصميمها البسيط، توفر هذه البطاقة مجموعة واسعة من المزايا التي تُسهّل عليك استخدام مشترياتك اليومية وتُحسّن وضعك المالي. لذا، تابع القراءة لتتعرف على جميع مزاياها.

- التصنيف الائتماني: الأنسب لأولئك الذين يتمتعون بتصنيف ائتماني جيد إلى ممتاز، مما يضمن عملية موافقة أكثر سلاسة.

- الرسوم السنوية: $0;

- معدل الفائدة السنوي للشراء: فترة أولية مدتها 15 شهراً بفائدة منخفضة. بعد ذلك، يتم تعديل السعر بناءً على جدارتك الائتمانية، ويتراوح بين 18.24% و 28.24%.

- معدل الفائدة السنوية للسحب النقدي: يتراوح بين 21.24% و 29.24%، لذا من الأفضل استخدامه باعتدال.

- المكافآت: كل عملية شراء تضيف 1.5% مباشرة إلى حسابك، مما يجعل الإنفاق أكثر فائدة بدون أي حدود.

بطاقة بنك أوف أمريكا® للمكافآت النقدية غير المحدودة: نظرة عامة

اكتشف مكافآت لا حصر لها مع بطاقة بنك أوف أمريكا® للمكافآت النقدية غير المحدودة. كل عملية شراء تعيد لك المال، مما يُسهّل عليك عملية الادخار بكل سهولة.

بالإضافة إلى ذلك، ستتمكن من الاستمتاع ببطاقة ائتمان بدون رسوم سنوية. هذه الميزة تُحافظ على مرونة وضعك المالي، وتُوفر لك مدخرات تتراكم مع مرور الوقت، مما يُعزز جاذبية البطاقة للمستخدمين الذين يُحسنون إدارة أموالهم.

بالإضافة إلى ذلك، تُعدّ فترة سعر الفائدة التمهيدي بمثابة استراحة مالية. إذ ينتقل السعر إلى معدل متغير (18.24% – 28.24%)، مما يوفر مزيجًا من المرونة وقابلية التكيف بعد انتهاء الفترة التمهيدية.

علاوة على ذلك، تُعتبر السلامة والراحة من أهم الأولويات. تحمي البطاقة إنفاقك مع توفير خيارات استرداد سهلة ومرنة، مما يضمن لك راحة البال.

وأخيرًا، يمكنك الحصول على معدلات استرداد نقدي فائقة من خلال الانضمام إلى برنامج المكافآت المفضلة، مما يدفع تراكم مكافآتك إلى مستويات رائعة تصل إلى 75%.

تحليل مزايا وعيوب بطاقة ائتمان بنك أوف أمريكا® للمكافآت النقدية غير المحدودة

دعونا نلقي نظرة على الميزات الرئيسية لبطاقة بنك أوف أمريكا® للمكافآت النقدية غير المحدودة ونقارنها. تجدونها أدناه.

الإيجابيات

- احصل على معدل ثابت قدره 1.5% على كل شيء، في كل مكان. بلا حدود.

- فهو يحافظ على ميزانيتك دون أي رسوم سنوية.

- بداية موفقة مع معدل فائدة سنوي منخفض لمدة 15 شهرًا، مما يسهل عملية التمويل.

- تتدفق المكافآت بحرية، ويمكنك استبدالها كما تشاء.

- إجراءات أمنية قوية للغاية لحماية إنفاقك.

- لا تنتهي صلاحية استرداد النقود أبدًا.

السلبيات

- لسوء الحظ، قد يؤدي معدل الفائدة السنوي بعد شهر العسل إلى كسر قلبك.

- تُفرض رسوم قدرها 3% لكل عملية تحويل رصيد.

- سعر ثابت واحد لجميع المشتريات، بدون فئات خاصة.

- قد يترتب على السفر إلى الخارج رسوم إضافية.

شروط الأهلية للحصول على بطاقة ائتمان بنك أوف أمريكا® للمكافآت النقدية غير المحدودة

كما قد تكون لاحظت في مراجعة بطاقة مكافآت بنك أوف أمريكا® النقدية غير المحدودة، فإن هذه البطاقة تتطلب درجة ائتمانية أعلى.

علاوة على ذلك، يجب عليك استيفاء معايير تأهيل أخرى مثل أن تكون بالغًا قانونيًا، وأن تكون مواطنًا أمريكيًا ولديك عنوان بريدي، ودخل ثابت بدون حالات إفلاس، وغير ذلك.

قد يكون بنك أوف أمريكا صارمًا جدًا في منح الائتمان. لذا، تأكد من مراجعة وضعك الائتماني قبل تقديم أي طلب حتى لا يؤثر ذلك سلبًا على سجلك الائتماني.

دليل التقديم على بطاقة ائتمان بنك أوف أمريكا® للمكافآت النقدية غير المحدودة

والآن، بعد أن رأيت ما يمكن أن تقدمه بطاقة الائتمان "بنك أوف أمريكا®" للمكافآت النقدية غير المحدودة لأموالك، فقد حان الوقت لاتخاذ الخطوة التالية ومراجعة كيفية عمل عملية التقديم.

على الرغم من سهولة طلب بطاقتك عبر الإنترنت، إلا أن هناك طرقًا أخرى للتقديم أيضًا. تعرّف عليها جميعًا من خلال الرابط التالي، واستعد لتجربة تسوق مميزة ومجزية مدى الحياة!

قدّم طلبك للحصول على مكافآت نقدية غير محدودة من بنك أوف أمريكا®

استمتع بإمكانيات ربح غير محدودة وبدون رسوم سنوية عند التقدم بطلب للحصول على بطاقة مكافآت بنك أوف أمريكا النقدية غير المحدودة!

المواضيع الرائجة

بطاقة يو إس بنك ألتيتيود جو فيزا: بدون رسوم سنوية ومكافآت ممتازة

اكسب مكافآت على تناول الطعام، وخدمات البث، ومشتريات البقالة، والمزيد مع بطاقة US Bank Altitude® Go Visa Signature® - بدون رسوم سنوية، ومزايا لا حصر لها!

تابع القراءة

برنامج Ink Business Cash®: اربح مبالغ نقدية عالية مع مزايا أساسية للأعمال

اكتشف استراتيجيات إنفاق أكثر ذكاءً مع بطاقة Ink Business Cash®. اربح ما يصل إلى 5% كاسترداد نقدي على مشتريات مختارة - كل ذلك بدون رسوم سنوية!

تابع القراءةقد يعجبك أيضاً

مراجعة تطبيق Chime: الخدمات المصرفية بلمسة عصرية

اكتشف تطبيق Chime، التطبيق المالي الذي يُحدث ثورة في طريقة تعامل الناس مع الخدمات المصرفية بفضل وفرة وظائفه.

تابع القراءة

أفضل تطبيقات إدارة الميزانية: حمّلها وقم بإدارة أموالك

هل ترغب في تنظيم أمورك المالية بكفاءة؟ اقرأ المقال لاكتشاف أفضل تطبيقات الميزانية لإدارة حياتك المالية.

تابع القراءة