Credit Card

Apply for Discover It® Secured Credit Card: Securing Your Future!

Start your credit journey by confidently applying for the Discover It® Secured Credit Card. Get the chance to change your financial future and get rewarded by using your card responsibly!

Advertisement

Earn rewards, get upgraded through responsible use and enjoy a quick application process!

Finding a credit card with numerous benefits for individuals with low scores is uncommon. But when you apply for the Discover It® Secured Credit Card, you find out that such possibilities do exist!

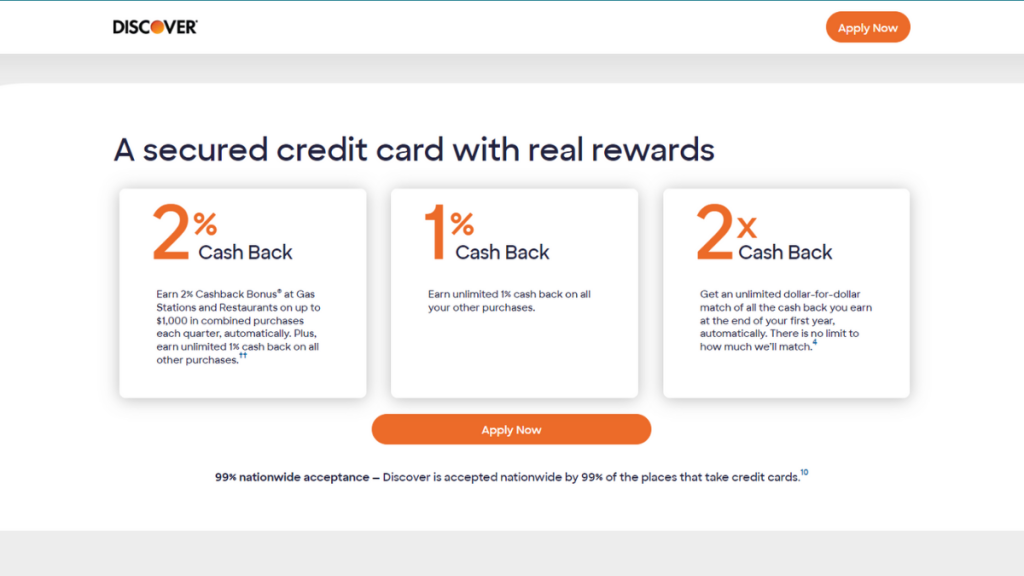

With a unique blend of rewards, this card is one of a kind when it comes to improving a financial profile. Enjoy money back on purchases and get rewarded for responsible behavior.

Moreover, by reporting to credit bureaus and regularly analyzing your account, it offers a chance to get your security deposit back! Then, you’ll know when you’re ready to try for a traditional card.

Discover a plethora of benefits and beyond when you obtain the Discover It® Secured Credit Card. With a quick and easy process, you can get your response in minutes! Learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes the Discover It® Secured Credit Card stand out

When you apply for the Discover It® Secured Credit Card, you gain access to a dependable and adaptable tool designed for individuals looking to bolster or refresh their creditworthiness.

What distinguishes this card is its inclusive approach, requiring no specific credit score for an application, thereby welcoming a diverse range of applicants, no matter their credit histories.

Moreover, the absence of any fee charges annually alleviates financial burdens. This allows you to concentrate solely on enhancing your credit without fretting over additional costs.

Finally, of course, the allure of cashback adds an extra layer of appeal to the card. This makes every dollar spent count towards financial gains. So, what are you waiting for? Apply now!

Application Options for the Discover It® Secured Credit Card

As previously noted, it’s a straightforward process to apply for the Discover It® Secured Credit Card. With a user-friendly platform, all you have to do is follow the steps and get a quick response!

How to apply online

- Go to the official website: Firstly, access the website and click on the “Credit Cards” option on the screen. Next, choose the credit card of your preference. Specifically the Discover It® Secured Credit Card in this instance.

- Pre-qualify: Also, you can confirm your eligibility for this credit card without any impact on your credit score.

- Start application: Once you’re done and find out this card actually fits your financial profile, you can click on “Apply Now”. Then, fill out the form with the information required. This includes name, annual income, employment status, and housing information.

- Deposit: As part of the application procedure, you’ll need to provide a security deposit, which will determine your starting credit limit.

- Submit the form: Once you’ve completed the application and reviewed all the information, submit your application for review.

- Approval: Once approved, you’ll receive your Discover It® Secured Credit Card in the mail. Upon receiving your card, activate it online or by phone as instructed by Discover.

Would you like to learn about other options? Here’s the Avant Credit Card!

Although the Discover It® Secured Credit Card is a great option to apply when you have poor or no credit history, various other cards cater to those seeking to rebuild their credit.

For example, the Avant Credit Card. This card requires no security deposit and offers a competitive interest rate and transparent terms. Besides, it comes with a user-friendly mobile app!

So, if you want convenience when it comes to managing your account and tracking your spending habits, the Avant Credit Card has got you covered! Want to check out more features?

For a detailed examination of the benefits and potential drawbacks of the Avant Credit Card, you can access an in-depth review. Discover how it can help you achieve your financial goals!

Apply for Avant Credit Card

From eligibility checks to the actual application submission, discover the simple process to apply for the Avant Credit Card online!

Trending Topics

How to Balance Work and Study When Taking Career Focused Courses

Learn to balance work and study effectively with strategies for setting routines, prioritizing tasks, and maintaining motivation.

Keep Reading

McDonald’s is Hiring: Entry-Level Positions Starting at $10/hour

Start your career at McDonald's! Flexible hours, steady pay, and growth opportunities make it a great place to work. See how to apply today!

Keep ReadingYou may also like

Why Understanding Loan Terms and Interest Rates Helps You Plan Better

Master loan terms interest with actionable tips to compare offers, avoid hidden fees, and manage payments for smarter financial decisions.

Keep Reading

Cash App: Your Go-To Financial Buddy for Budgeting and Money Management

Cash App is a mobile payment service that's all about making your financial transactions a breeze. Developed by Square Inc.

Keep Reading