Credit Card

Apply for Chase Slate Edge® Credit Card: Branch or Online!

The Chase Slate Edge® Credit Card can be the key to your financial freedom with its introductory interest rates. Enjoy purchases and balance transfers without any interest, and tools to help improve your credit health!

Advertisement

Take the opportunity to transfer debt or even make a big purchase with no interest rates!

Recovering from a financial mistake can be challenging. But, when you apply for Chase Slate Edge® Credit Card, you can make the most out of a zero interest rate on balance transfers.

This means you can transfer your debt and save big on APR. Besides, by managing your credit responsibly, you get to enjoy other benefits like an increase in your credit line.

Whether you’re consolidating a debt or want to make a large purchase, this credit card can be the best option for you. Plus, the application process is quick and straightforward.

Being a Chase card, you can either apply online with security and convenience or go to the nearest branch. Want to check out an easy guide and learn how it works? Then keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes the Chase Slate Edge® Credit Card stand out

When you apply for the Chase Slate Edge® Credit Card, getting peace of mind in your financial journey becomes attainable. Afterall, the intro bonus offering no interest rates can be quite helpful.

Besides, this introductory bonus lasts for as long as 18 months, giving you plenty of time to manage your finances. Additionally, this card provides increasing purchasing power over time.

When you pay your statements on time and manage your finances responsibly, it offers an increase on your credit line automatically. Plus, it also features the potential for APR reduction.

With no annual fee and access to tools for monitoring credit health, this card is ideal for people seeking to save on interest costs, improve their credit profile, and achieve financial stability.

Application Options for the Chase Slate Edge® Credit Card

Whether it’s consolidating debt, making essential purchases, or managing everyday expenses, this card offers the flexibility you need. Check out how to apply below!

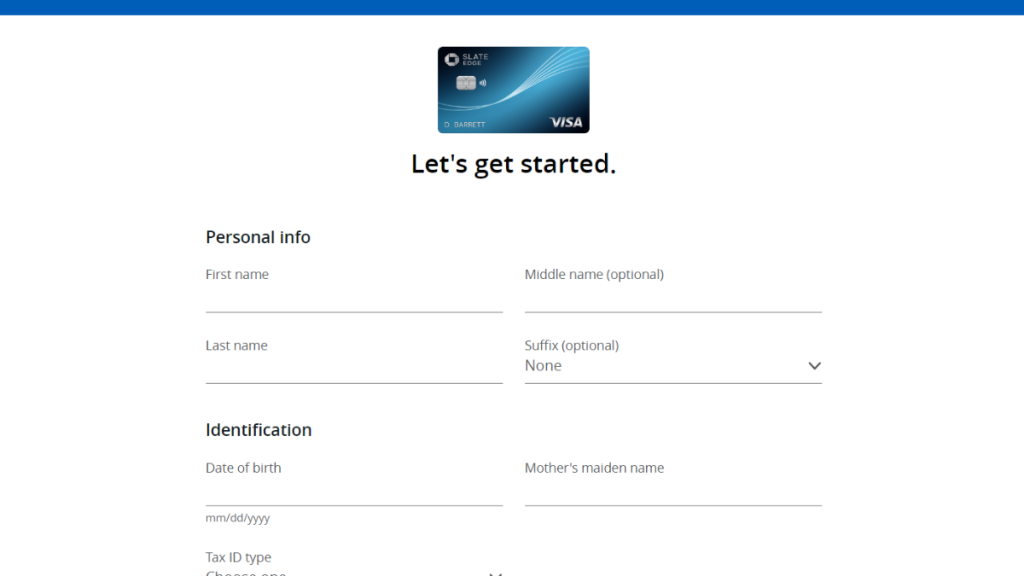

How to apply online

- Visit the official website: Start by going to the bank’s website and clicking on “Credit Cards” on the menu. Next, click on “Personal Credit Cards”.

- Find the card: Scroll down and find the Chase Slate Edge® Credit Card, but before you click to apply, it’s essential to review the terms and conditions.

- Begin your application: When you’re sure this is the right card for you, click on the “Apply Now” button. Then, input the information required, and when you’re done, submit it.

- Approval: After submitting your application, Chase will review your information to determine your eligibility. If your application is approved, Chase will send you your Chase Slate Edge® Credit Card in the mail.

How to apply in person at a bank branch

- Find the nearest branch: Firstly, access Chase website and find the branch closest to you. Next, gather the necessary documents usually required for a credit card application.

- Visit Chase branch: Once you’ve identified the nearest Chase branch, visit the branch during its operating hours. When you arrive, inform a banker that you want to apply for the Chase Slate Edge® Credit Card.

- Complete the form: The banker should help you fill out the application form, which will require you to provide personal information. You may also need to provide employment and income information.

- Submit and wait for approval: Once you’ve completed the application form and reviewed the terms, sign the application and submit it to the banker for processing. If your application is approved, the bank will notify you and your Chase Slate Edge® Credit Card will be mailed to you.

Would you like to learn about other options? Here’s the Chase Freedom Flex® Credit Card!

If you’re considering the Chase Slate Edge® Credit Card, you might also want to explore the Chase Freedom Flex® Credit Card as a compelling alternative to apply.

While both cards offer distinct features, the Chase Freedom Flex® Credit Card provides a compelling rewards program and other valuable benefits. With it, you can maximize your spending!

Start earning cash back rewards on a variety of everyday purchases, including dining, groceries, and travel. Additionally, the card offers a generous sign-up bonus for new cardmembers.

Overall, the Chase Freedom Flex® Credit Card provides a boost when it comes to rewards. Interest in learning more? Dive into this credit card’s specifics by clicking the link below!

Apply for Chase Freedom Flex® Credit Card

Apply for Chase Freedom Flex® Credit Card and enjoy reimbursements on daily spending such as gas and groceries.

Trending Topics

Why Certifications Matter and How to Choose One for Your Career

Learn how to choose the right career certification with practical steps, market demand, and strategies for long-term career success.

Keep ReadingYou may also like

Exploring PayPal: The Online Payment Revolution

Discover how PayPal revolutionizes the way we send and receive money. Experience a safer and faster way to handle your finances.

Keep Reading

How to Find Affordable and Quality Courses for Professional Development

Find affordable professional courses that offer practical skills and real-world application to boost your career without overspending.

Keep Reading

Discover it® Chrome: Earn Cashback on Gas and Dining

Discover the benefits of the Discover it® Chrome Gas & Restaurant Credit Card, offering 2% cashback on gas and dining with no annual fee!

Keep Reading