Credit Card

Apply for Revvi Card: Accessible Credit!

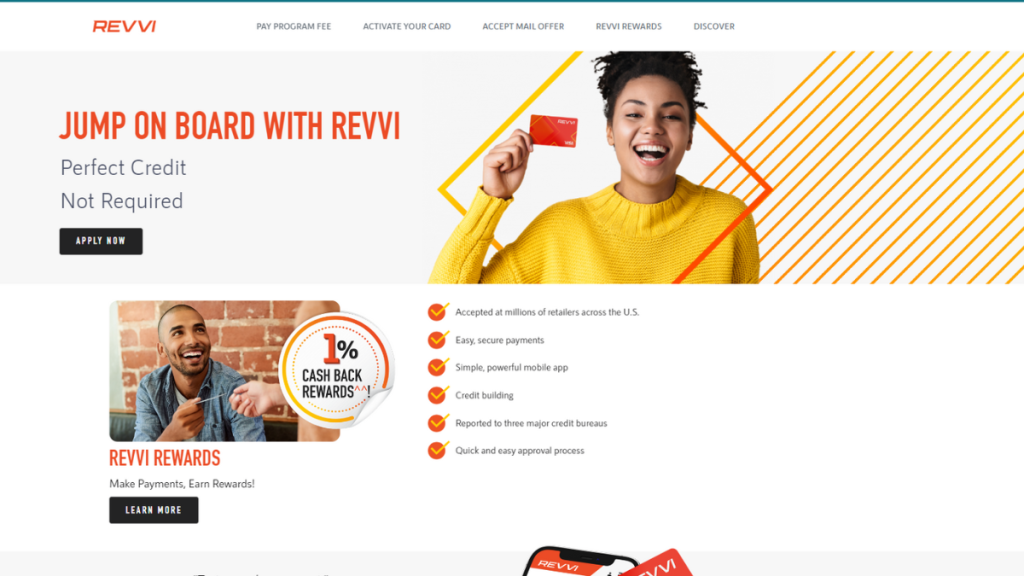

Take control of your finances and access valuable credit resources with the Revvi Card. Enjoy a Visa® credit card option, regardless of your credit history! All you have to do is access the website and apply in a few easy steps!

Advertisement

With clear instructions and helpful tips, applying for a genuine Visa® credit card has never been easier!

Having a credit card that offers you rewards even with a low credit score is possible! All you have to do is apply for the Revvi Card and get a genuine Visa® card in your hands.

While it offers a chance to establish or even build your credit, the Revvi Card also features a generous cash back program. With this card, you get 1% cash back on your payments.

Besides, by reporting to some of the major credit bureaus in the country, the Revvi Card can help you improve your score over time. So, are you ready to take control of your financial future?

Then keep reading to discover how to apply for this credit card in a few steps easily. The process is online, and all you have to do is fill out the form and get your answer in minutes!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes the Revvi Card stand out

With a focus on accessibility and empowerment, the Revvi Card can be a good option to apply if you’re on the lookout for a credit card that accepts individuals with varying credit backgrounds.

Moreover, this inclusive approach opens doors to financial opportunities for those who may have faced barriers in the past, offering a pathway to building or rebuilding credit.

While it does have fees, including a one-time Program Fee and an Annual Fee, you can expect transparency regarding these costs. These fees contribute to the maintenance of the card program.

In summary, the Revvi Card offers a rewards program on payments, credit-building support, and a convenient way to manage your finances. All you have to do is apply to reach your financial goals!

Application Options for the Revvi Card

Whether you’re looking to build credit, earn rewards, or simply access a Visa® credit card option, apply for the Revvi Card and get support on your journey to financial independence.

How to apply online

- Go to the official website: Start your process by accessing the official Revvi Card website. Then, take some time to explore the features, benefits, and terms of the Revvi Card to ensure it aligns with your financial goals and needs.

- Check eligibility: Before applying for the Revvi Card, ensure you meet the eligibility criteria. Applicants must be at least 18 years old, have a valid Social Security number, and possess a checking account in their name.

- Fill out the form: When you’re ready, fill out the on-page form with your personal information, such as your name, address, Social Security number, and employment information.

- Submit the application form: Once you’re done, review the information provided and click to submit the form. You’ll receive a response in seconds.

- Approval: If your application is approved, you’ll be required to pay a one-time Program Fee to open your account. Once you’ve received your Revvi Card in the mail, activate it by following the instructions provided with the card.

Would you like to learn about other options? Here’s the Avant Credit Card!

So, looking for a credit-building card with fewer fees attached? Then, before you decide to apply for the Revvi Card, check out another compelling option! Meet the Avant Credit Card.

With features like no deposit required and a competitive APR, it also provides an accessible credit solution for those looking to build or rebuild their credit. And it comes with an intuitive mobile app!

This allows users to manage their accounts with ease, providing tools for tracking spending, making payments, and monitoring credit activity. Curious to learn more about this credit card?

With a commitment to empowering your credit journey, the Avant Credit Card stands as a viable alternative to consider. Discover more features and benefits in an exclusive review below!

Apply for Avant Credit Card

From eligibility checks to the actual application submission, discover the simple process to apply for the Avant Credit Card online!

Trending Topics

US Bank Altitude® Go Visa: No Annual Fee and Excellent Rewards

Earn rewards on dining, streaming, groceries, and more with the US Bank Altitude® Go Visa Signature® Card—no annual fee, endless benefits!

Keep ReadingYou may also like

Chase Sapphire Preferred Credit Card: Premium Travel Rewards

Explore the Chase Sapphire Preferred Credit Card: travel rewards, dining perks, and flexible point redemption. Unlock premium benefits!

Keep Reading

Discover it® Chrome: Earn Cashback on Gas and Dining

Discover the benefits of the Discover it® Chrome Gas & Restaurant Credit Card, offering 2% cashback on gas and dining with no annual fee!

Keep Reading