Credit Card

Apply for Upgrade Triple Cash Rewards Visa®: Fixed Payments

With the Upgrade Triple Cash Rewards Visa®, you get not just a card but a spending partner, offering wide acceptance and predictable payments to help streamline your finances and budget effectively.

Advertisement

Plan your budget effectively with predictable monthly payments on large purchases!

Getting a reliable card that combines high credit limits, rewards, and no annual fee might seem impossible. But when you apply for the Upgrade Triple Cash Rewards Visa®, you know it’s real.

This is a card that provides unparalleled flexibility and convenience. You can make large purchases and pay them back as if you would a loan, with fixed monthly installments that fit your budget.

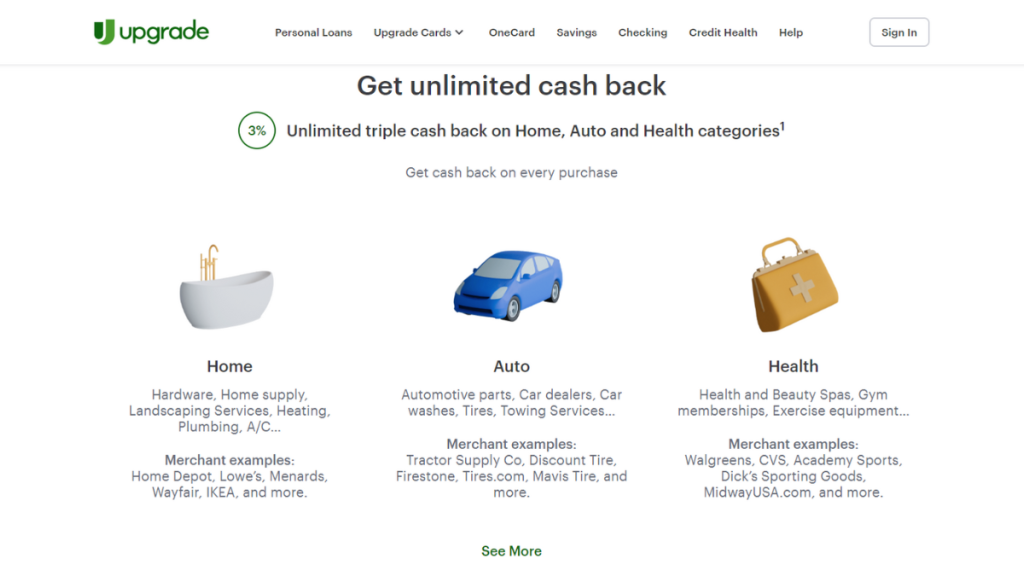

Not only that, but essential purchases for your home, car, or health get you rewarded with 3% back. Anything else gives you a 1% return, making every swipe an opportunity to earn more.

Discover how the Upgrade Triple Cash Rewards Visa® can change your finances when you apply. Keep reading to learn about the entire process and how to request yours with ease!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes Upgrade Triple Cash Rewards Visa® stand out

When you apply for the Upgrade Triple Cash Rewards Visa®, you’re stepping into a new level of financial management. With no annual fees and generous rewards, it’s a card that helps you evolve.

Mirroring a loan, the Upgrade Triple Cash Rewards Visa® can give you a limit of up to $25,000, and you can repay your big purchases in equally fixed monthly installments. It’s flexibility at your fingertips.

Moreover, buying items for your home, health, and vehicle automatically earns you 3% back. All other purchases give you a 1% return. Therefore, no matter what you buy, there’s always a reward.

Lastly, the card’s robust security and broad acceptance means you can take it anywhere in the world and have peace of mind with every transaction. It’s not just a card, it’s a financial ally.

Application Options for the Upgrade Triple Cash Rewards Visa®

While the Upgrade Triple Cash Rewards Visa® offers an incredible mobile app for account management, you can only apply online for it. But the website is mobile-friendly for your convenience!

How to apply online

- Visit the Official Website: Start by navigating to the Upgrade website. Look for the “Credit Cards” section and select the Upgrade Triple Cash Rewards Visa®.

- Pre-Qualification Process: Engage in the pre-qualification process, which involves a soft pull on your credit so it remains unaffected. This step gives you an idea of your eligibility.

- Complete the Form: Fill out the detailed application form with your personal, financial, and employment information. Ensure accuracy to prevent any delays in the approval process.

- Review and Submit: Before submitting, review all the information you’ve entered for accuracy. Once satisfied, submit your application to proceed with the credit evaluation.

- Await Approval: After submission, wait for a response from Upgrade. You may be approved instantly or, in some cases, might need to provide additional information.

- Receive Your Card: Once approved, your Upgrade Triple Cash Rewards Visa® will be mailed to you. Follow any activation instructions included to start using your card.

Would you like to learn about other options? Here’s the Avant Credit Card

If you’re on the fence about whether or not to apply for the Upgrade Triple Cash Rewards Visa®, or if you still need to work on your score in order to get it, we have another recommendation.

The Avant Credit Card is known for its lenient credit requirements and easy application process. Also, it offers a practical route for credit building, with automatic reviews for credit limit increases.

Moreover, with its transparent fee structure and absence of hidden charges, the Avant Credit Card stands out as a straightforward, user-friendly financial tool for everyday use.

So, are you intrigued by the Avant Credit Card’s offerings? Delve into how it can serve as a solid alternative to the Upgrade Triple Cash Rewards Visa®! Learn more in the link below.

Apply for Avant Credit Card

From eligibility checks to the actual application submission, discover the simple process to apply for the Avant Credit Card online!

Trending Topics

BankAmericard® Credit Card: No Annual Fee and Extended 0% APR

BankAmericard® Credit Card offers 0% APR for 18 months, no annual fee, and low costs—perfect for managing debt and saving on interest.

Keep Reading

How to Make the Most of Free Online Courses for Skill Development

Maximize free online courses by setting clear goals, building consistent study habits, and applying skills for real-world career growth.

Keep Reading

How to Choose a Loan That Matches Your Financial Goals

Learn how to choose loan goals that fit your financial priorities with tips on loan types, repayment strategies, and long-term success.

Keep ReadingYou may also like

Venmo: The Fun and Convenient Way to Split Bills and Share Expenses!

Embark on a journey toward smarter money management and hassle-free transactions. Get ready to experience the ease of Venmo!

Keep Reading

Best Budgeting Apps: Download and Manage Your Finances

Do you want to efficiently organize your finances? Read the article to discover the best budget apps to manage your financial life.

Keep Reading