Credit Card

Apply for FIT Mastercard®: Monitor Your Credit

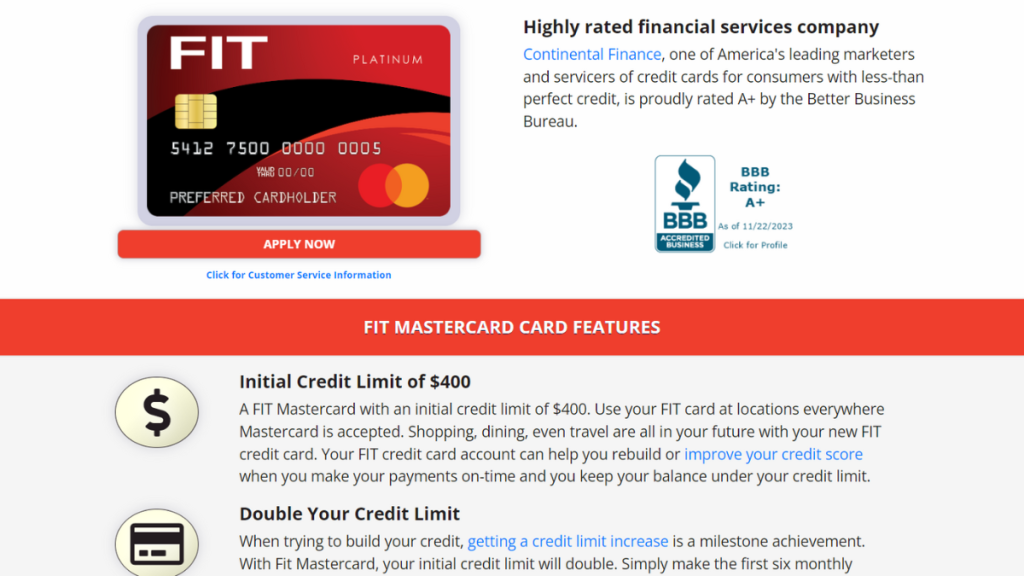

Start the journey of credit improvement with ease. Applying for the FIT™ Platinum Mastercard® is your first step to a secure, better financial future with unmatched benefits and simple management.

Advertisement

Reshape your financial health with a card designed for credit improvement

Are you starting a credit-building quest? Then, learn how to easily apply for the FIT Mastercard® and take that first needed step toward financial recovery.

This card is designed with your credit-building journey in mind, offering an accessible path to improved credit scores. With a quick application process, it welcomes all credit backgrounds.

The FIT Mastercard® comes with no deposit requirements, protection against fraud, and a helpful mobile management feature. Plus, you have the opportunity to double your limit.

However, it’s important to review the card’s set of fees to understand its cost-effectiveness. If you’re ready to see how fast applying for the FITMastercard® is, keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes FIT Mastercard® stand out

The FIT Mastercard® shines in rebuilding credit. Its easy reporting to bureaus helps users improve scores efficiently, making it a solid choice for financial improvement.

Its main appeal lies in the credit limit increase after six on-time payments. This feature rewards responsible use, offering an incentive for those committed to better financial habits.

Also, applying for the FIT Mastercard® is effortless, welcoming those with all kinds of credit backgrounds. Its accessibility is a major plus on the path to healthy credit.

Moreover, the card’s Zero Liability protection and mobile app make managing finances straightforward, highlighting the card’s modern approach to credit building.

Application Options for the FIT Mastercard®

If you’re after a convenient spending partner that helps you achieve financial success, then learn how to apply for the FIT Mastercard® with our step-by-step guide below!

How to apply online

- Start the Process: Visit the FIT Mastercard® website to begin your application, marking the first step towards rebuilding your credit.

- Fill Out the Application: Complete the application with your personal details, including name, social security number, birth date, and physical address, to verify your identity.

- Confirm Your Checking Account: A checking account is necessary for applying, serving as evidence of your financial stability and ability to manage a credit account responsibly.

- Await the Decision: Submit your application and wait. An instant decision is common, but sometimes more information is needed, potentially extending the process.

- Program Fee Payment: Upon approval, you’ll need to pay a program fee to activate your account, a crucial step before your FIT Mastercard® is issued and sent.

- Card Arrival: Once approved and the program fee is paid, your new credit card will be mailed within three business days, inviting you to begin your credit improvement journey.

- Activate Your Card: Upon receiving your card, promptly activate it online or by phone. This step is crucial to start using your card and benefit from its features.

- Download the Mobile App: For convenient account management, download the card’s mobile app. It allows easy tracking of purchases, payments, and credit score updates.

How to apply over the phone

- Call Customer Service: Begin by dialing the official customer service number at 1-888-673-4755. This direct line connects you to a representative who can assist with your application.

- Provide Necessary Information: Be ready to share your personal and financial details, including your full name, social security number, and physical address.

- Verify Financial Stability: Confirm you have a checking account during the call, as this is a requirement for the process, showing your capability to manage finances.

- Listen for Approval Details: The representative will guide you through the approval process. An instant decision may be possible; otherwise, they’ll inform you of any additional steps.

- Understand Fees and Activation: If approved, discuss the program fee payment and how to activate your card once it arrives. This ensures you’re fully prepared to use it.

Would you like to learn about other options? Here’s the Mission Lane Visa® Credit Card

If you’re not sure whether or not to apply for the FIT Mastercard®, the Mission Lane Visa® Credit Card could be a worthy alternative. It’s also a strong credit-building ally.

Additionally, the Mission Lane Visa® Credit Card often starts users with a higher initial credit limit, adding more financial flexibility. This makes it an appealing choice if you require more spending power.

Furthermore, it mirrors the FIT card in offering consumer protection and accessible online account management. These features streamline financial tracking and protect user transactions.

So, are you eager for more details? Then, learn everything about the Mission Lane Visa® Credit Card in the link below. This card might just be the key to unlocking your financial potential.

Apply for Mission Lane Visa® Credit Card

From low APRs to hassle-free application process, apply for the Mission Lane Visa® Credit Card and improve your credit with confidence!

Trending Topics

Amazon Openings: Start at Over $18 per Hour Plus Benefits

Explore Amazon jobs starting at $18/hour. Entry-level roles with benefits and real chances for career growth in the U.S.!

Keep Reading

Exploring PayPal: The Online Payment Revolution

Discover how PayPal revolutionizes the way we send and receive money. Experience a safer and faster way to handle your finances.

Keep ReadingYou may also like

Freelancer Review: Platform for Freelance Opportunities

Discover Freelancer, a dynamic platform connecting freelancers and clients worldwide. Explore functionalities, advantages, and comparisons!

Keep Reading

Grow Debit Mastercard: Build Credit with No Fees

Build credit effortlessly with the Grow Debit Mastercard! A fee-free, debt-free solution perfect for those with limited credit history.

Keep Reading