Credit Card

Apply for Chase Freedom Unlimited® Credit Card: Instant Access

Let every purchase work harder for you. Apply for the Chase Freedom Unlimited® Credit Card and start enjoying the benefits of no annual fee, alongside comprehensive fraud protection for worry-free spending.

Advertisement

Get immediate spending power with fast digital card access after approval

Keeping your credit score in good shape pays off, and that’s abundantly clear when you apply for the Chase Freedom Unlimited® Credit Card – a worthy nominee for one of the best cash back cards.

The card’s list of advantages is quite impressive and is made even better by the lack of annual charges. Also, newcomers are graced with a $200 bonus + increased rebates and a low intro APR.

Moreover, the Freedom Unlimited® rewards structure demands zero tracking. You swipe, you earn, and it can mean either 1.5%, 3%, or 5% back, depending on what you purchased and where.

Sounds too good to be true? See how this all could become your reality when you apply for the Chase Freedom Unlimited® Credit Card, and keep reading below to learn exactly how to.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes Chase Freedom Unlimited® Credit Card stand out

Firstly, the Freedom Unlimited® Credit Card stands out in many different ways. For example, with this card, you have the ability to earn money back on every swipe, be it a coffee or a new TV.

Once you apply and get the Chase Freedom Unlimited® Credit Card, you’ll be able to take your mind away from interest rates for 15 months on new purchases and balance transfers.

Moreover, newcomers get extra incentives like a $200 bonus and more rebates on gas and groceries, making the introduction package hard to resist—and all of this with zero yearly charges.

Beyond rewards, members are graced with comprehensive protection and insurance, flexible rewards redemption, and even referral programs that add up to $500 in cash back yearly.

Application Options for the Chase Freedom Unlimited® Credit Card

Although the Chase Freedom Unlimited® Credit Card is manageable by mobile app, you can only apply online or by visiting a branch. Let’s dissect both processes so you can get your card.

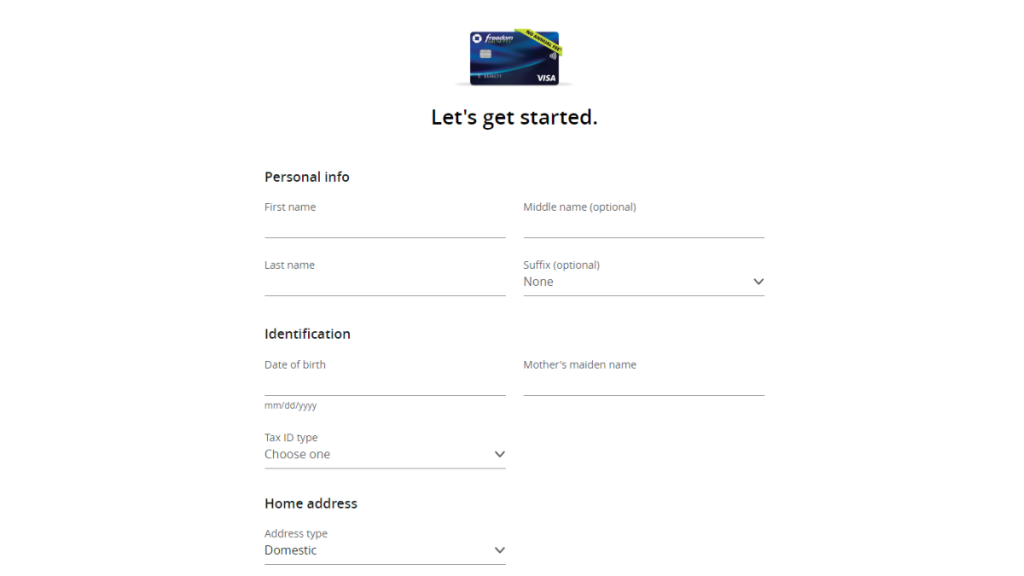

How to apply online

- Start the Journey: Visit the Chase website. Find the Freedom Unlimited® Credit Card under the “Credit Cards” section to begin your application adventure.

- Get to Know You: Fill in the application form. Provide personal details like your name, address, income, and social security number to help Chase get acquainted with you.

- Financial Storytelling: Share your employment status and annual income. This information paints a picture of your financial health, ensuring Chase understands your narrative.

- Security Check: Enter your social security number and date of birth. These crucial details add a layer of security, confirming your identity in the vast digital world.

- Review and Agree: Carefully review the terms and conditions. Embrace the legalities of your new financial tool by understanding the agreement between you and Chase.

- Submit to Destiny: Hit the “Submit” button. With a single click, you propel your application into the digital world, where it will be reviewed by the financial representatives at Chase.

- Await the Verdict: Wait for approval. Chase will assess your application, a process that may take a few minutes or a few days, leading to a decision communicated via email or mail.

How to apply in person at a bank branch

- Visit Your Local Chase Branch: Start by finding and visiting your nearest Chase branch. It’s a straightforward way to apply and get personalized assistance.

- Speak with a Bank Representative: Once there, ask to speak with a representative about applying for the Chase Freedom Unlimited® Credit Card. They will guide you through the process.

- Provide Necessary Information: The representative will ask for personal and financial information, including your name, address, income, and social security number, to fill out the application.

- Verify Your Identity: You’ll need to present a valid form of identification, such as a driver’s license or passport, to verify your identity as part of the application process.

- Review the Application: Go over the application details with the representative to ensure all the information is correct and complete.

- Submit the Application: The bank representative will submit your application for you. You’ve done your part; now, it’s up to the bank to process it.

- Wait for Approval: After submission, you will have to wait for the bank to review your application. Chase will notify you of their decision through mail or email.

Would you like to learn about other options? Here’s the Chase Freedom Flex® Credit Card

Say you’re not entirely sure whether or not to apply for the Chase Freedom Unlimited® Credit Card, but you want a similar option, and you don’t really mind tracking your rewards category.

Then perhaps the Chase Freedom Flex® will benefit you just as much. Its specifics are basically the same as its Freedom Unlimited® companion, but you can earn more on bonus categories.

Therefore, if you usually spend more on groceries, streaming, etc, you’ll earn more in those segments with this card once you activate your rewards. Besides, there’s no annual fee as well.

Care to expand further on the Freedom Flex® alternative? Then check the following link to learn how you can enjoy a series of incredible benefits to their fullest while pocketing valuable rewards.

Apply for Chase Freedom Flex® Credit Card

Apply for Chase Freedom Flex® Credit Card and enjoy reimbursements on daily spending such as gas and groceries.

Trending Topics

How to Download Budgeting Apps?

Learn how to download budgeting apps on your mobile device. Easily manage your finances and organize your personal financial control.

Keep Reading

The Best Courses for a Smooth Career Transition: Standout Paths for Success

Discover actionable strategies and the best career transition courses to help you smoothly switch careers and achieve long-term growth.

Keep ReadingYou may also like

SoFi Credit Card: Earn Unlimited 2% Cash Back Without Fees

Discover the SoFi Credit Card: unlimited 2% cash back on all purchases, no annual fee, and seamless integration with SoFi accounts.

Keep Reading

What to Consider Before Taking Out a Home Loan: Key Steps and Rules

Learn key steps to choose the right home loan, from budgeting to comparing terms, for a smooth home buying experience.

Keep Reading